life insurance life assurance

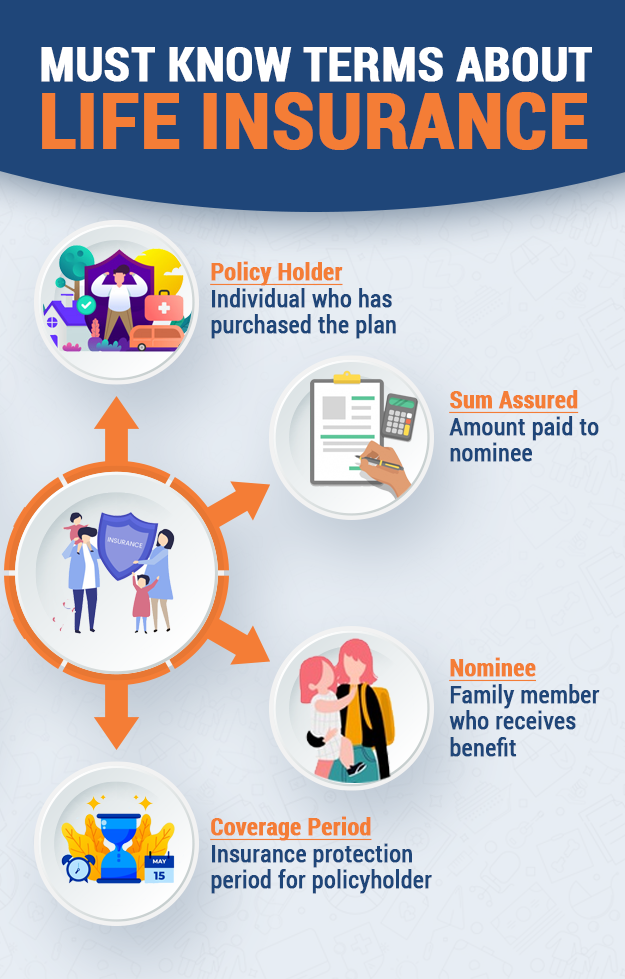

Life insurance and life assurance are both policies that pay out if you die during the cover term. Product client service forms and company financial information available. Commuinsure offers general insurance products like home insurance car insurance other than life.

Once you ve thought about a plan it s time to decide if a life assurance policy is for you.

