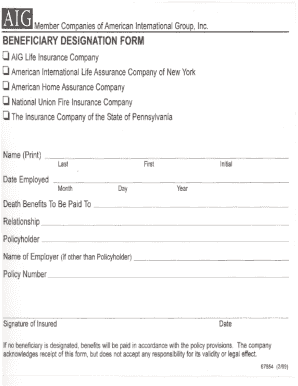

life insurance policy beneficiary

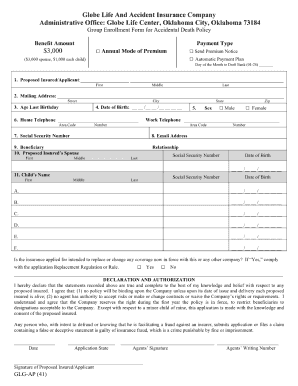

A busy national life insurance attorney will explain what happens if the beneficiary of a life insurance policy is deceased dies soon after or at the same time as the insured dies while the claim is under review or if the beneficiary designation is otherwise invalid. How beneficiaries can claim life insurance and social security benefits accessed aug. Wait for the claim to be processed.

Once you take care of things on your end the insurance company will perform a few basic checks.

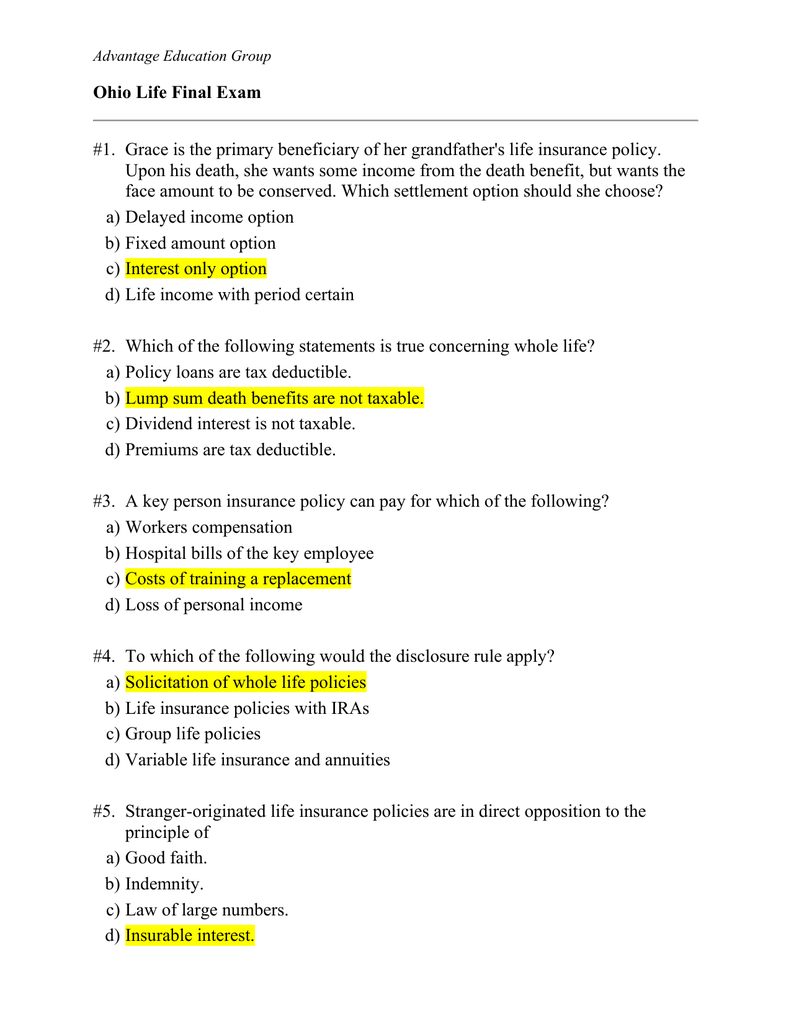

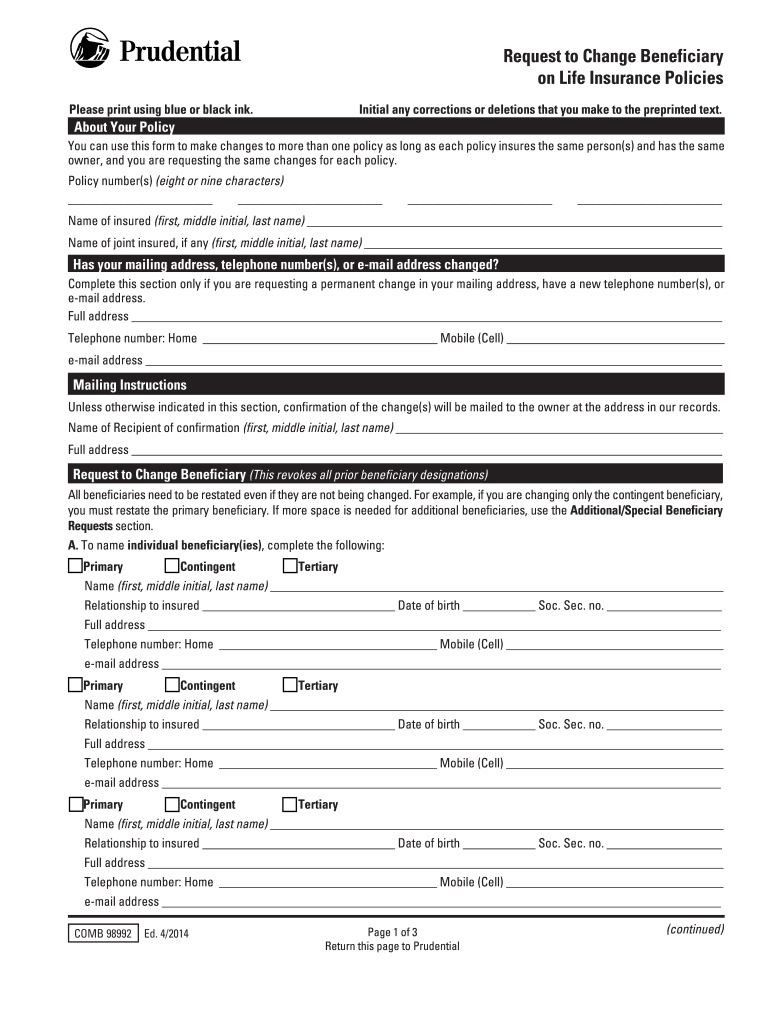

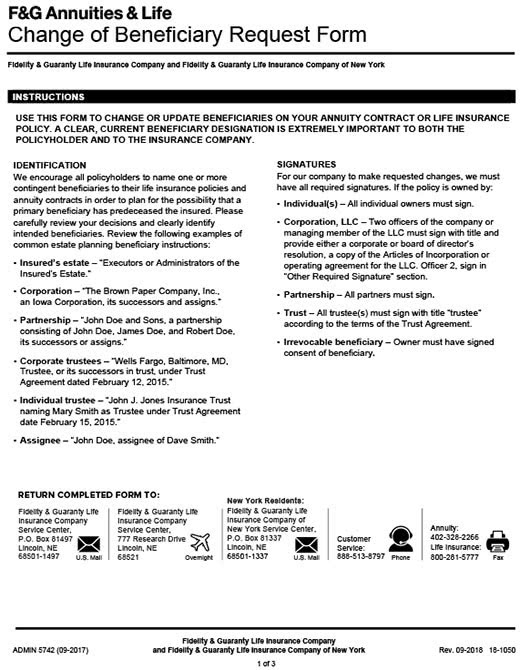

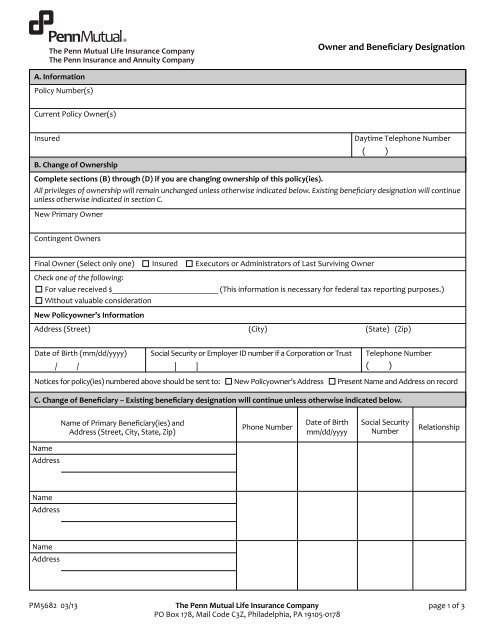

Life insurance policy beneficiary. Is the life insurance beneficiary deceased. The life insurance beneficiary may contest a last minute change by putting forth evidence of mental incapacity. During the underwriting process insurance companies require the policyholder to provide the name address social. They ll make sure that you are in fact the beneficiary assigned to the policy so that they aren t paying out to the wrong person.

