life insurance whole life

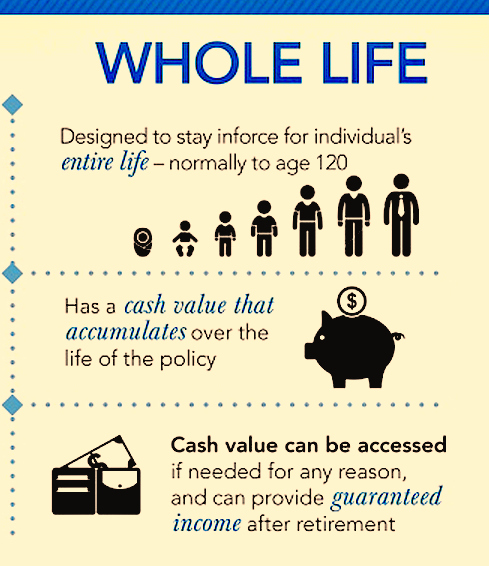

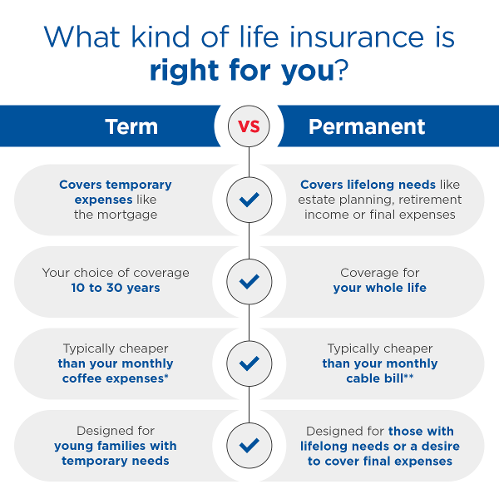

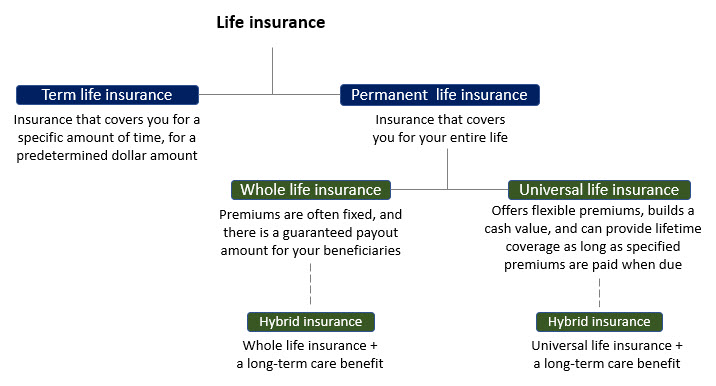

