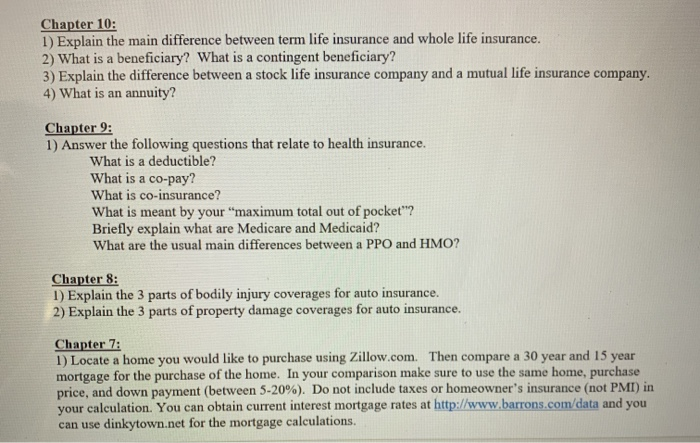

difference between term and whole life insurance

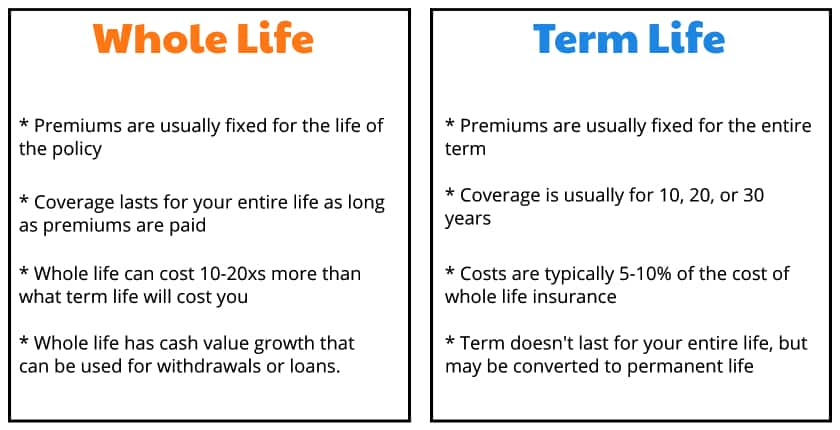

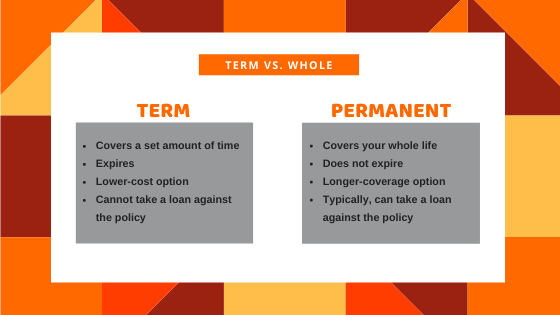

