life insurance underwriting

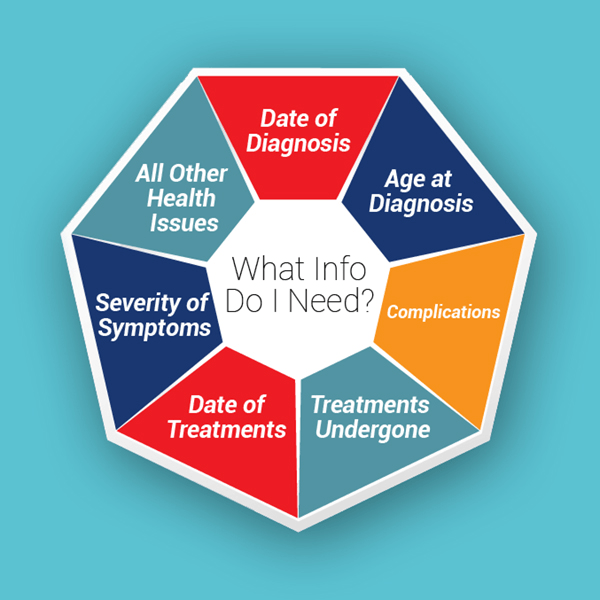

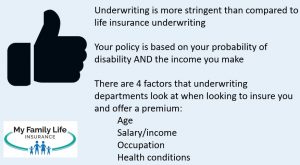

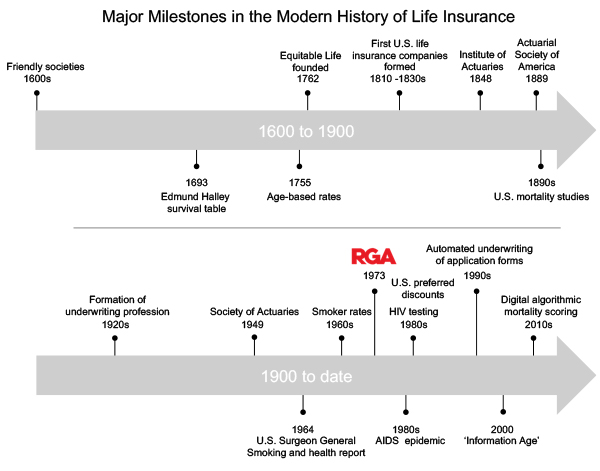

Life insurance can help protect your family members when they suffer the loss of a breadwinner or stay at home parent. First an underwriter will need to determine the probability of an applicant s life lasting as long or even longer than the average life expectancy for an individual of that particular age and. Factors considered when underwriting a life insurance policy there are numerous factors considered when underwriting a life insurance policy.

Life insurance allows a family to help maintain its standard of living by providing income tax free money to help pay for funeral expenses pay off the mortgage set aside college tuition for the kids and help provide financial peace of mind after the loss of a loved one.

