life insurance for sba loan

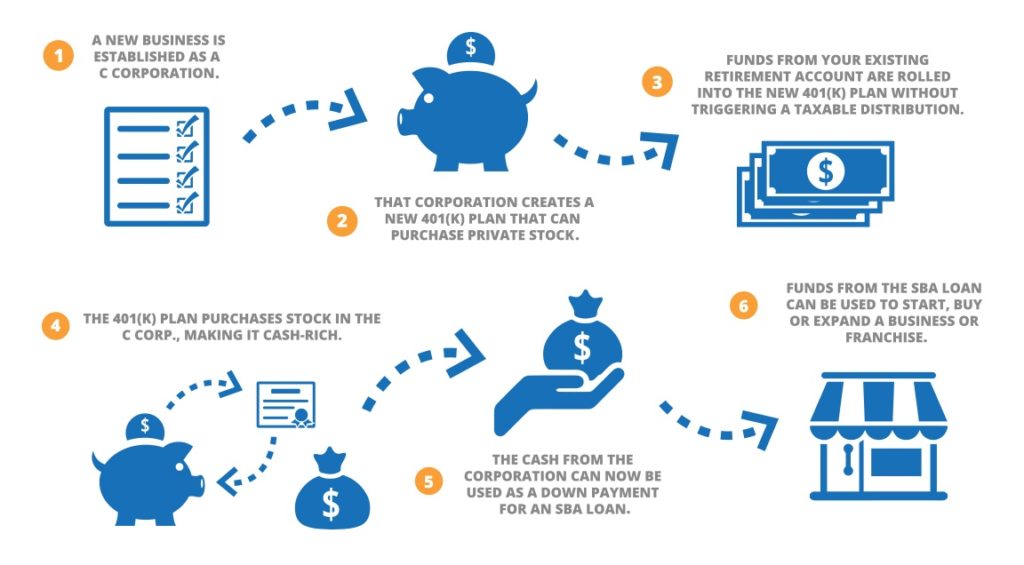

For example say that a small business owner applies for a standard 7 a sba loan worth 500 000. The borrower repays the lender and the sba guarantees the loan in case of borrower default. The challenges are many.