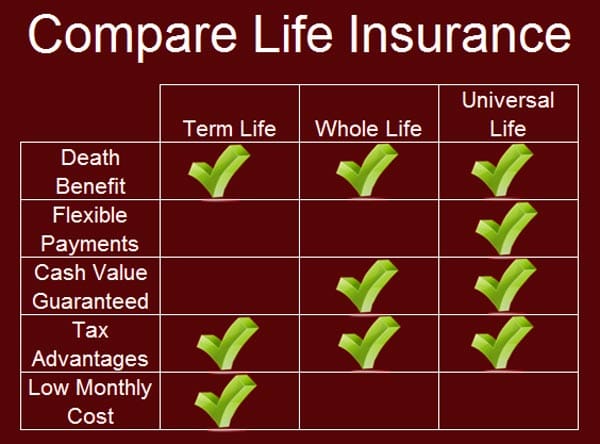

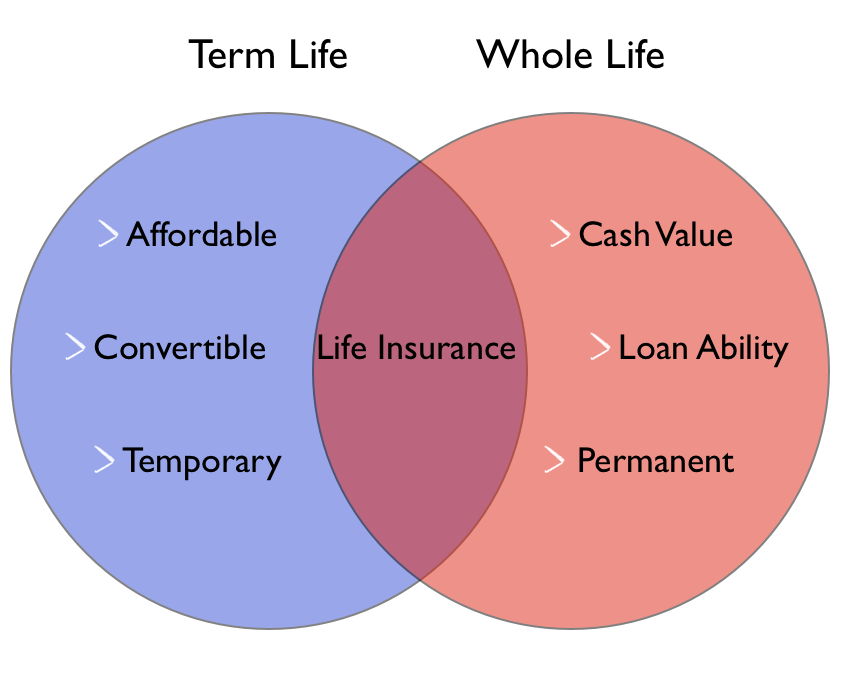

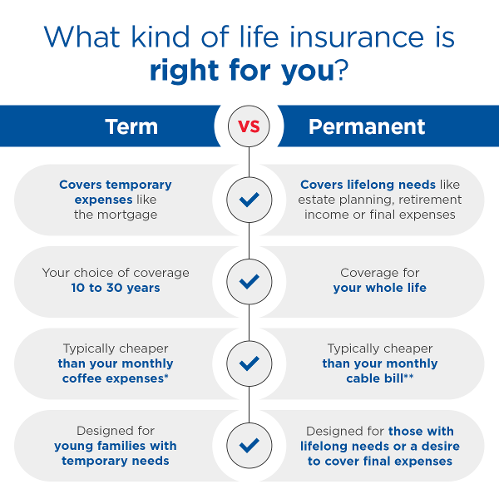

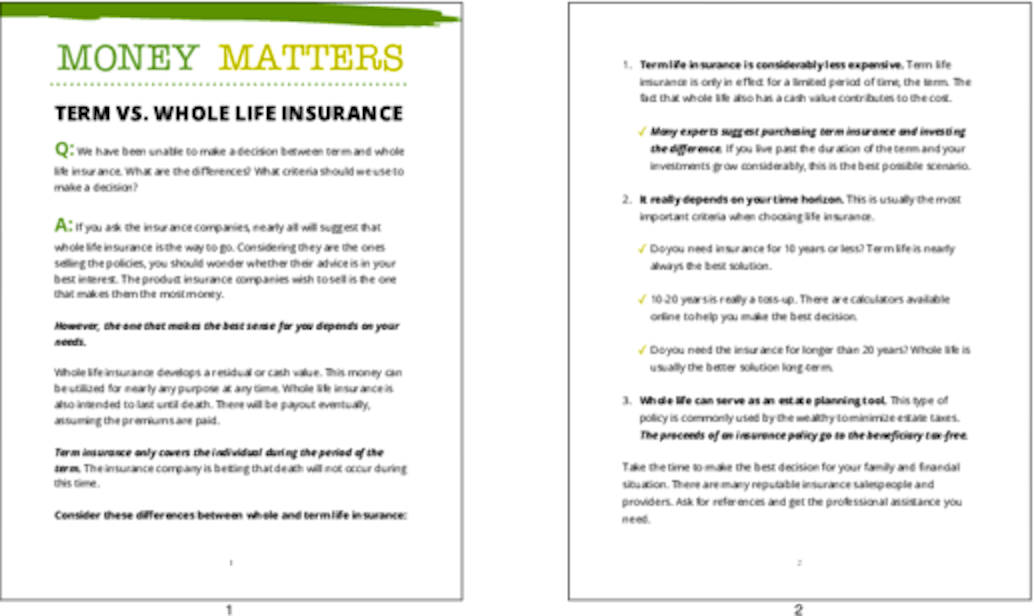

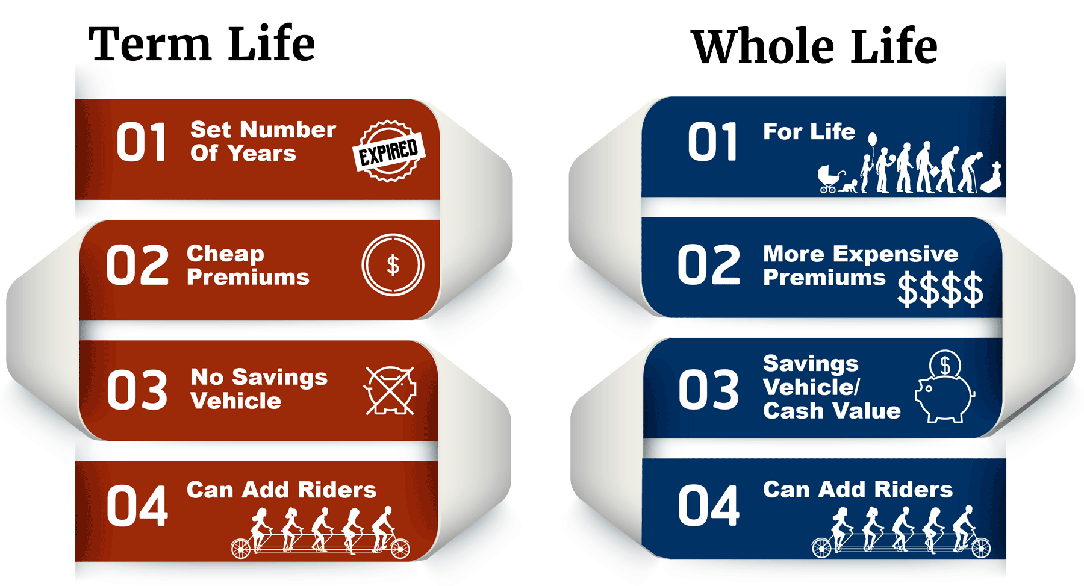