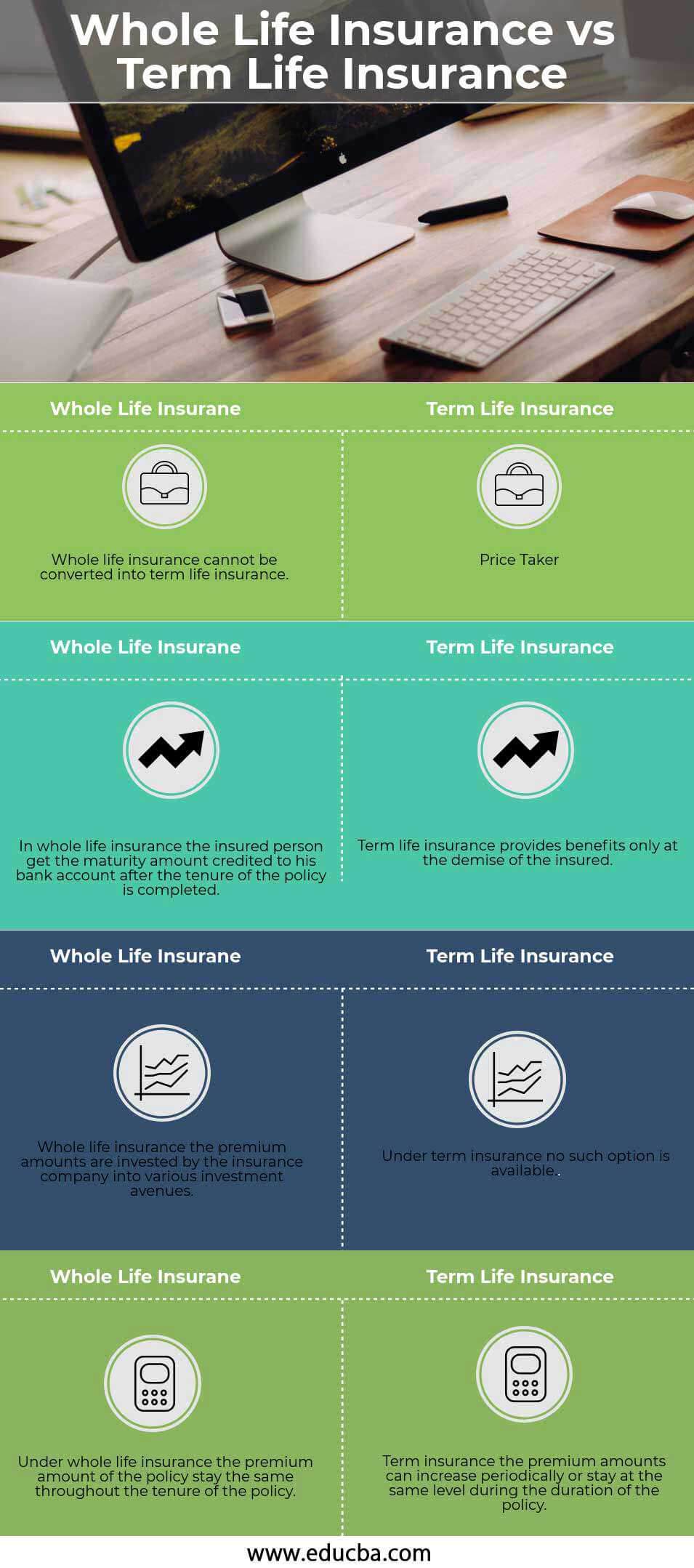

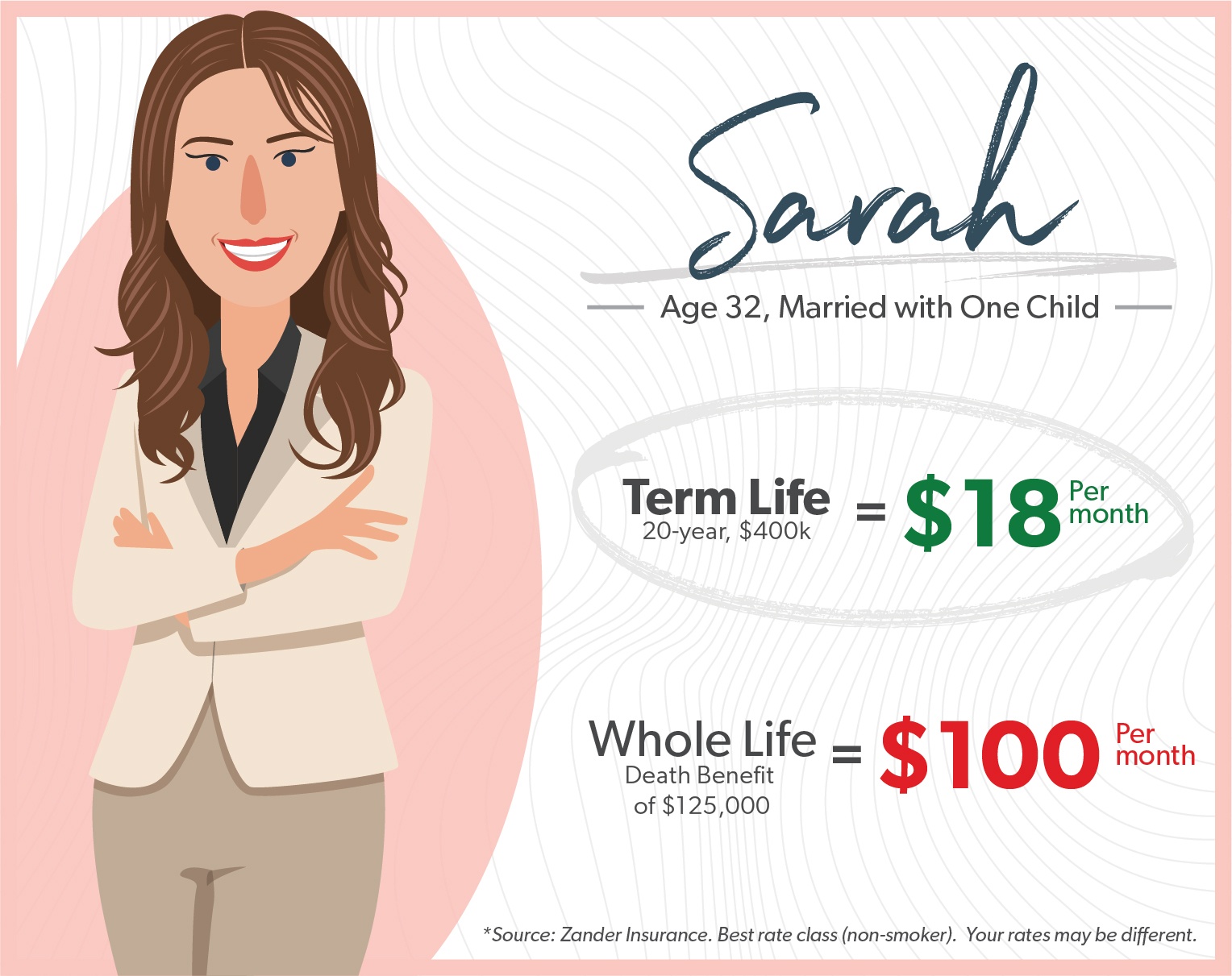

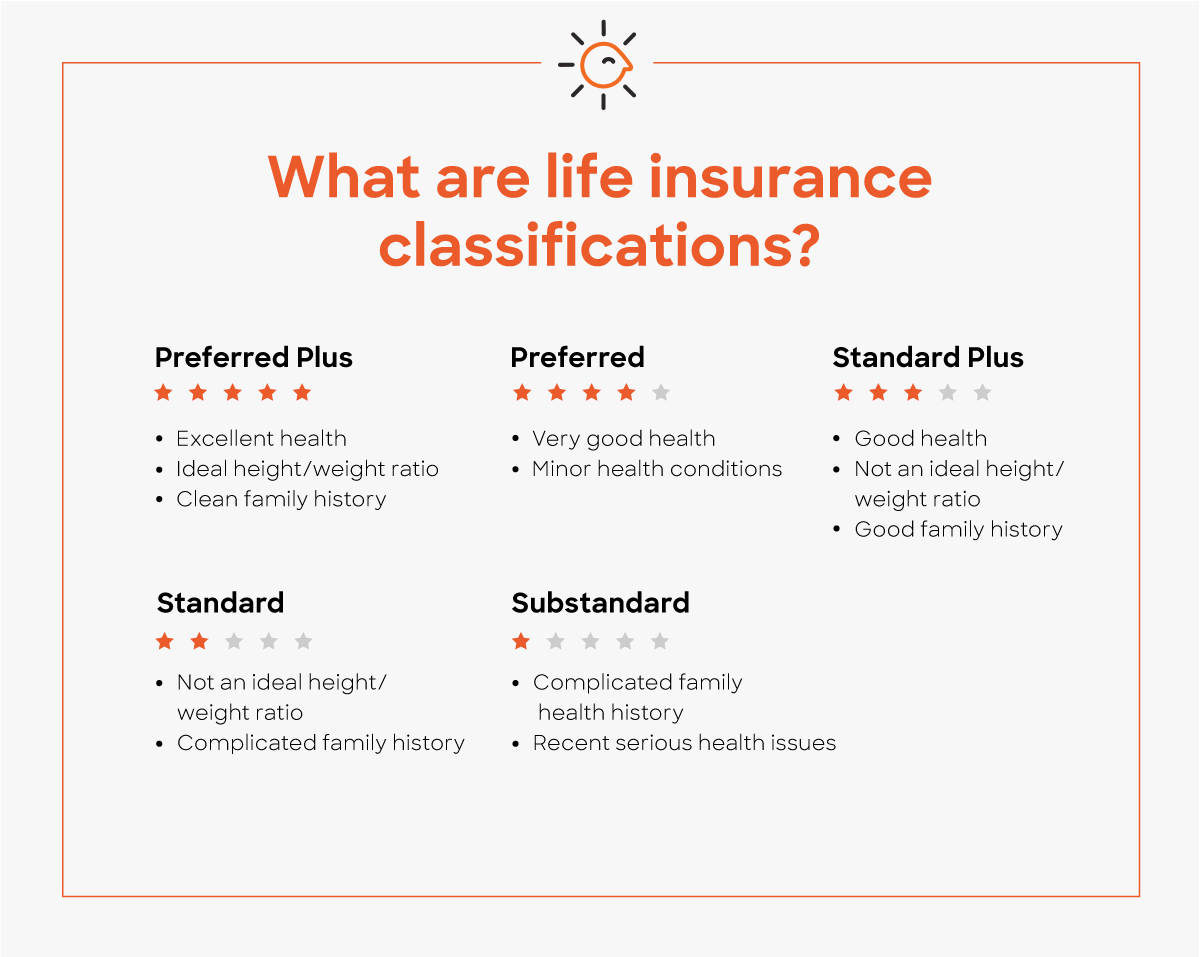