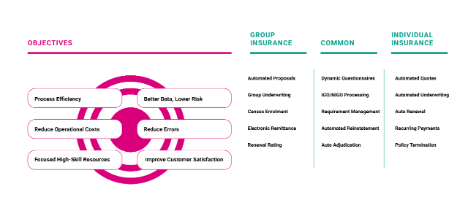

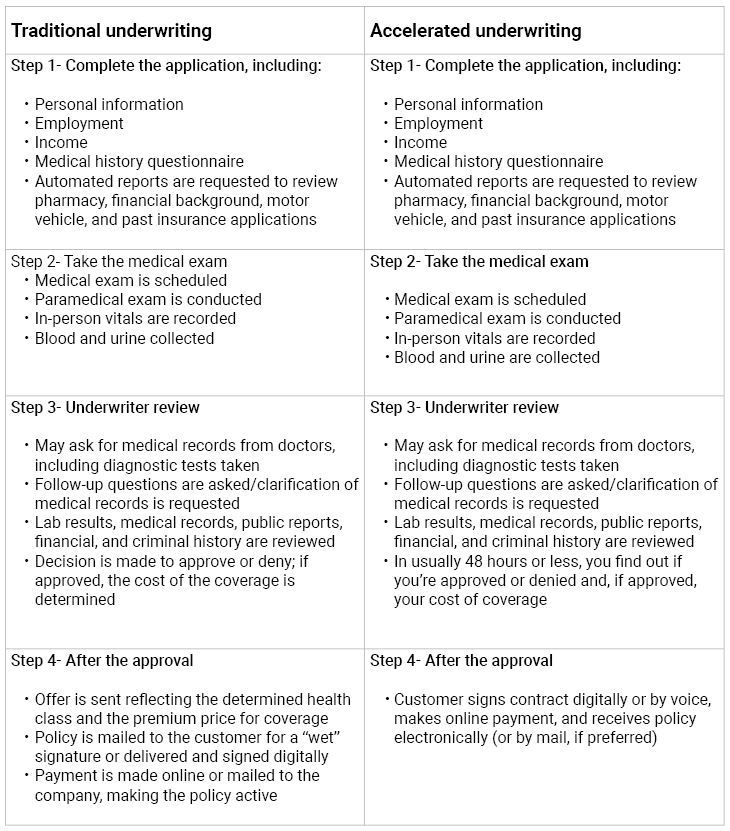

Life insurance underwriting. Group life insurance also known as wholesale life insurance or institutional life insurance is term insurance covering a group of people usually employees of a company members of a union or association or members of a pension or superannuation fund. You can often receive instantaneous life insurance coverage. Individual proof of insurability is not normally a consideration in its underwriting. Life insurance is an insurance that will pay out a sum of money to a beneficiary of the insured usually a family member upon the death of the insured.