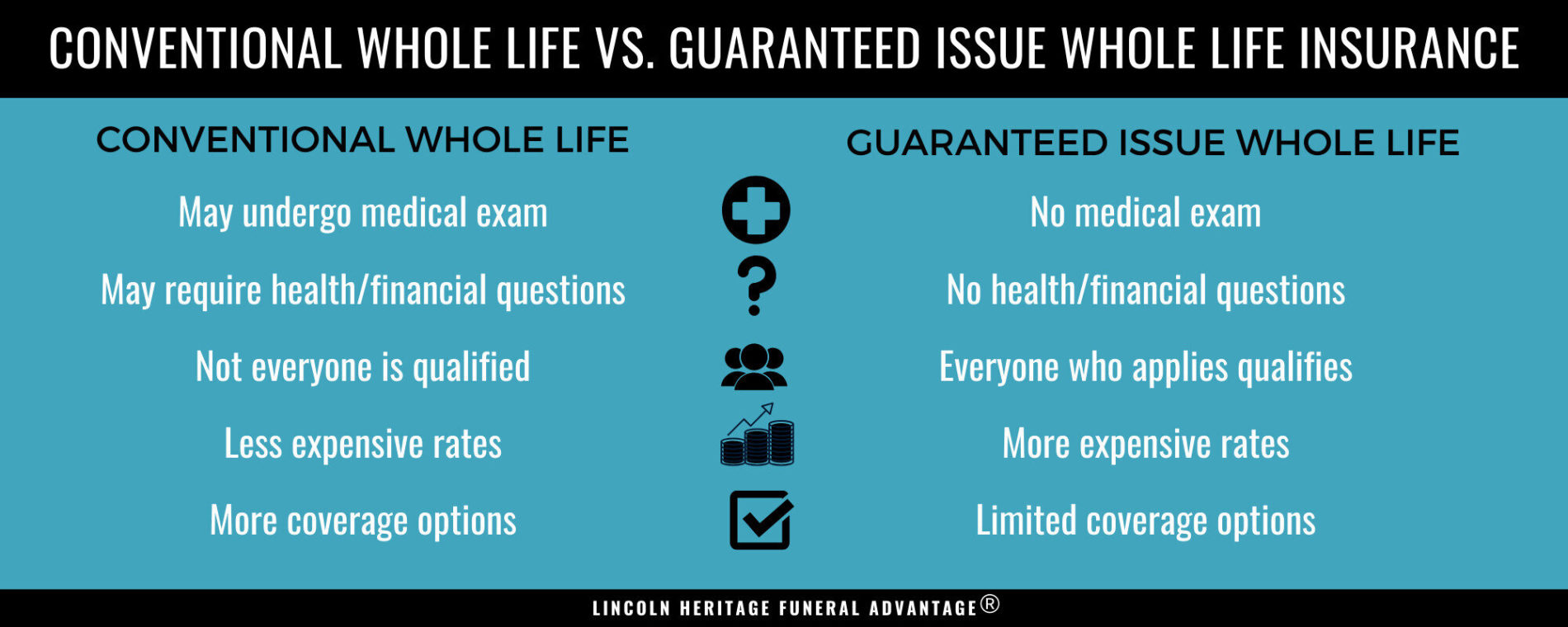

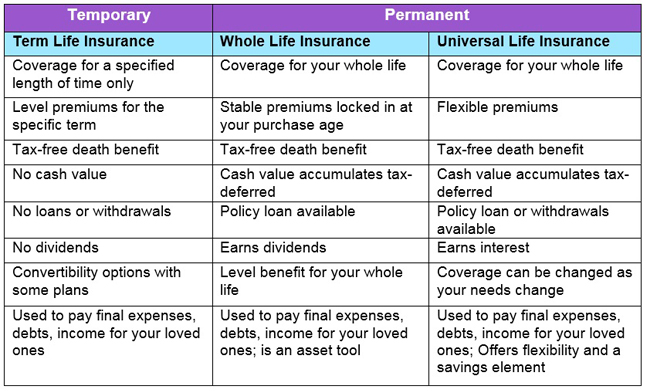

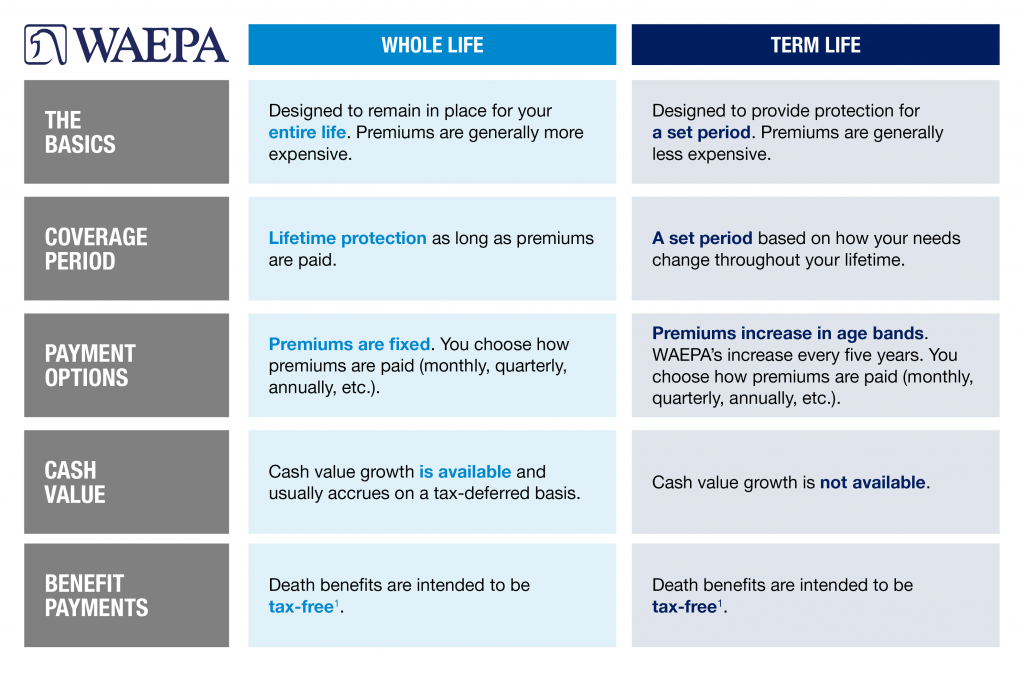

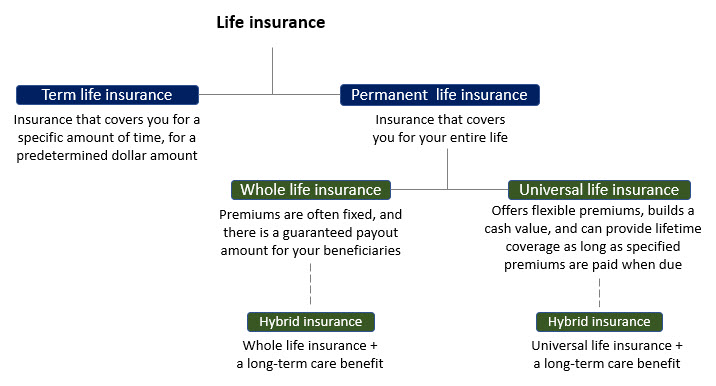

Term life insurance builds no cash value. Whole life insurance is the other main type of life insurance it aims to last your whole life no matter how old you are when you die. Whole life insurance covers the policyholder for a lifetime in contrast with term life insurance which expires after a set term.

Whole life policies contain a cash value account that builds cover time at a fixed interest rate.