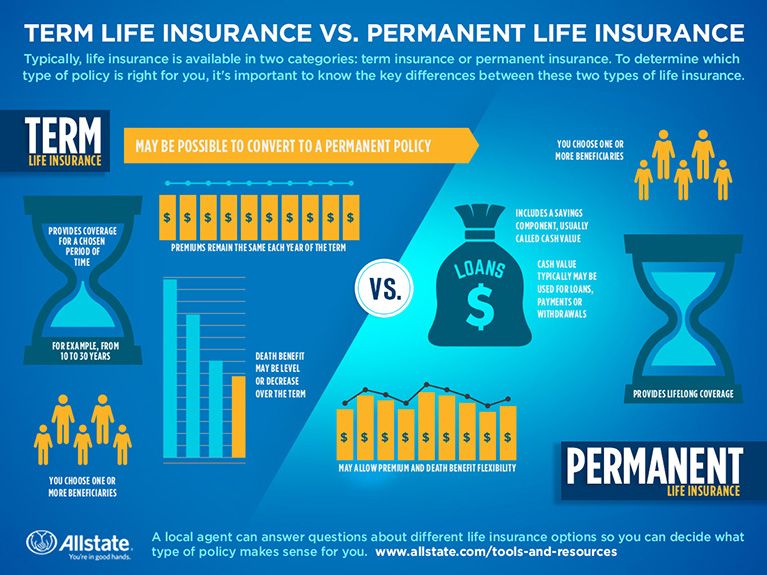

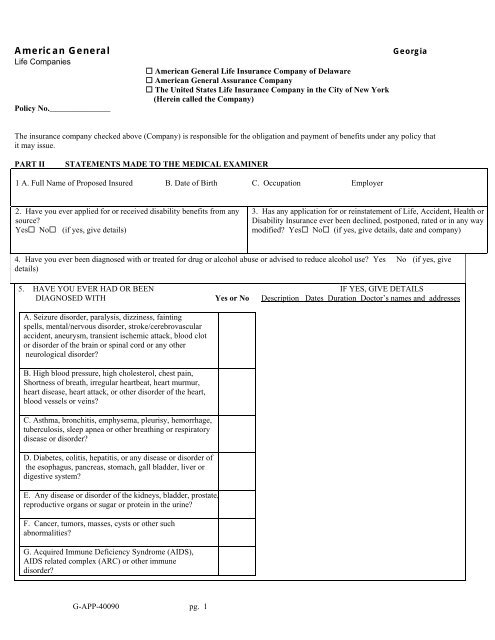

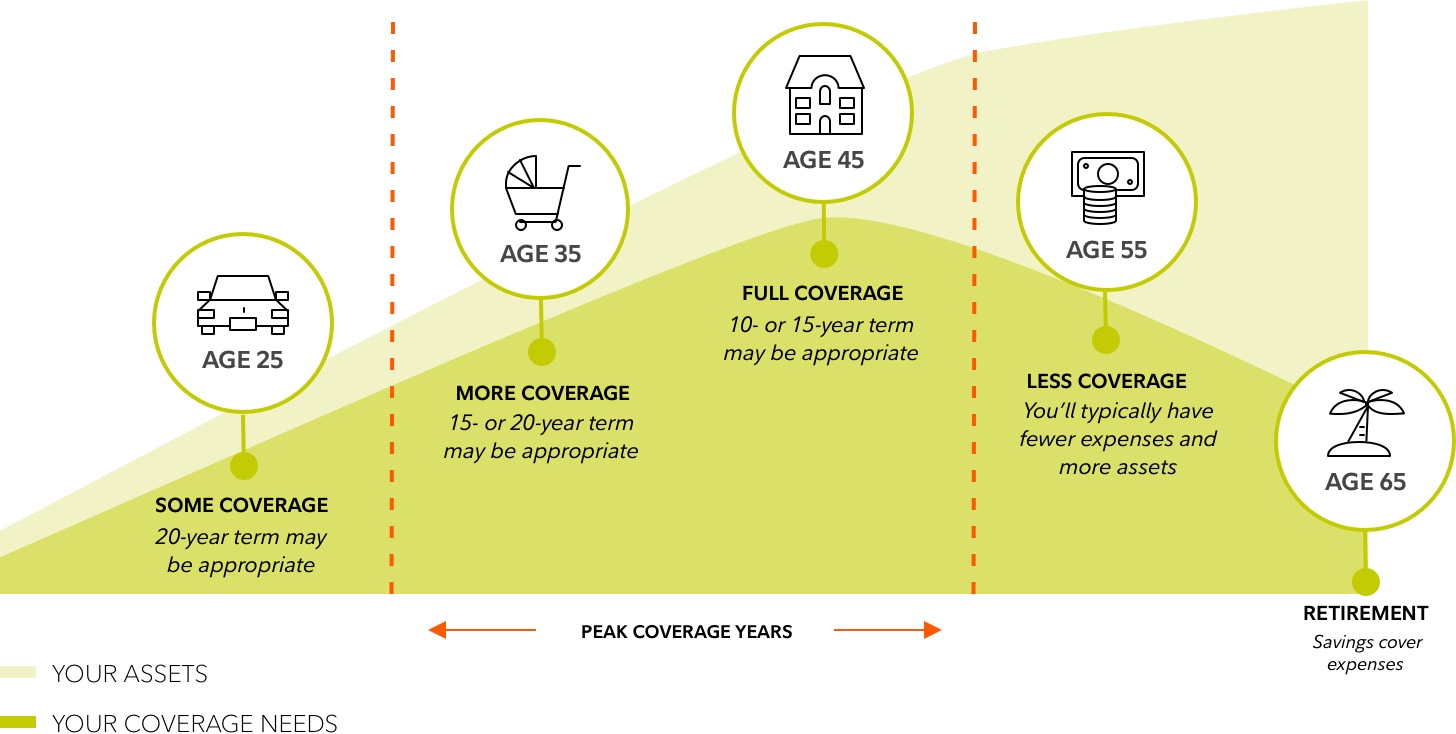

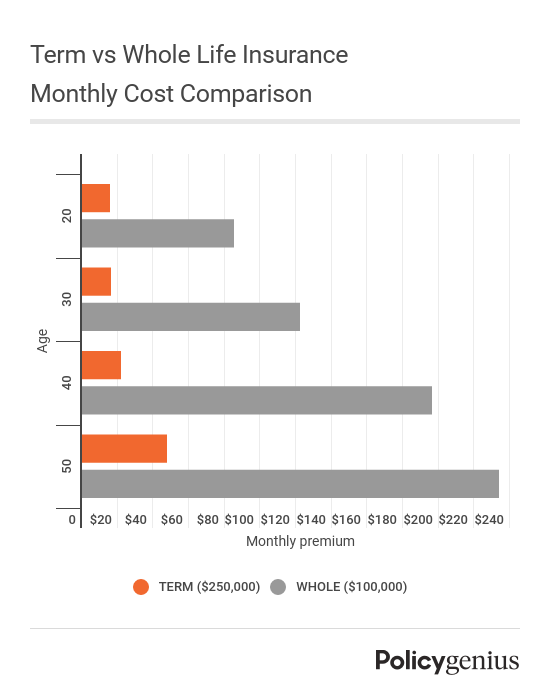

Life insurance life assurance. There s benefits to each. Life insurance usually only covers you for a set period say 25 years. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. Most term life insurance policies are taken out for a set period usually between five and 30 years.