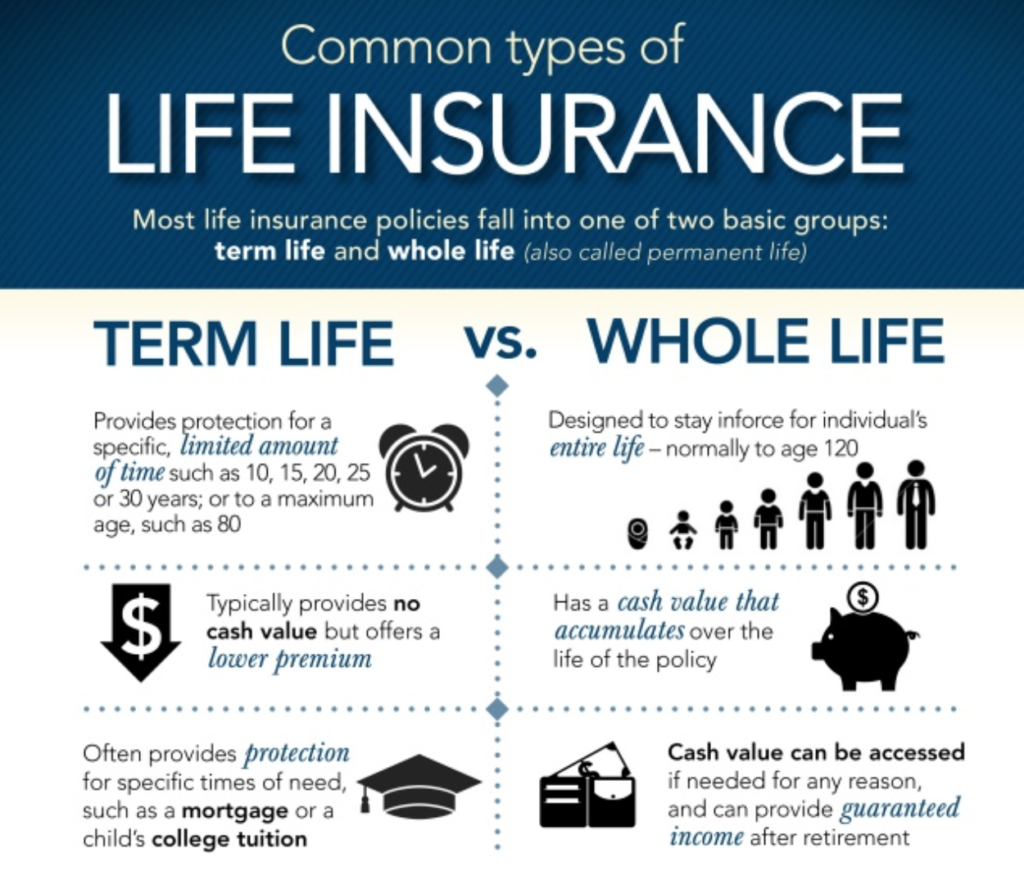

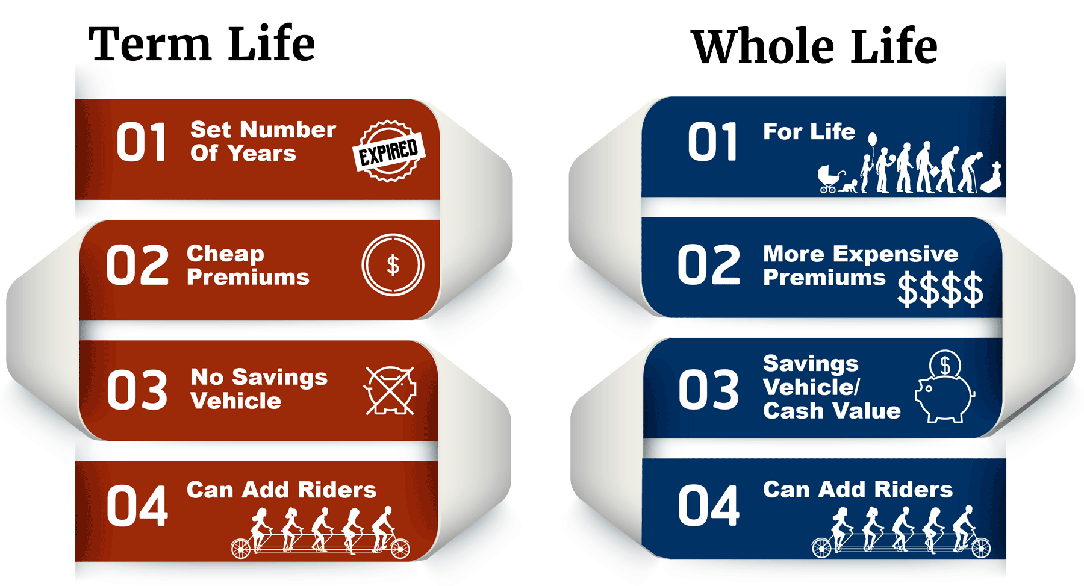

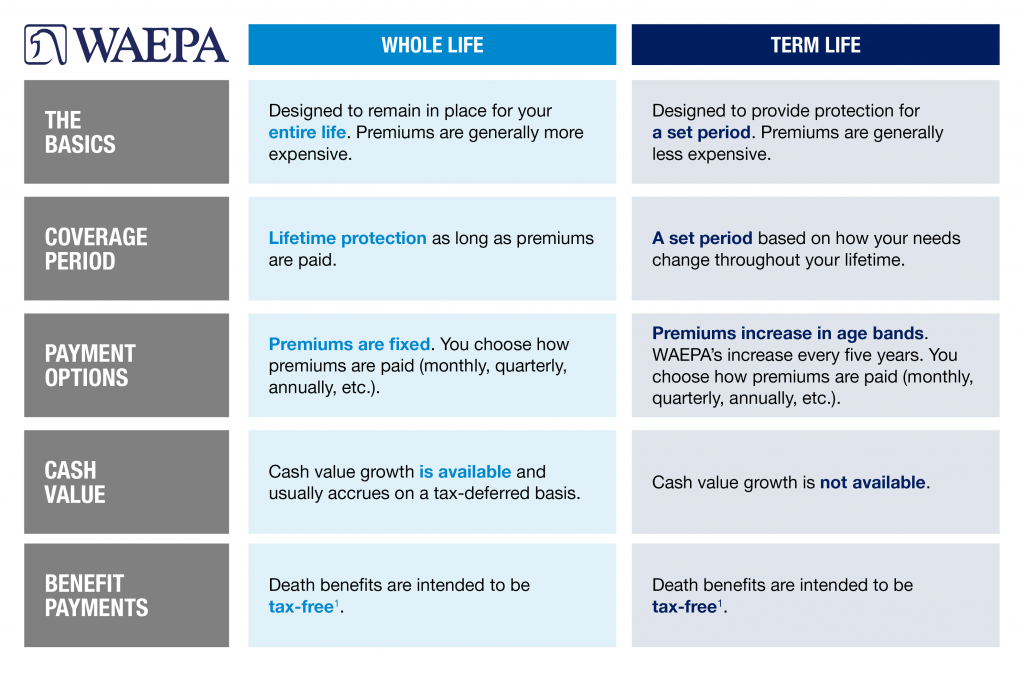

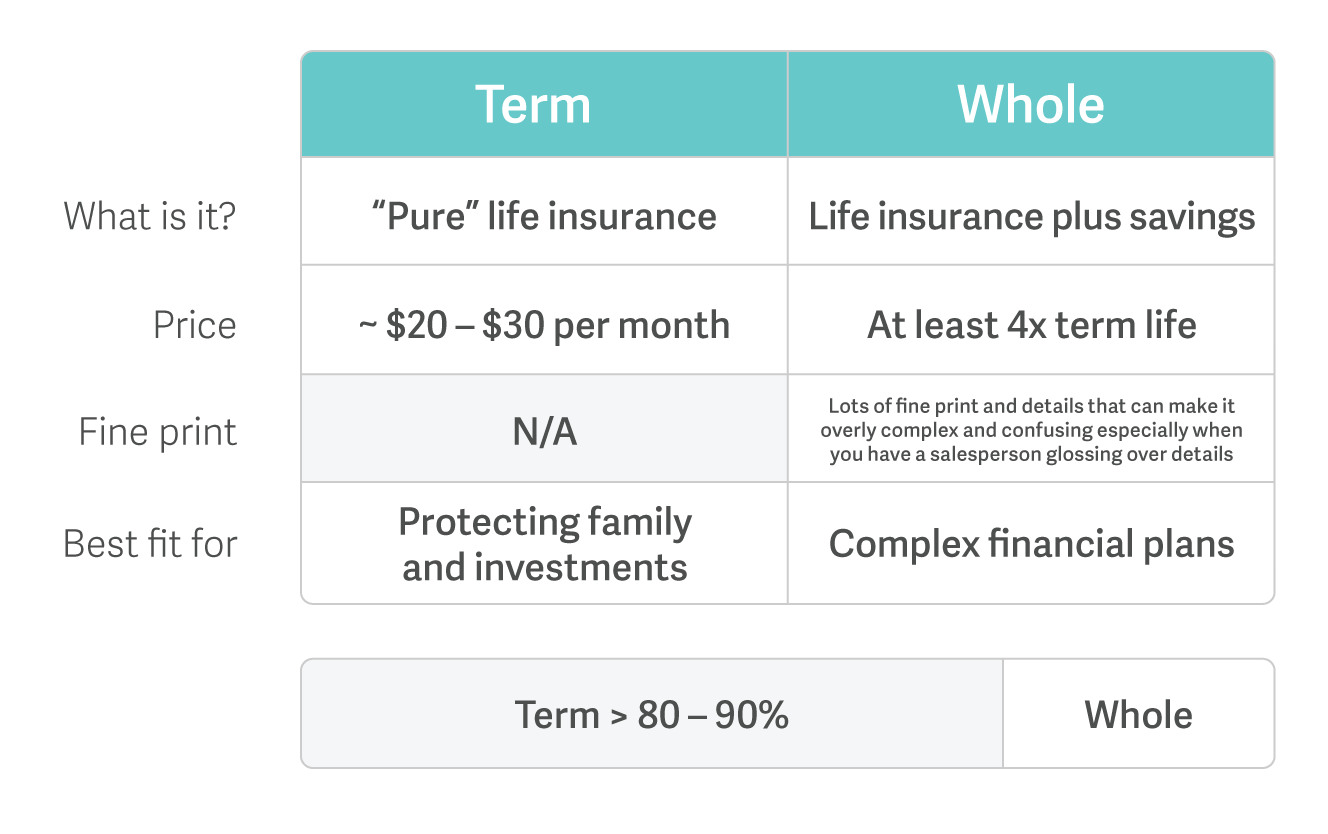