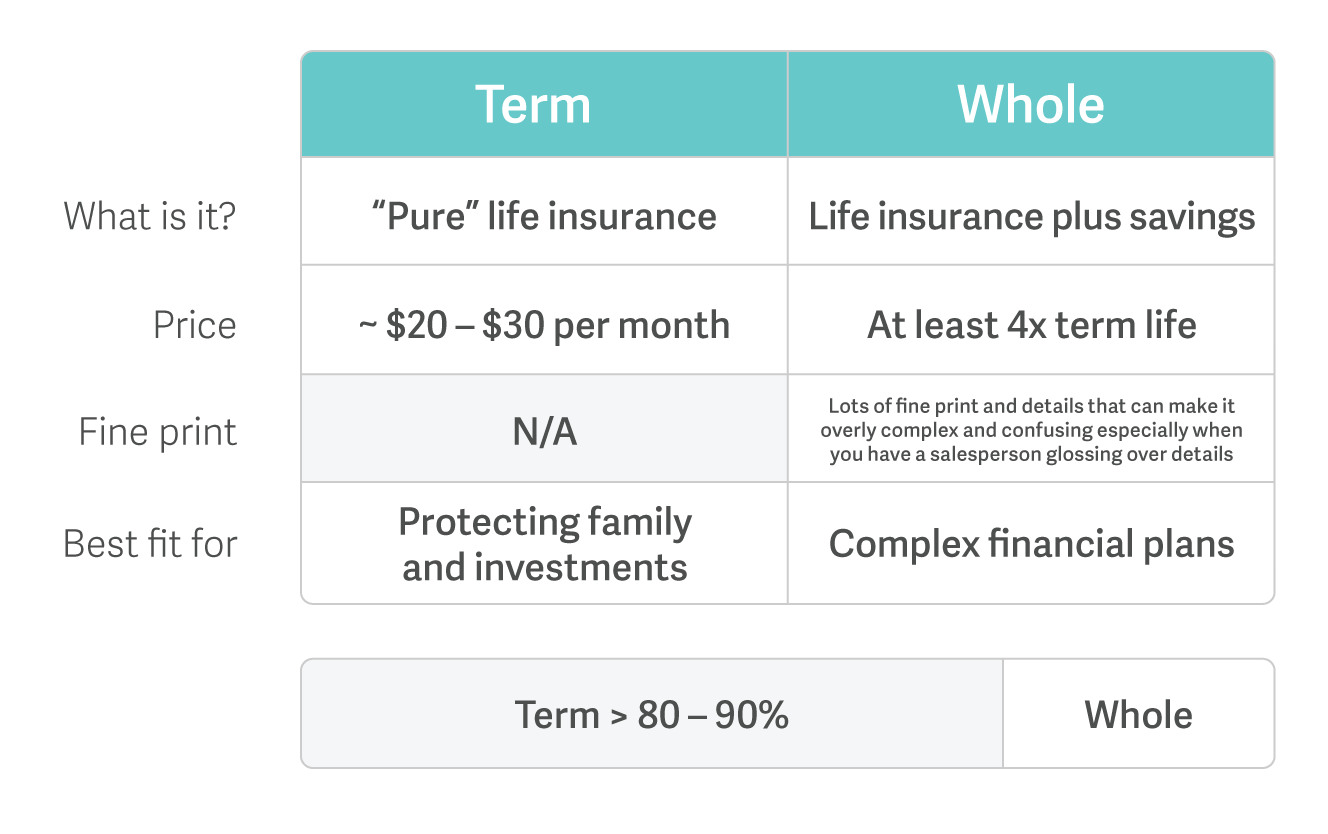

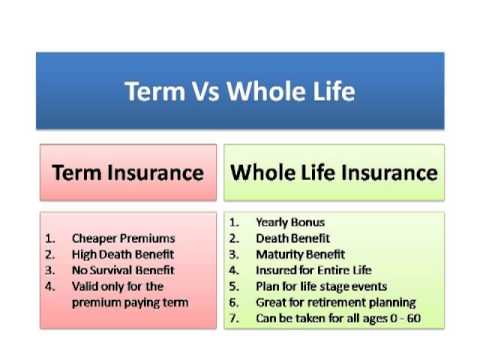

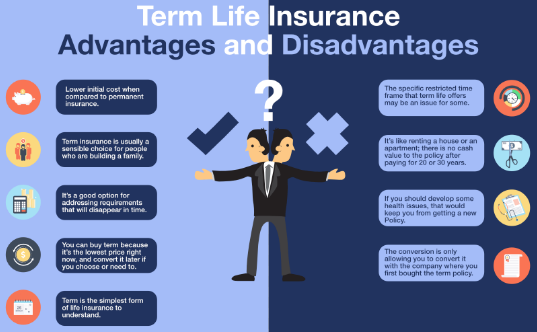

Difference between term and whole life insurance. Whole life insurance is designed to last the rest of your. Term life insurance plans are much more affordable than whole life insurance. Term life insurance is easier to understand and costs much less than whole life. This guaranteed cash value growth is one of the reasons.