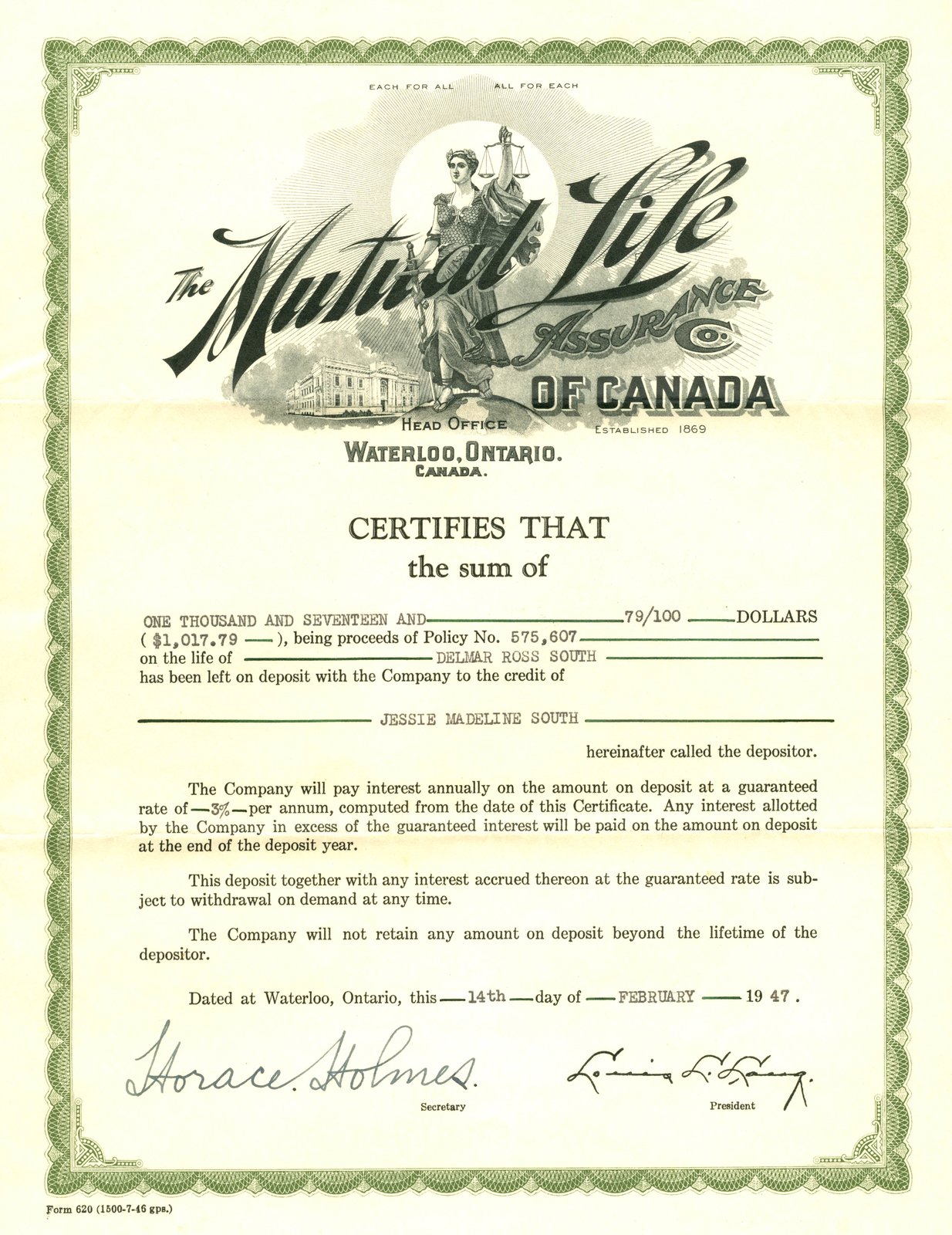

Licensed in forty six states offering life insurance annuity products and qualified retirement annuities. It is a subsidiary of the commonwealth bank of australia. Both are forms of protection designed to pay out after the policyholder passes away but they don t work the same way. It provides a large range of life insurance products to its customers by offering affordable and flexible premiums.