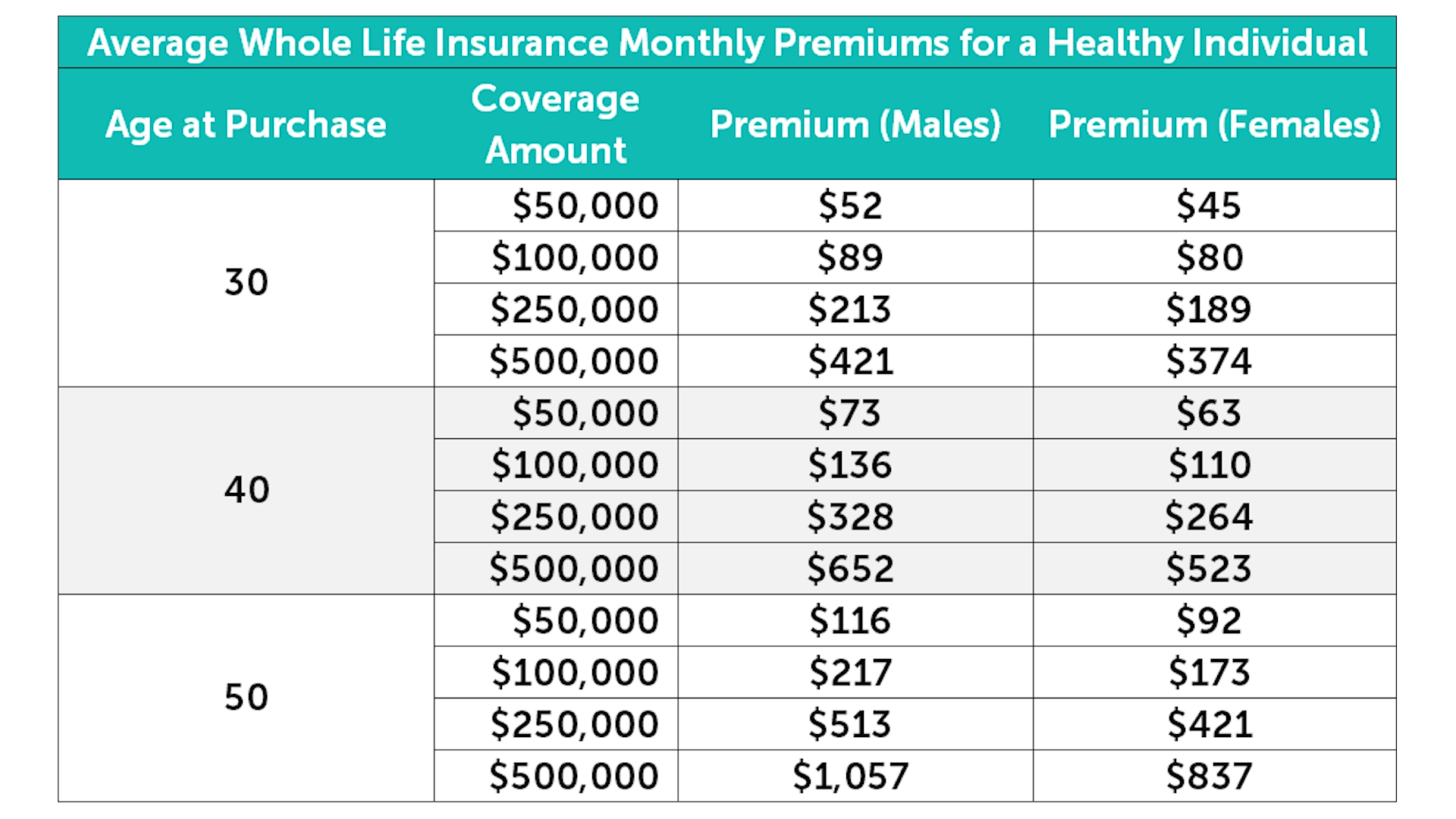

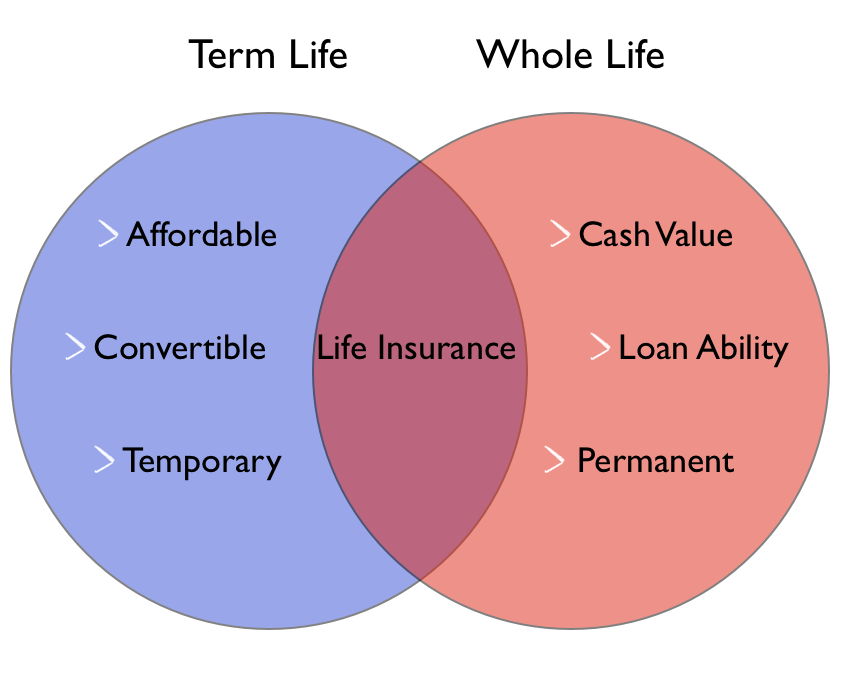

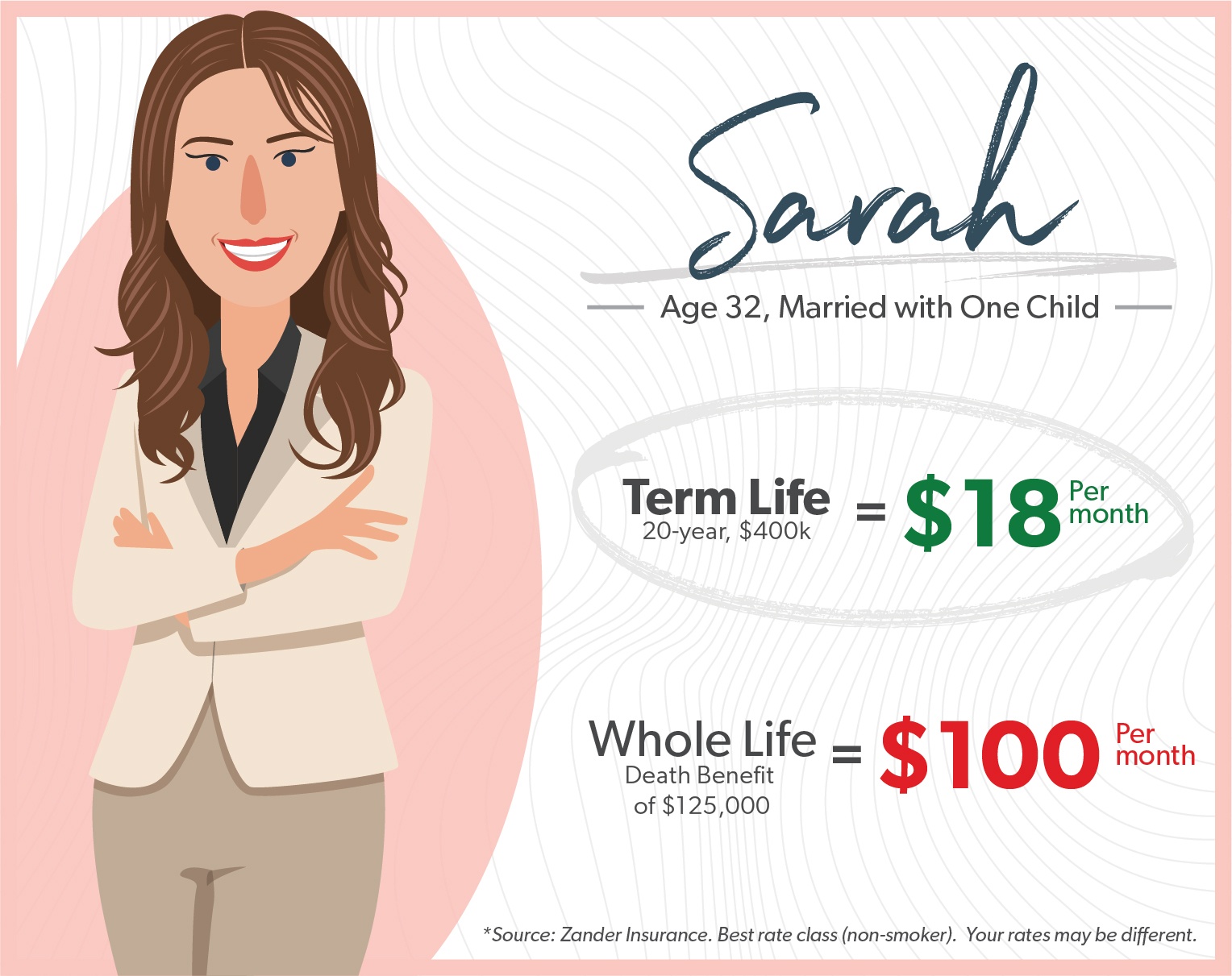