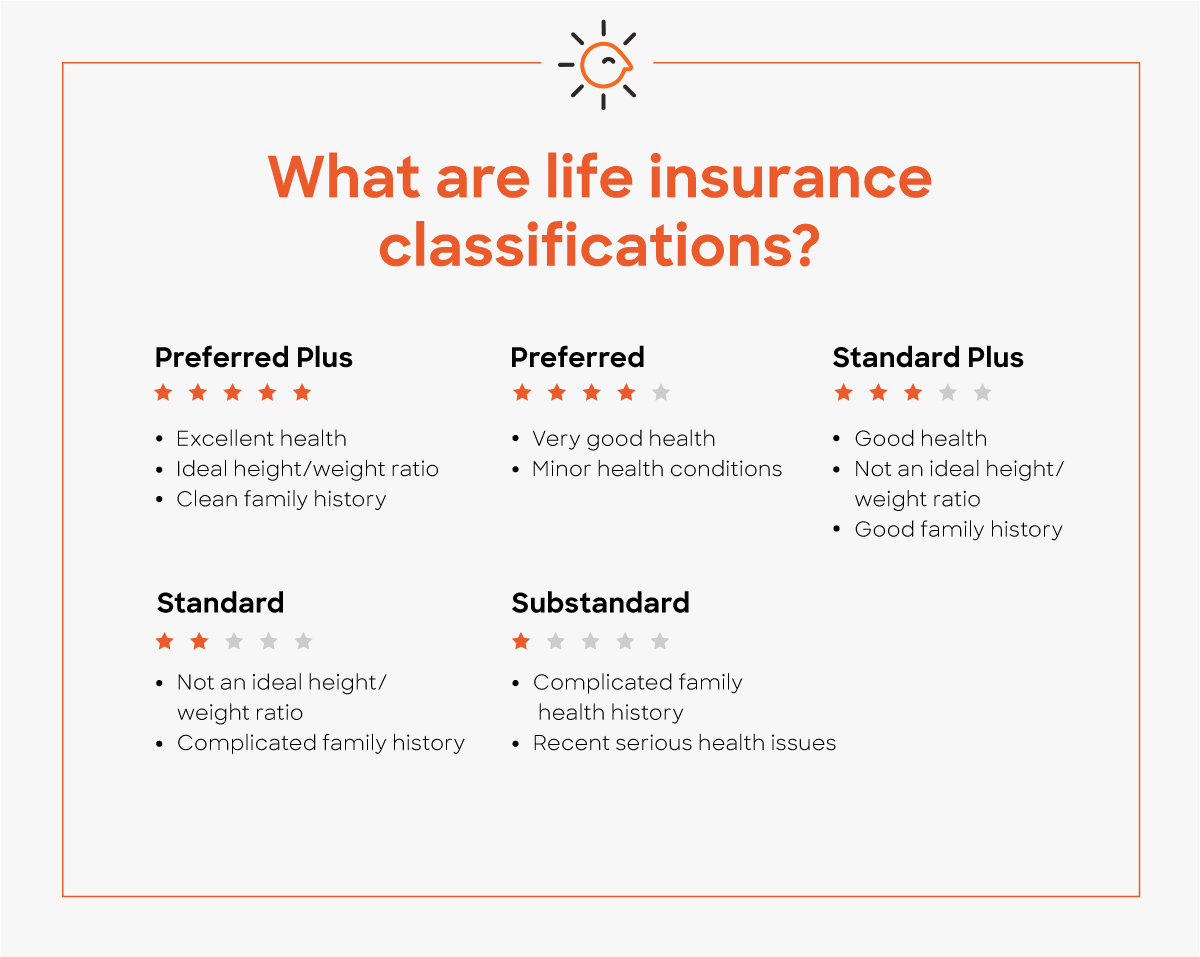

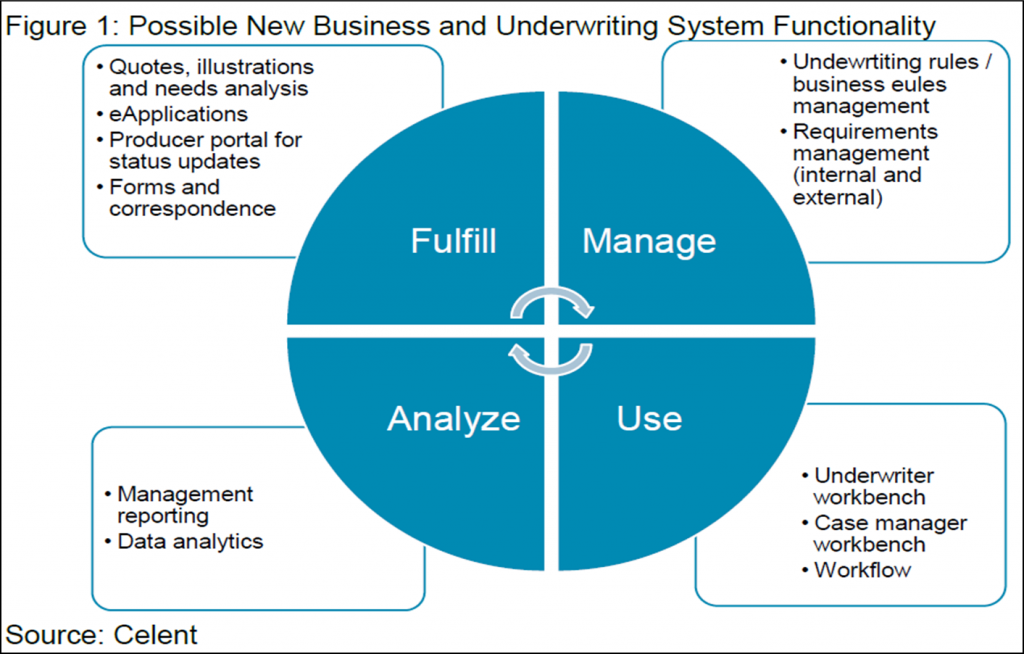

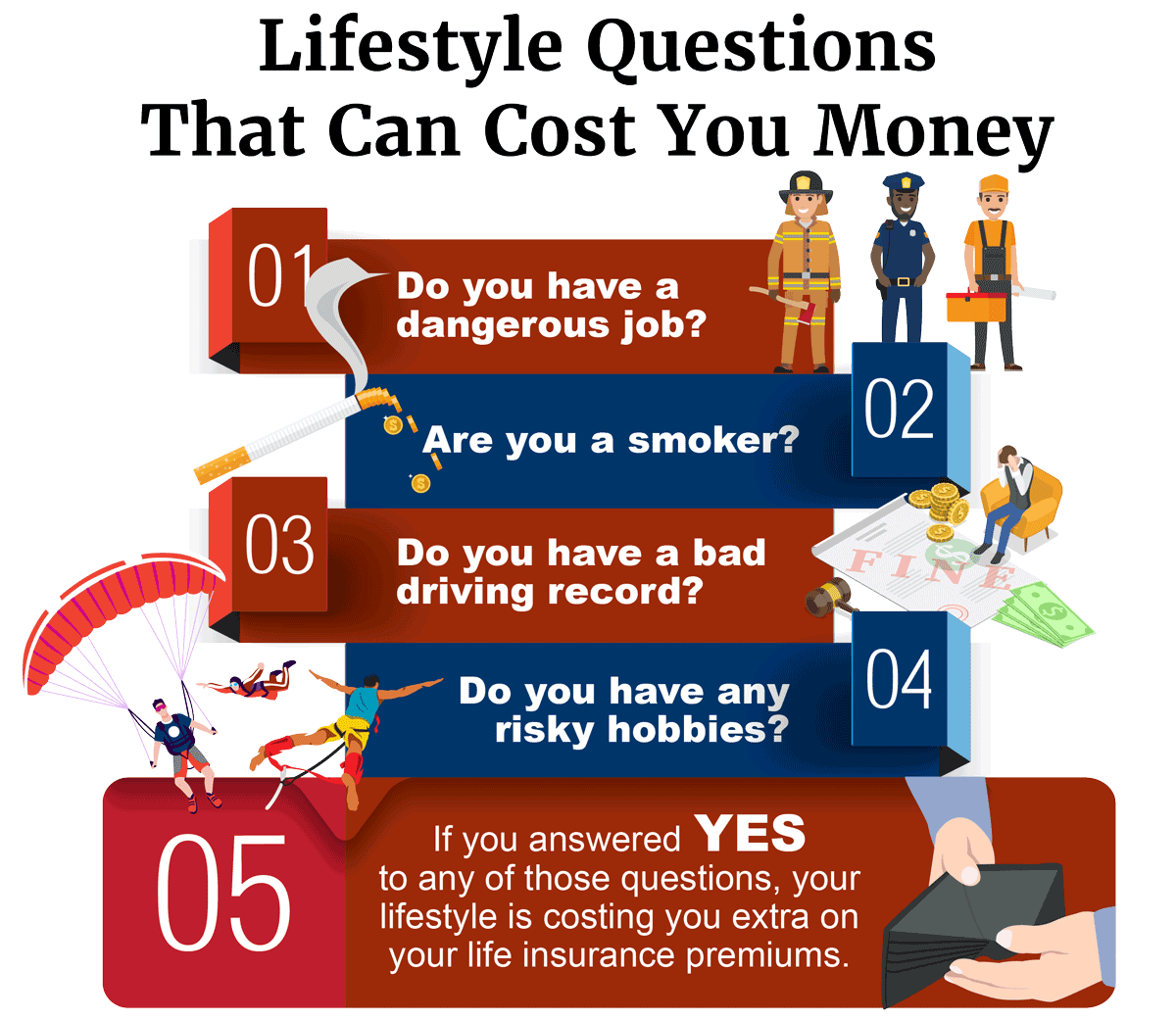

Life insurance is a great way to protect your loved ones financially but it s also a major investment over a period of years even a slightly lower premium can yield major savings. If you want to get a better handle on life insurance you re in the right place. They evaluate your application details health information and lifestyle to give you an insurance classification which correlates to how likely you are. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