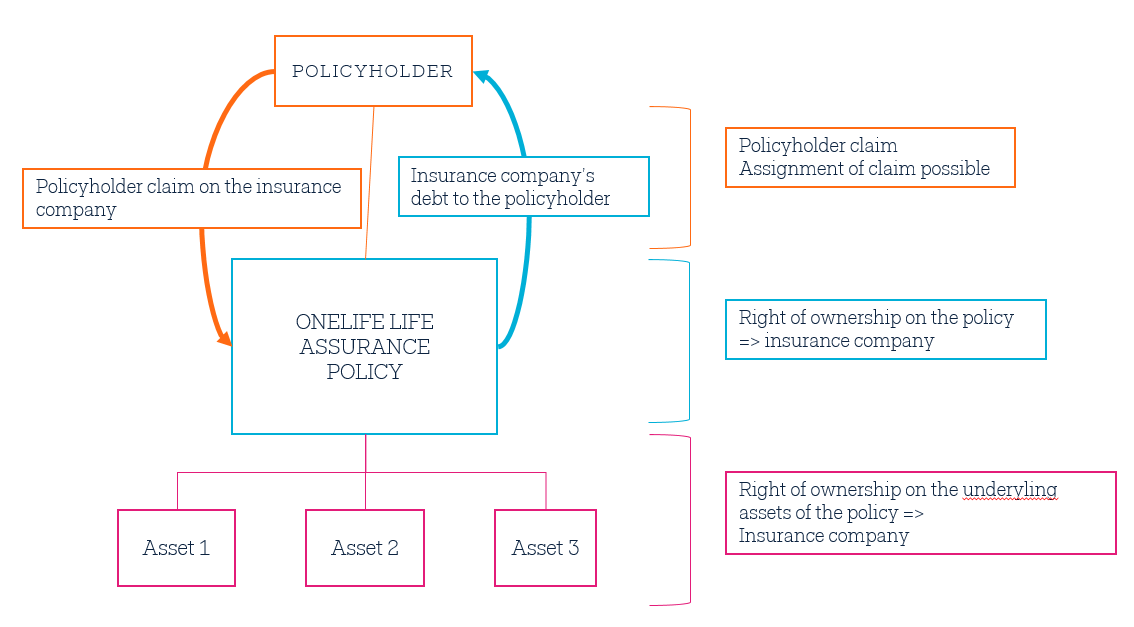

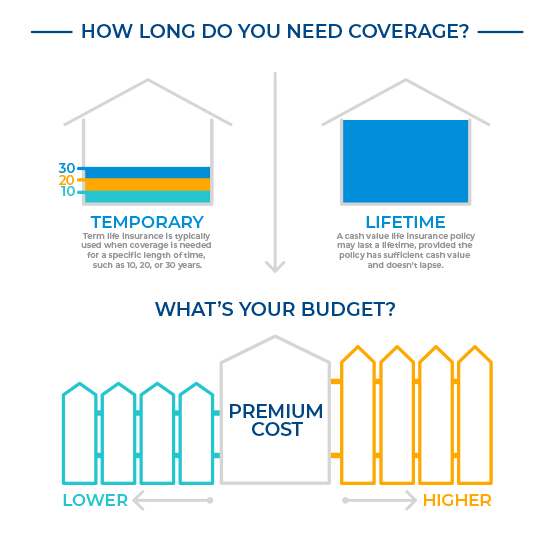

It s worth being aware that over 50s life insurance can sometimes cover life assurance. Life insurance and life assurance are terms that are often used interchangeably but is there a difference. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. 3 whole life advantage is a whole life insurance policy issued by allstate assurance company 3075 sanders rd northbrook il 60062 and is available in most states with contract series icc18ac1 nc18ac1 and rider series icc18ac2 nc18ac2 icc18ac7 nc18ac7 icc18ac4 nc18ac4 icc18ac5 nc18ac5 icc18ac6 nc18ac6 icc18ac8 nc18ac8 icc18ac9 nc18ac9.

The main difference is that life assurance also called whole of life cover covers you from the day you take out a policy until the day you die. Depending on the contract other events such as terminal illness. The term assurance means that you re guaranteed to be paid out upon death and typically whole of life insurance is the main assurance product. Life assurance is an assurance that you eventually earn a pay out whereas a life insurance policy will finish at the end of its term.

Get started with our irish life life insurance quotes and explore life assurance products from mortgage protection insurance to critical illness cover. Life assurance vs life insurance.

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

/types-of-insurance-policies-you-need-1289675-Final21-42e0a09be99f439e8f155b97f6decd8e.png)