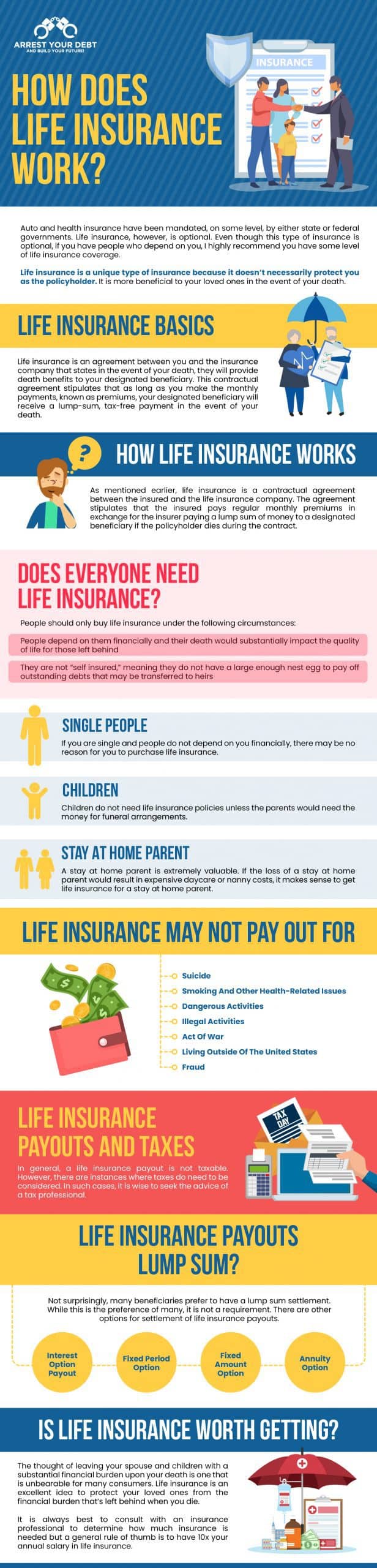

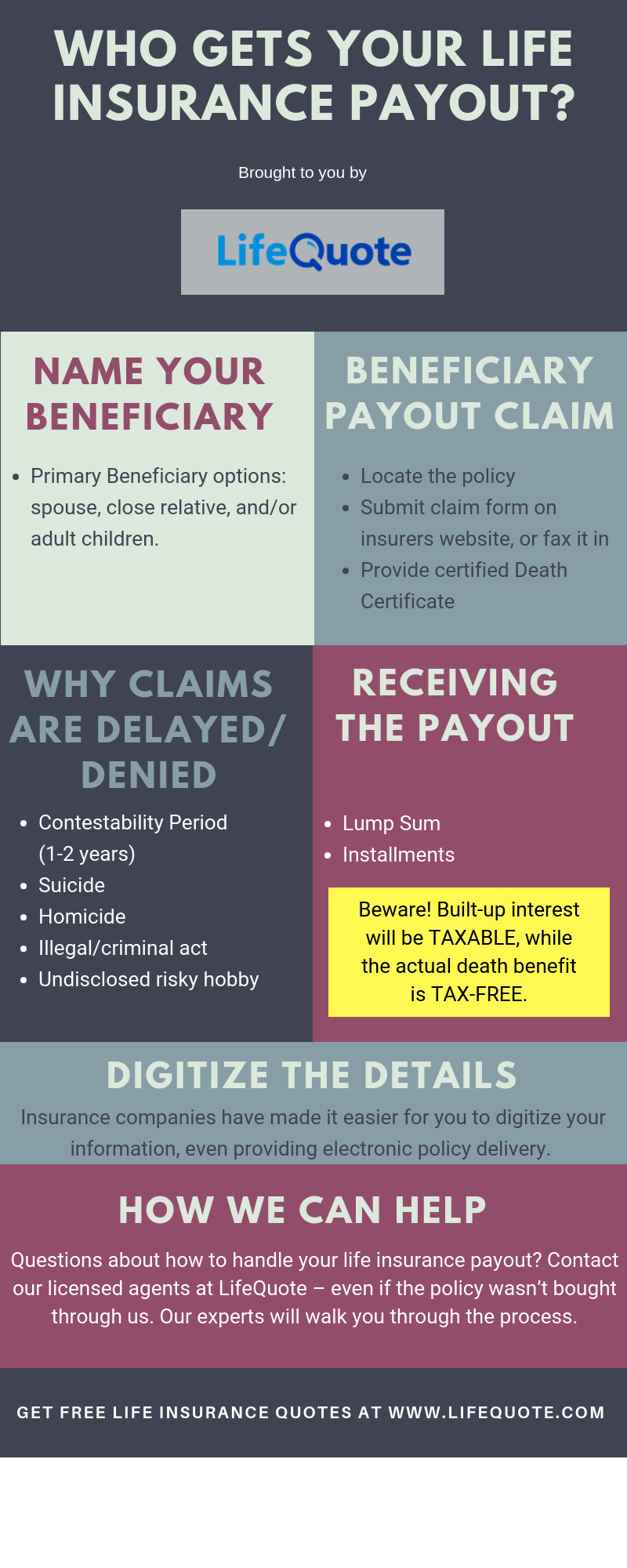

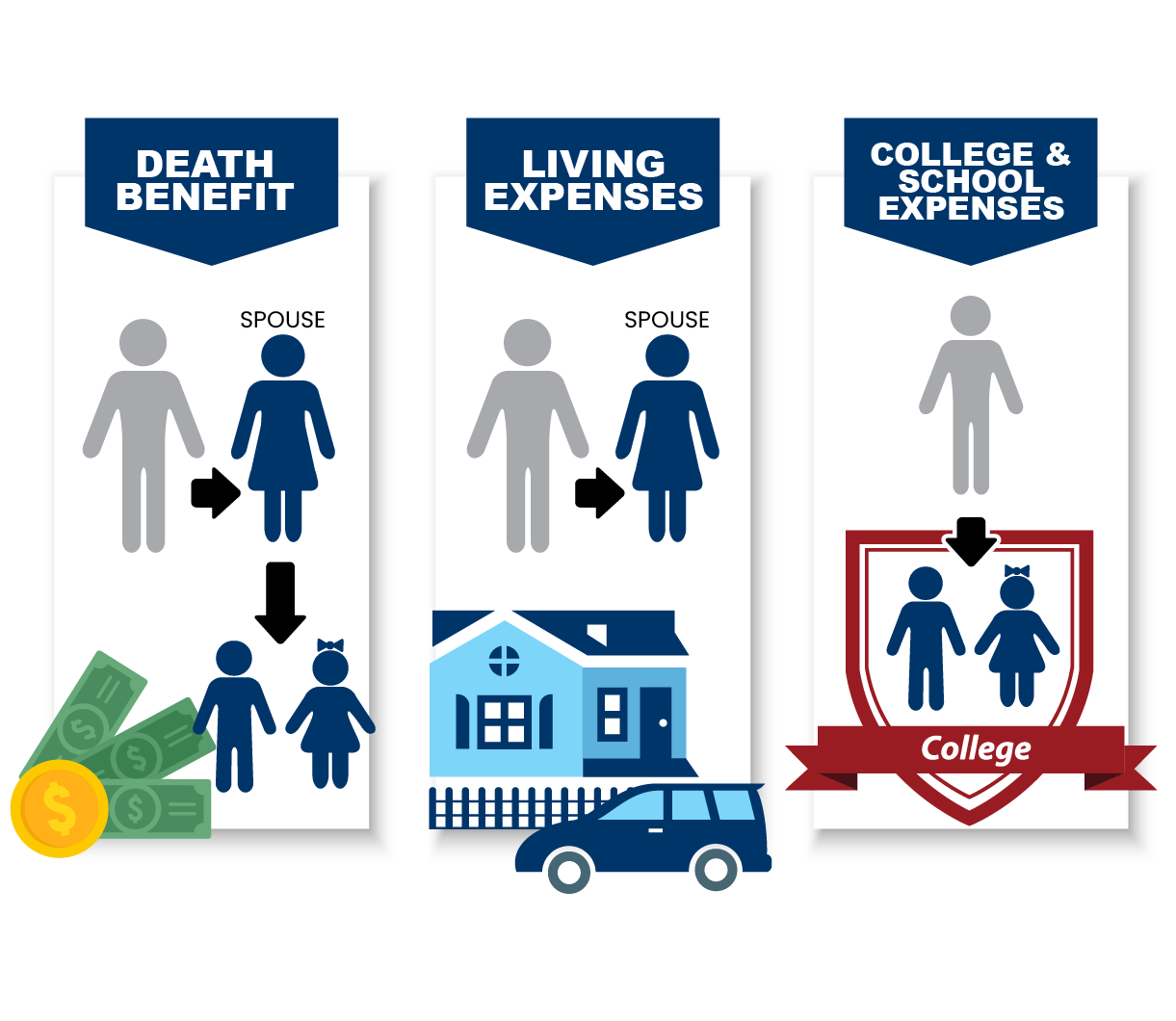

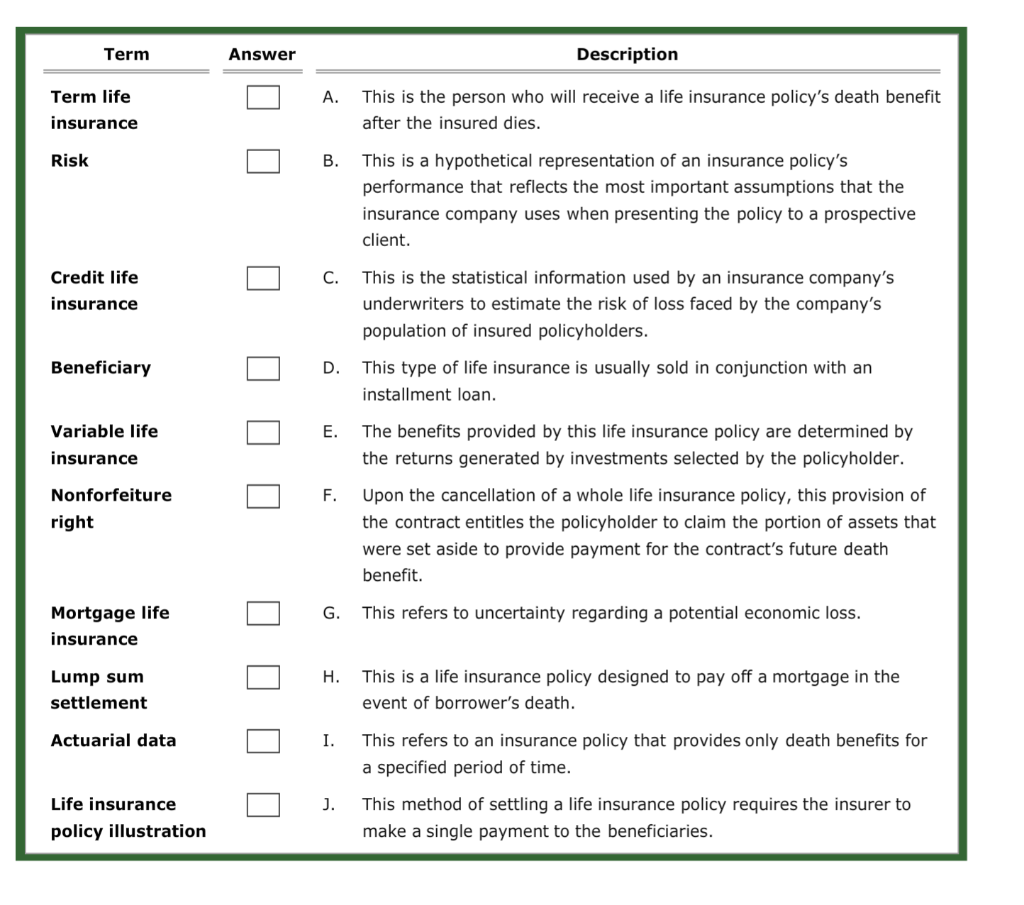

A beneficiary is a person who will receive the payout from a life insurance policy if you were to die. A life insurance policy is an agreement between