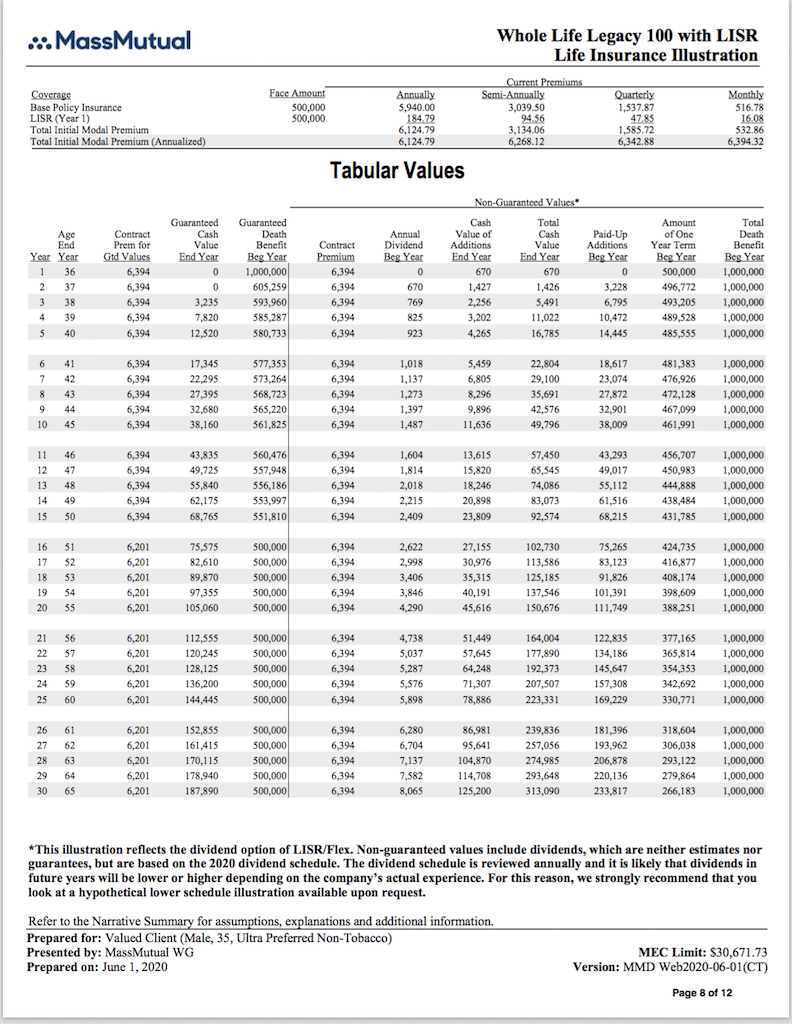

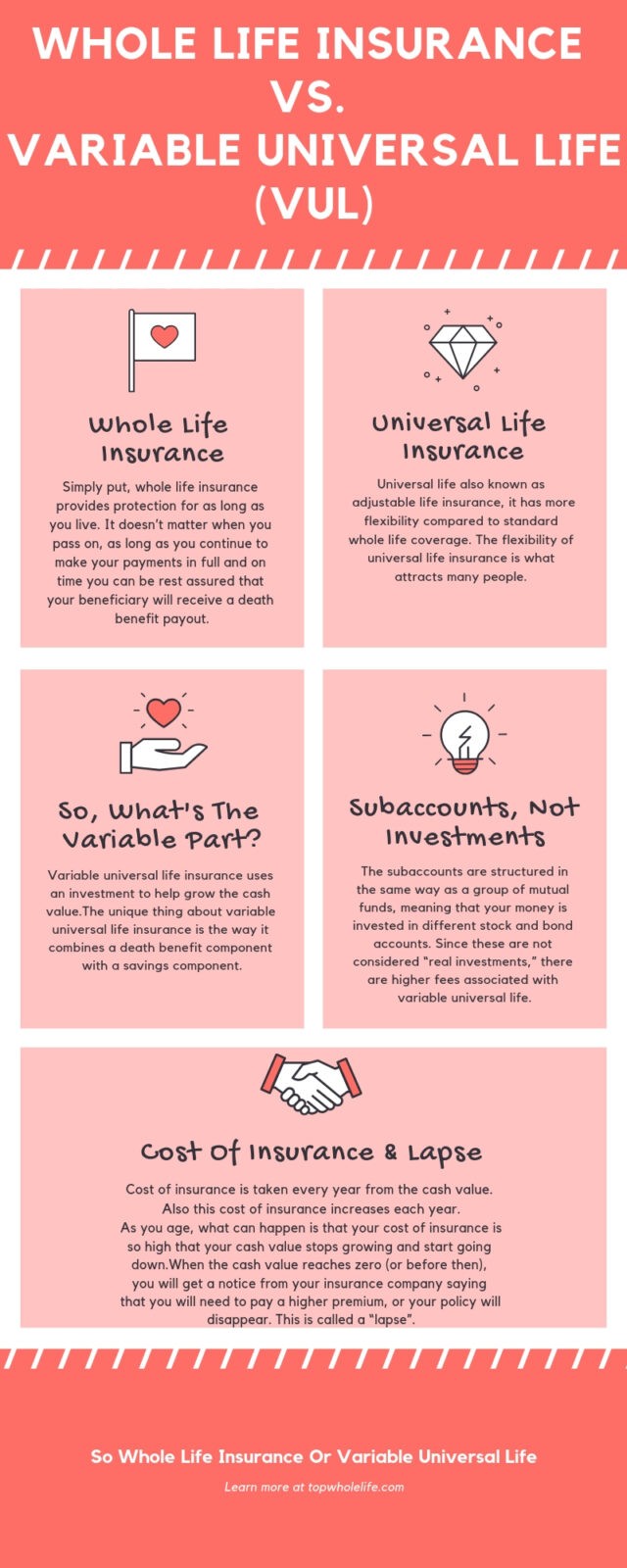

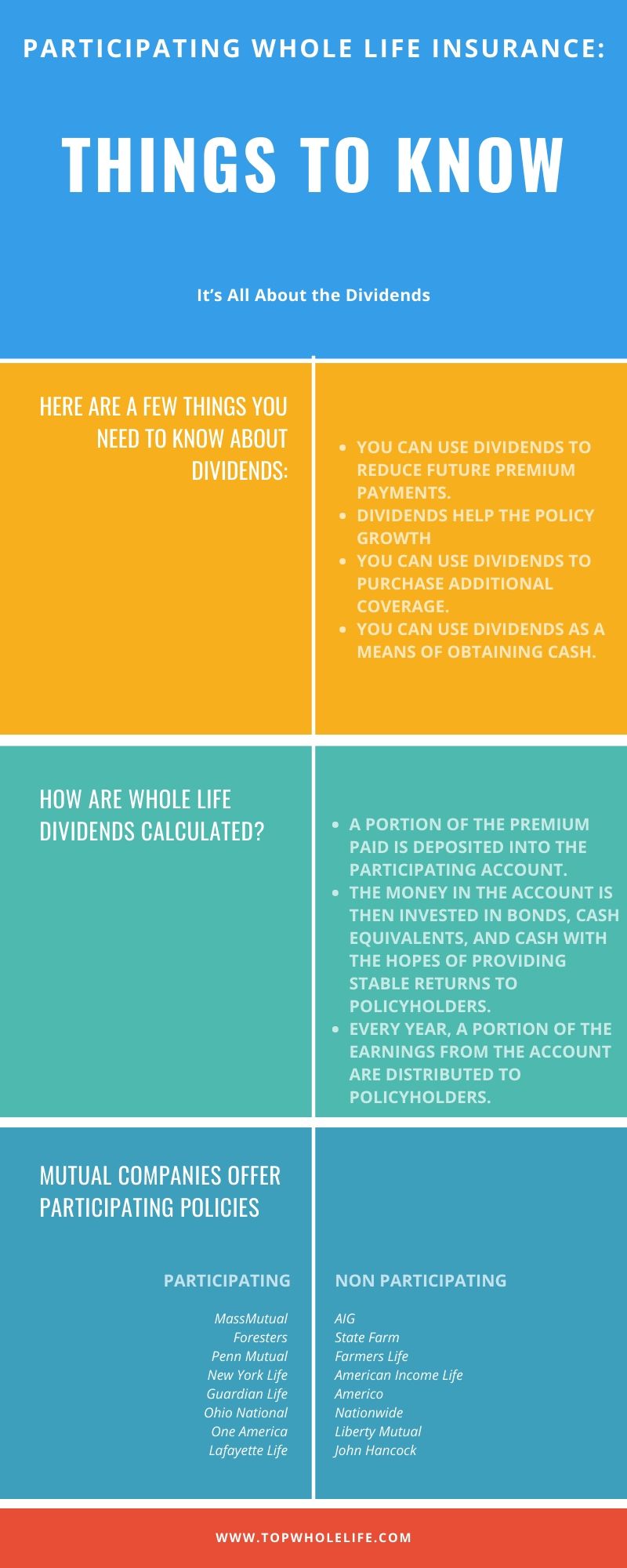

In addition to providing a guaranteed life insurance benefit it also offers an important way to save for the future helping you to be prepared for whatever lies ahead. Icons representing life insurance products are broken out into four simplified term life term life flexible life and whole life. Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