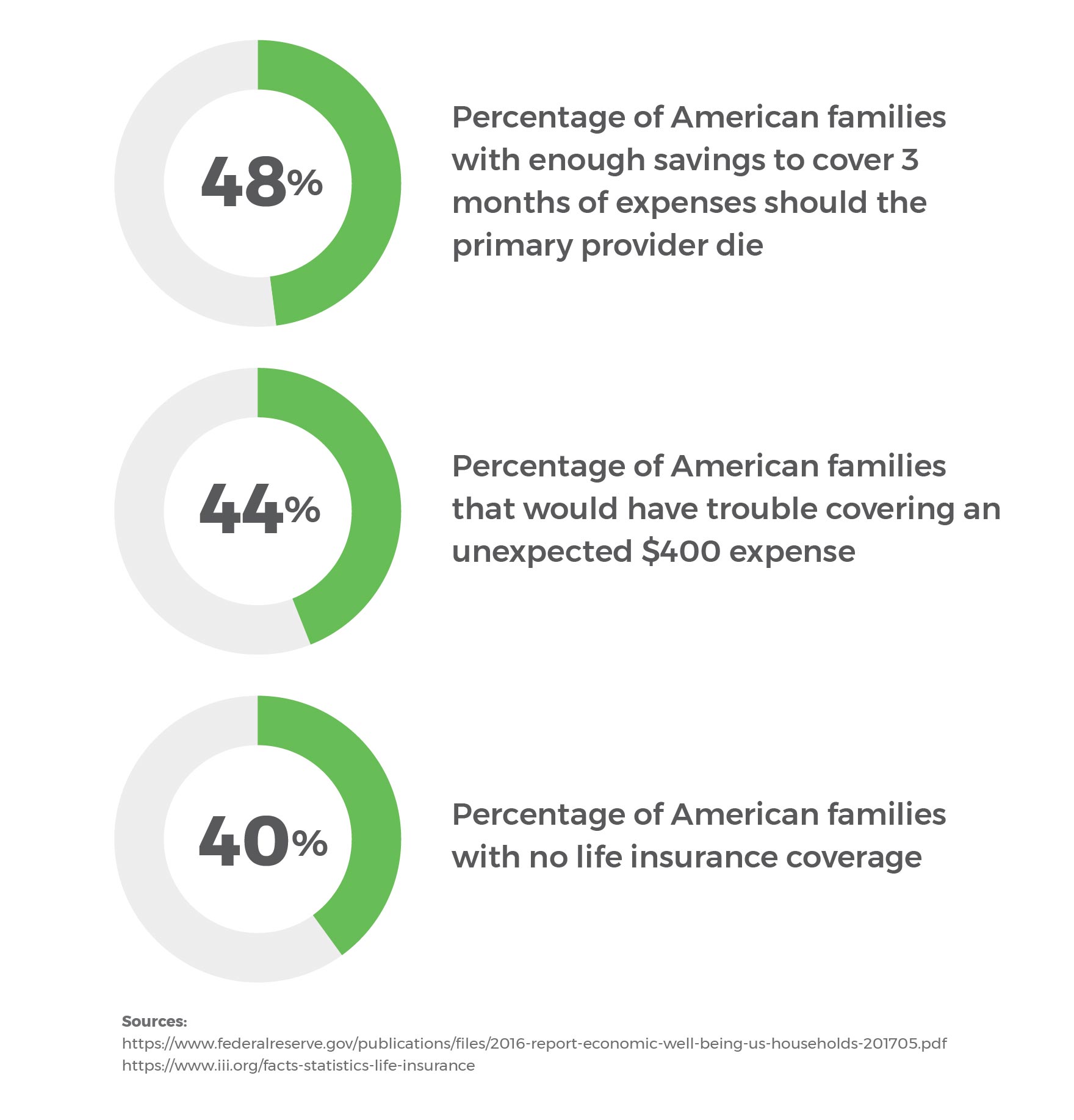

Term life insurance is affordable and straightforward while whole life doesn t expire but is more expensive. Term life is only there to replace an income. For most families term life insurance is the best option because it s the most affordable and it s straight forward. While this means you could be paying premiums on your policy.