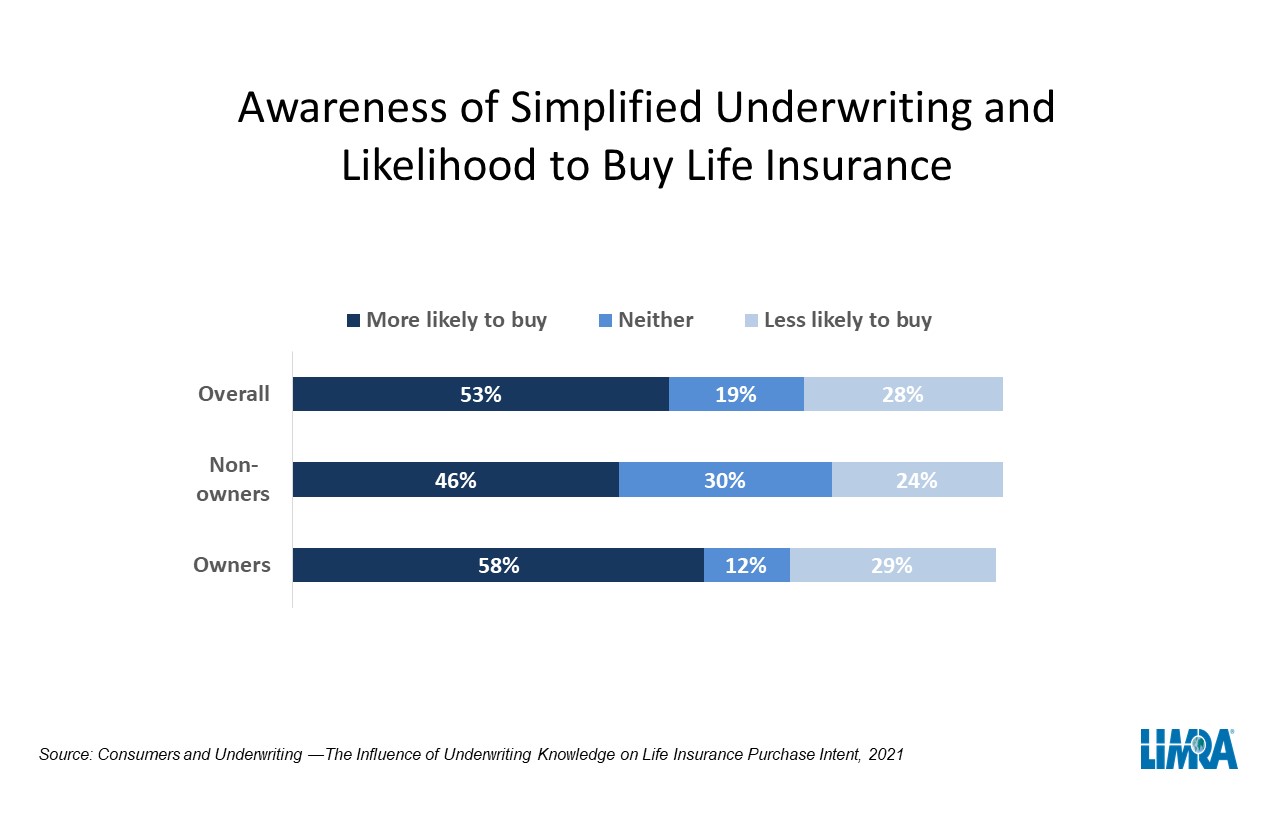

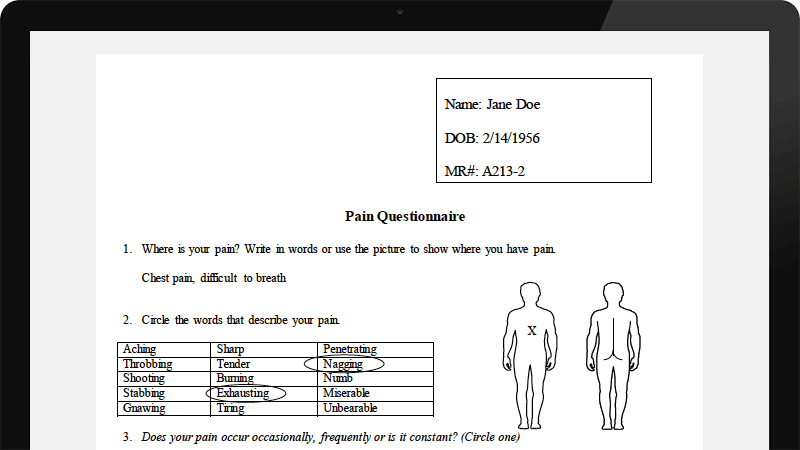

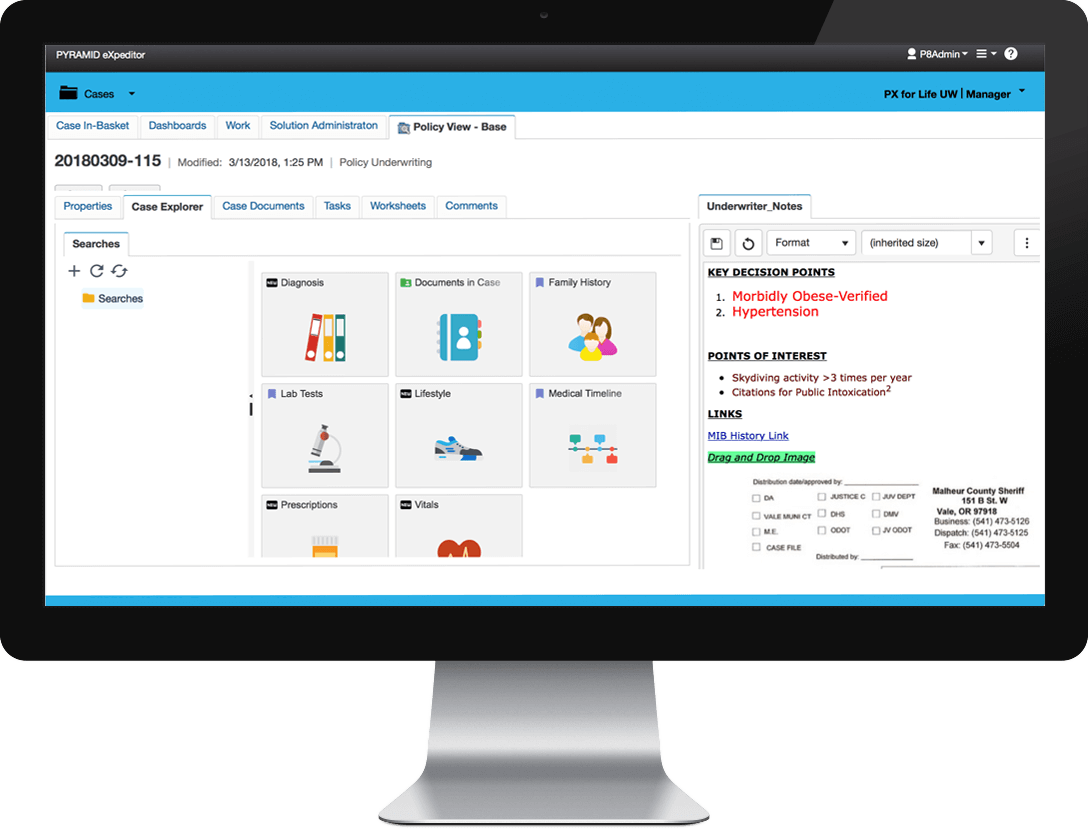

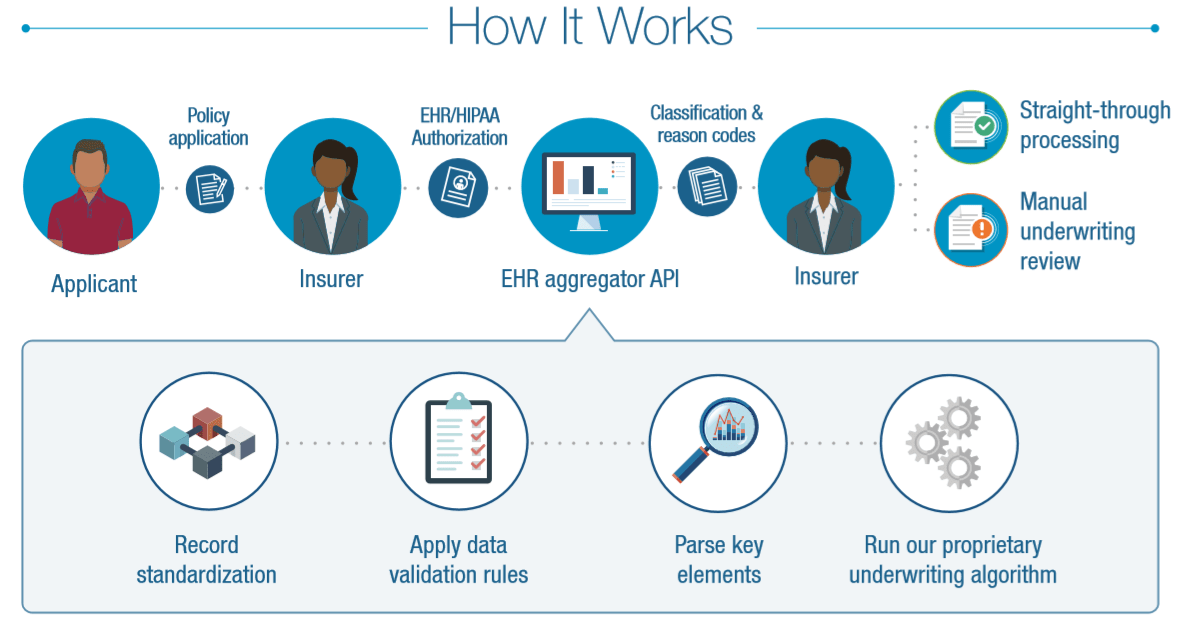

Here s where you can explore topics such as what life insurance is how it really works and the types available. In contrast simplified underwriting is usually a quick online life insurance application that does not require a medical exam. An underwriter works on behalf of the life insurance company to determine if you should get the premium you were originally quoted. The price for life insurance is normally based on the age health and expected longevity of the person applying for life insurance.

Policy is a level death benefit term life insurance policy to age 90 policy form number icc16 tl 21 tl 21 and state variations thereof issued by protective life insurance company in all states except new york where it is issued by protective life and and annuity insurance company policy form number tl 21 ny 4 16. After you apply for life insurance you go through a process called underwriting with the insurance company.

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)

:max_bytes(150000):strip_icc()/insurance-underwriter-job-description-salary-and-skills-2061796-Final-99e6693dac354876a0e9eb470b469131.png)