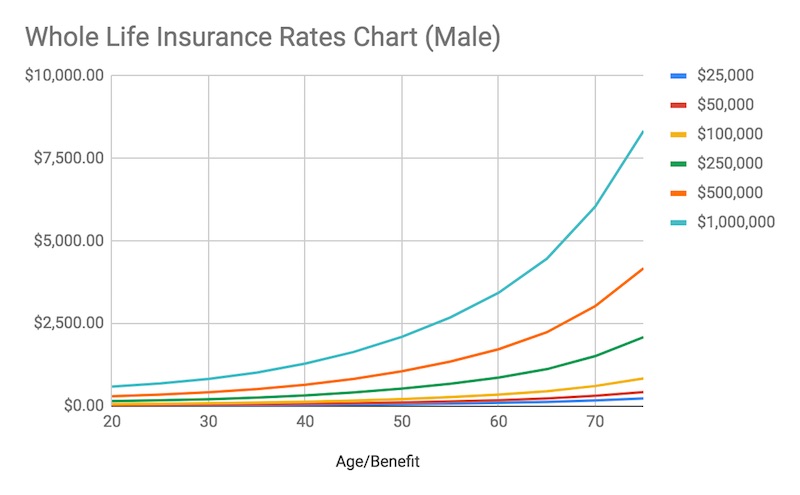

Designed with affordability in mind a dreamsecure whole life insurance policy is a simple convenient way to help you protect your family s future.