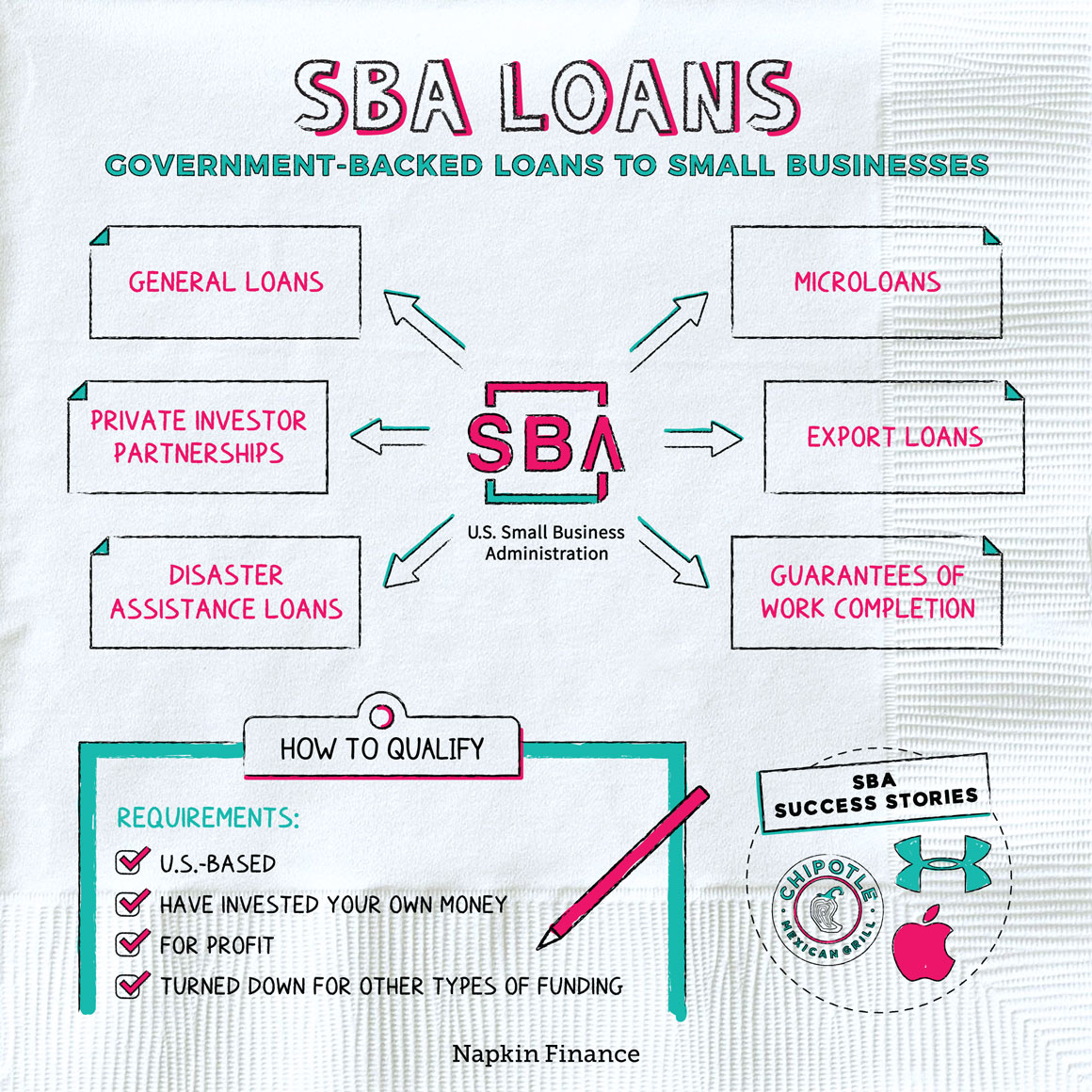

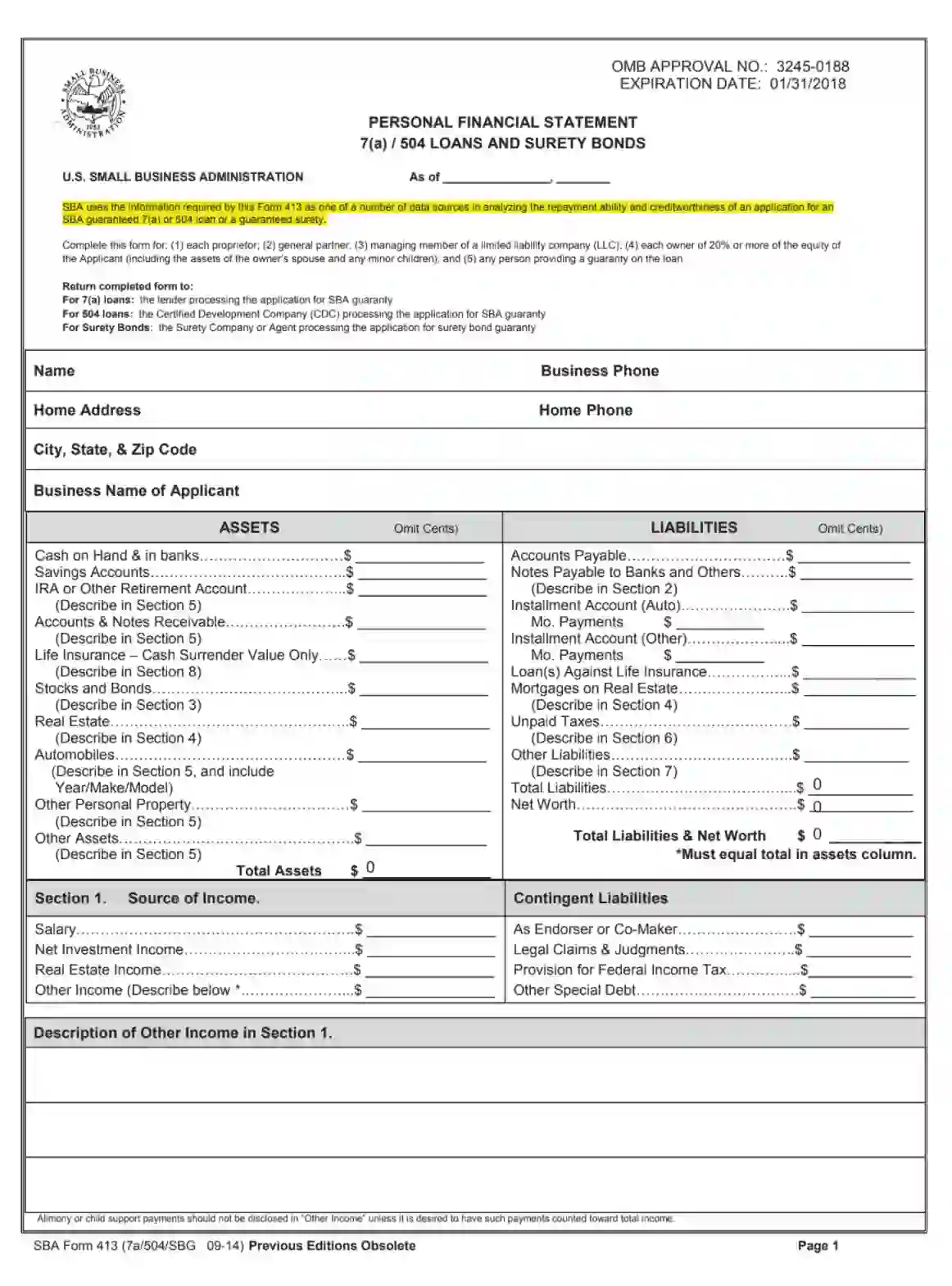

Small business administration sba loan requirements determine your eligibility to qualify for funding and are focused on the characteristics of you and your business.