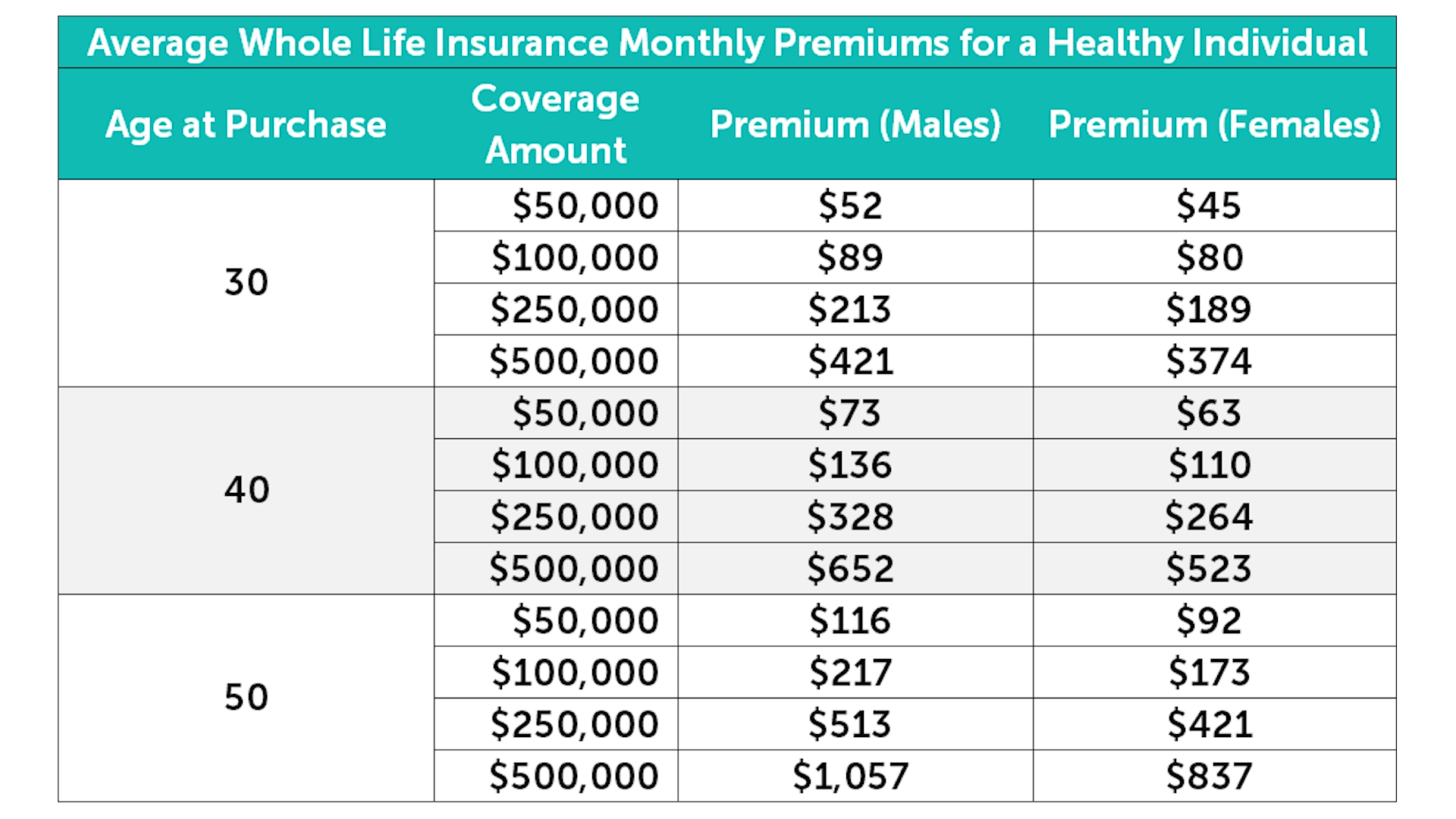

The key difference between whole life insurance and term life insurance is as the names may suggest the duration the insurance lasts for. Even so whole life insurance tends to have higher premiums than term life insurance. Term life insurance is right for most people but that doesn t mean it s right for everyone and some people may benefit from whole life insurance. One of the main differences between whole and term life insurance is the cost.

The costs of either plan vary depending on age group gender and medical history. Permanent life insurance products like universal life insurance and whole life insurance are more complex have many features and are more expensive. This is because the term life policy has no cash value until you or your spouse dies. In simpler terms the policy is not worth anything unless the policy owner dies during the course of the term.

The premiums are higher because the payments are put into an account that accumulates over time.