an insurance company a policyholder that offers financial coverage under which the insurance company guarantees to pay a certain amount to the nominated beneficiary in the unfortunate event of the insured person s demise during the term of life insurance plans. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. Illegal or last minute life insurance beneficiary changes may or may not be valid.

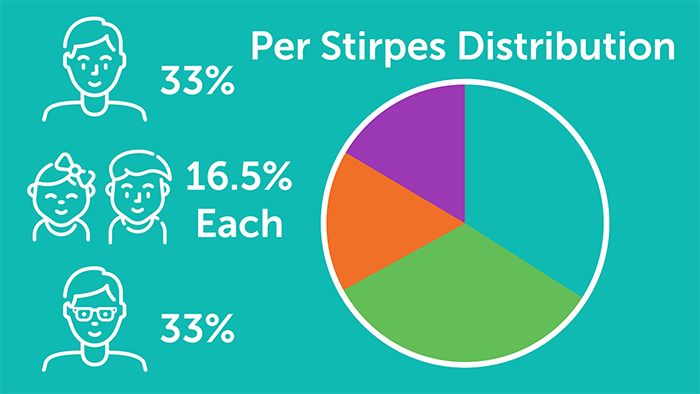

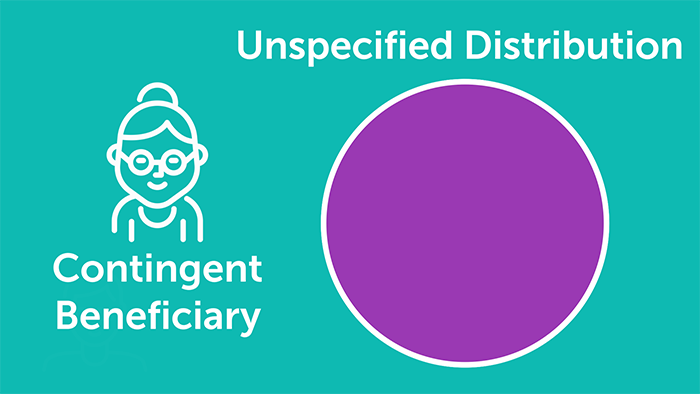

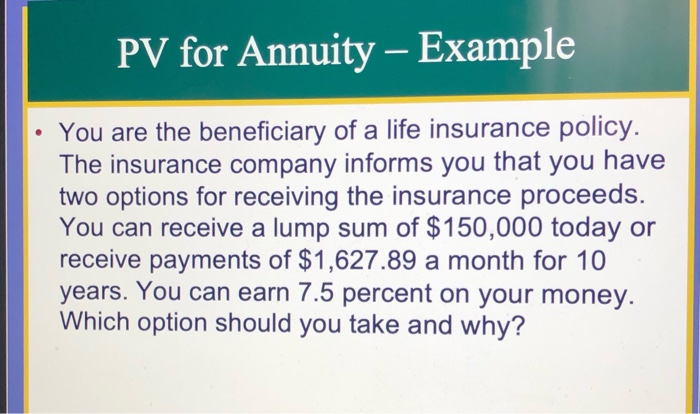

You can name an individual or entity and you can designate multiple beneficiaries including primary and contingent beneficiaries. While it is possible to dispute beneficiaries on a life insurance policy doing so creates a tremendous amount of cost and takes a lot of time the law firm says. Are you the beneficiary of an aig life insurance policy accessed aug. Depending on the contract other events such as terminal illness.