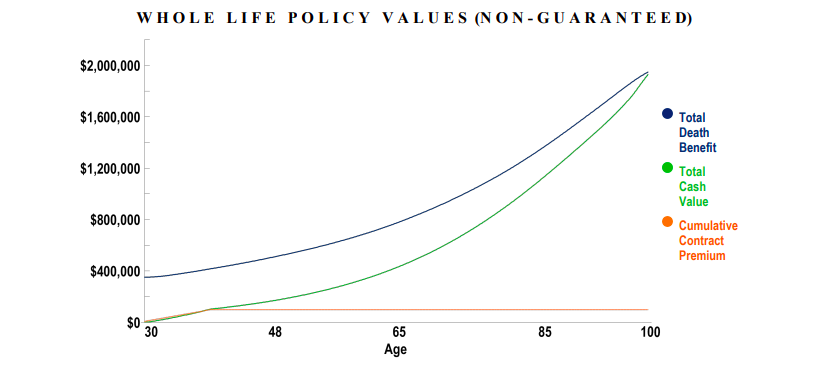

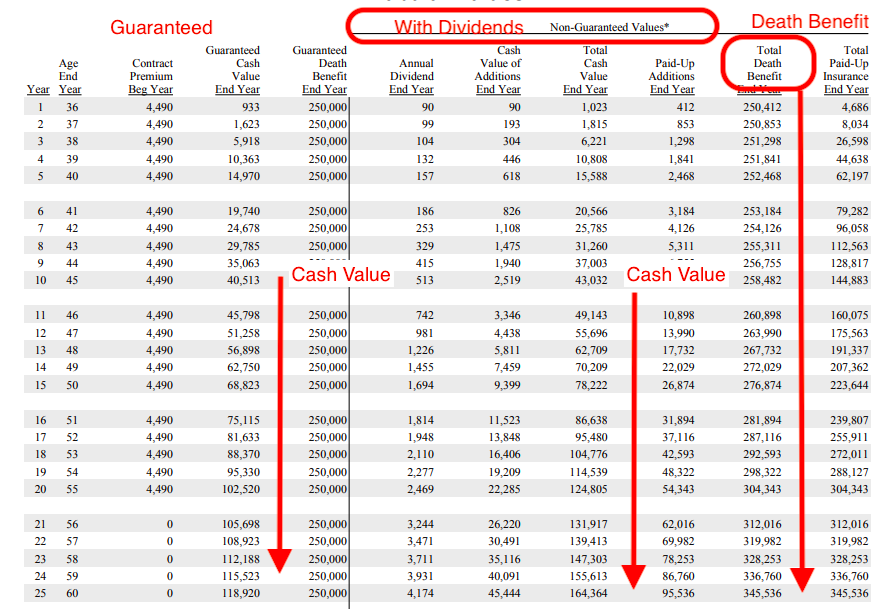

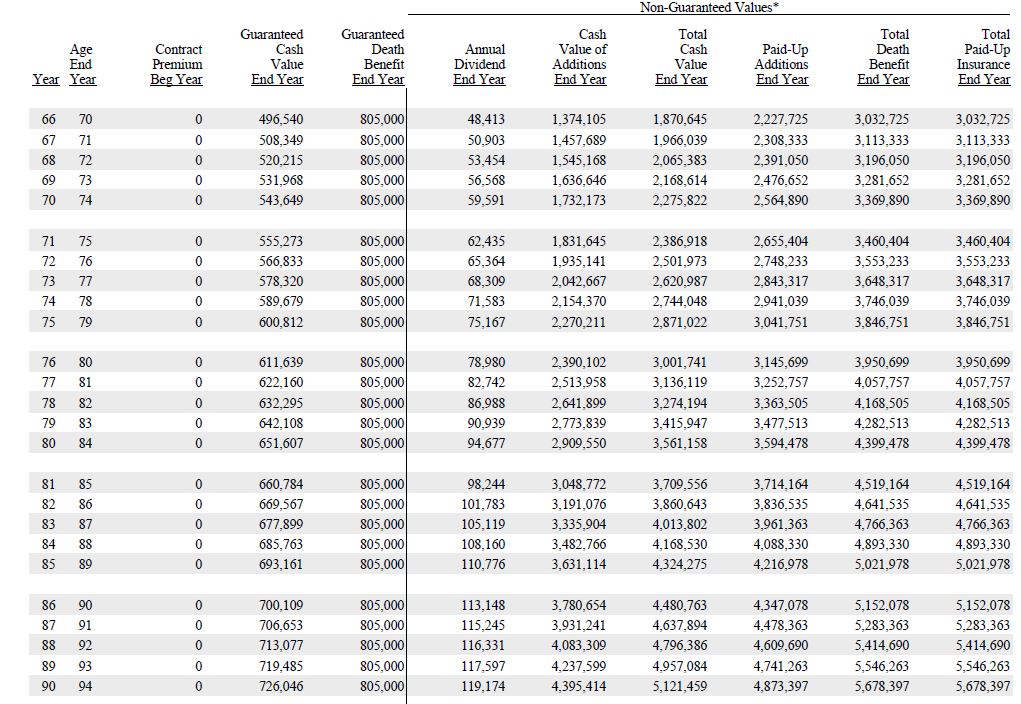

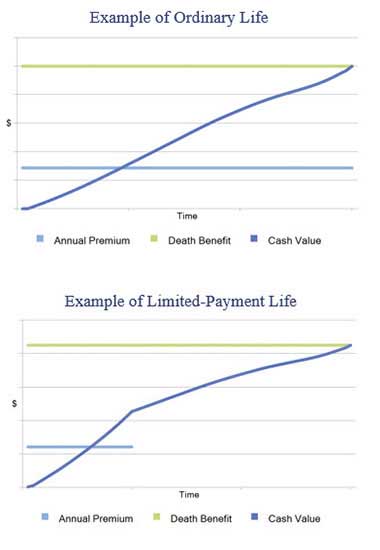

Life insurance whole life. With whole life the cash value of your policy grows tax deferred which means you can. It also provides guaranteed cash value that you can access at any time for any need including funds to help pay for college cash to support your business or income in retirement. Whole life insurance is the other main type of life insurance it aims to last your whole life no matter how old you are when you die. Depending on the contract other events such as terminal illness.

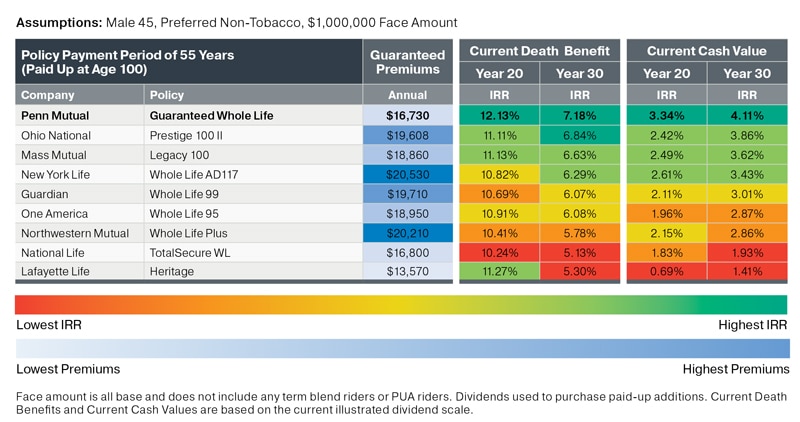

What do you want from your life insurance. Perhaps you want to help protect your family s financial future with higher. The guaranteed death benefit can help replace a family s loss of income help with mortgage costs or educational needs or to leave a legacy for the next generation. Whole life insurance policies offer two primary benefits.

Whole life insurance helps your family prepare for the unexpected. Whole life insurance can help protect your spouse during retirement or become a legacy for your loved ones or a favorite charity. Over time these policies build cash value that grows tax free. Whole life insurance is made to fulfill an individual s long term goals and it is important to keep it going for as long as you live.

While this means you could be paying premiums on your. Whole life insurance is for those looking for lifetime protection with added benefits. What is whole life insurance. The selling of a life insurance policy by a terminally ill person so that person can receive a benefit from the policy while still alive and the purchaser of the policy can receive a.

You might be looking for predictability a policy you keep permanently premiums that never change and a guaranteed death benefit 1 maybe you like the idea of a policy that builds cash value you can access 2 to help you with financial obligations.

.jpg)

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)