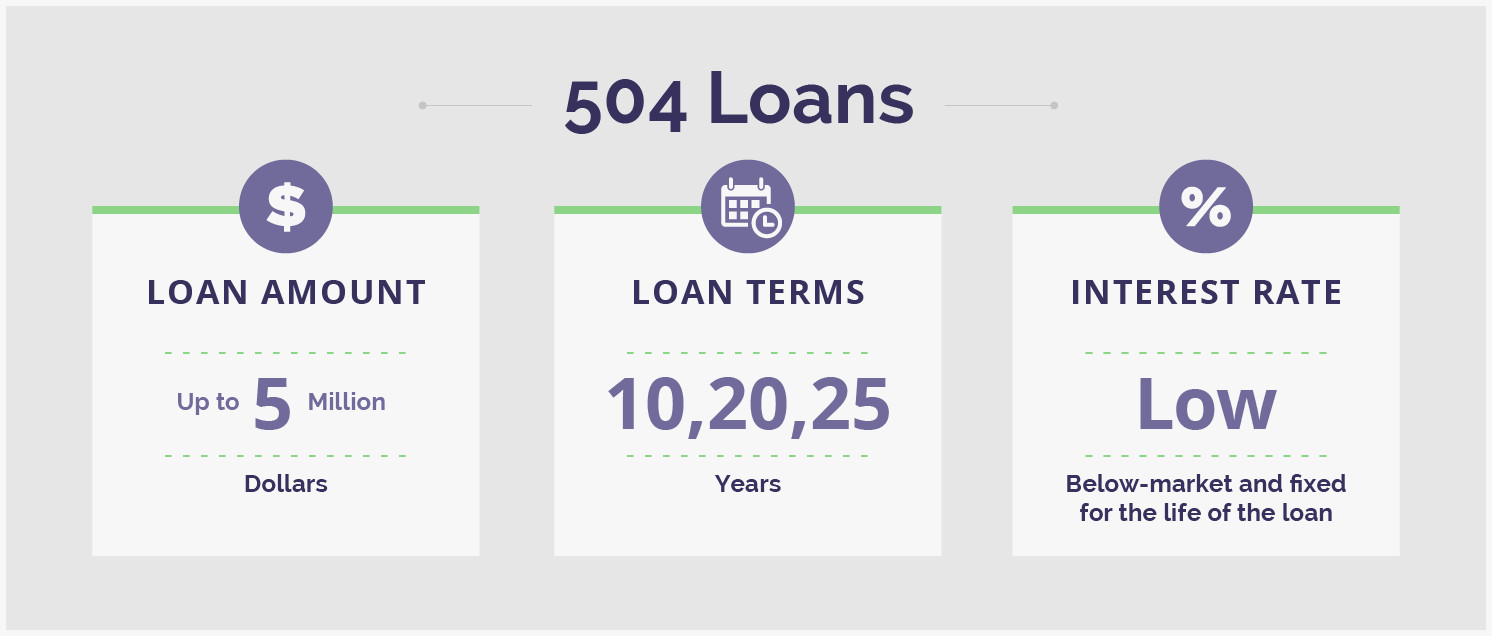

Life insurance for sba loan. An sba loan authorization is prepared which is an agreement between the sba and the lender as to the terms and conditions under which sba will guaranty the loan. Keeping up on the small business administration s terms and rates is part of a smart approach to finding a small business loan the 7 a loan is the sba s most popular product and offers a. Amortization schedule an amortization schedule is a table that shows a breakdown of this monthly payment including how much interest and principal you paid each month and what your. The 7 a loan program is the small business administration s most popular program.

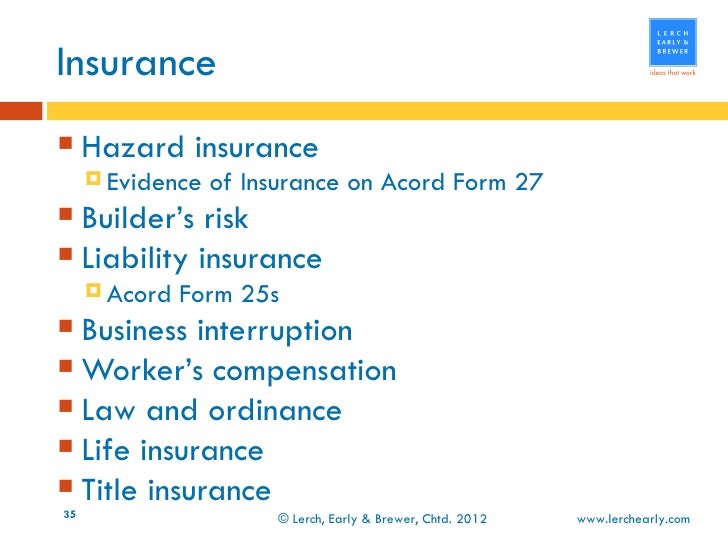

Lender completes loan underwriting such as obtaining and reviewing appraisals title work environmental reports etc. This is as the name suggests the most common form of lending. In order to estimate the monthly sba loan payment our calculator assumes the loan will be fully paid off in equal monthly payments throughout the life of the loan. Contact us at 541 714 4000 ext.

Other sba loan qualifications include having adequate collateral and providing a personal guarantee. Put simply an sba loan is a small business loan that is partially guaranteed by the government the small business administration which eliminates some of the risk for the financial institution. Life insurance is a requirment for any business owner looking to receive an sba loan. The lender extends the loan based on terms it sets within limits established by the sba.

We offer trusted fast and dependable life insurance for sba loans. Sba revokes authority of sem resource capital to participate in the 504 loan program revised by sba revokes authority of atlanta micro fund inc. Sba 7 a loan rates. Borrowers need to have excellent credit and strong financials that demonstrate their ability to repay the loan.

/168450140-56a0a4af3df78cafdaa38ba4.jpg)