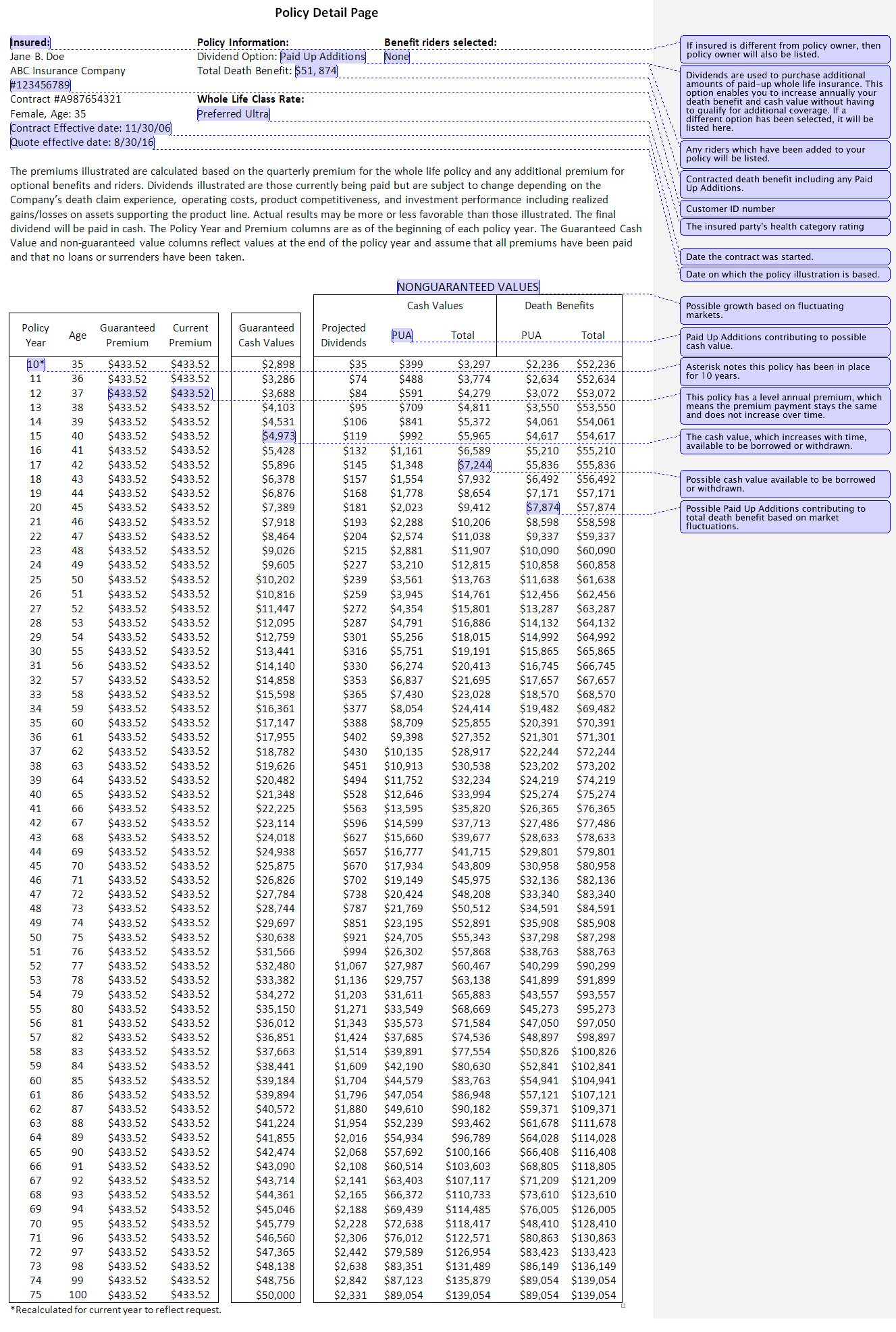

However cash value withdrawals can have unexpected or unrealized consequences. A life insurance beneficiary receives the policy s death benefit if the insured dies during the policy term.

:max_bytes(150000):strip_icc()/fatherandsontalking-3233f350519542a19224af43b9ca8c1b.jpg)

/179242090-5bfc392646e0fb00265fa90b.jpg)

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)