life insurance for diabetics

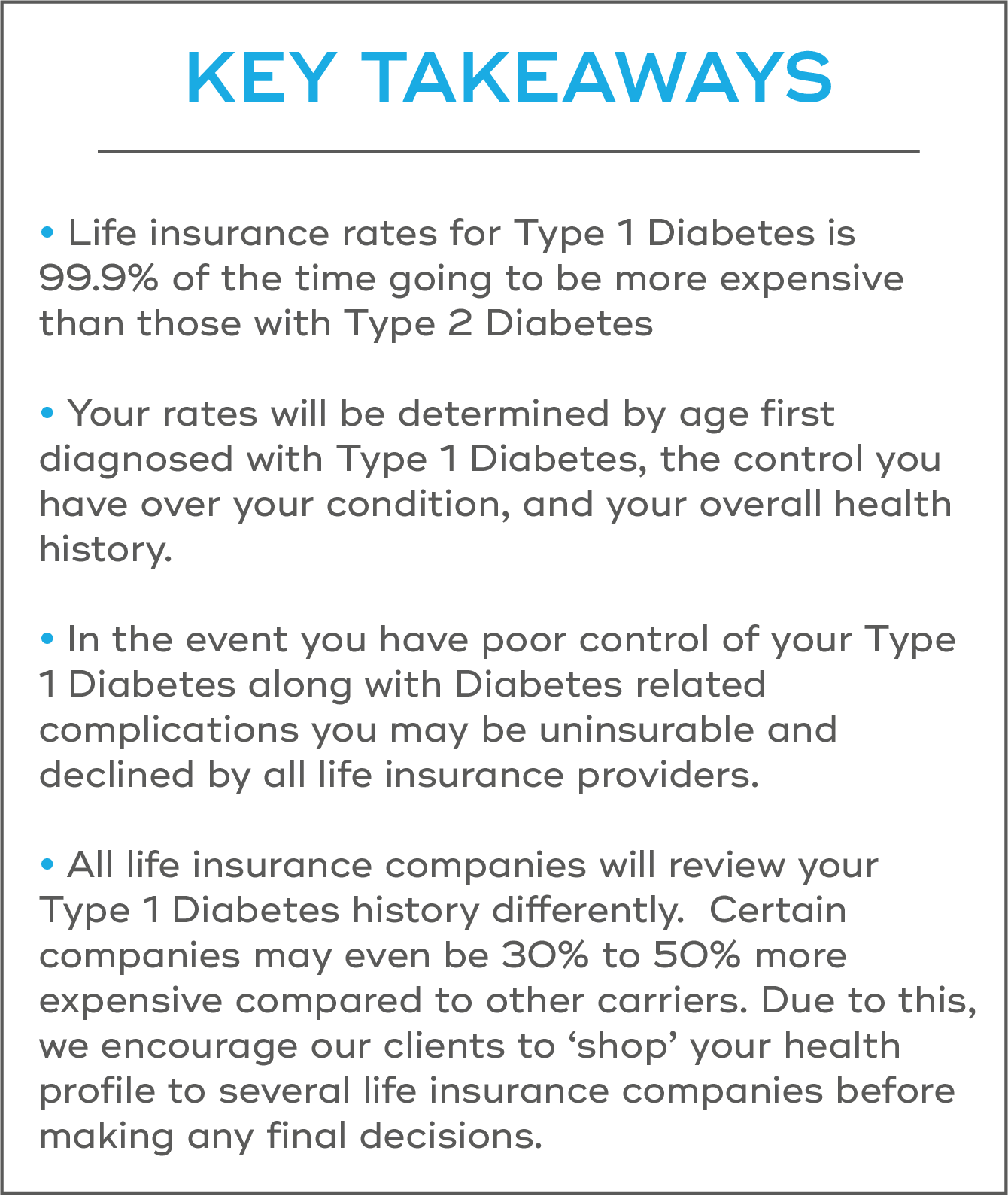

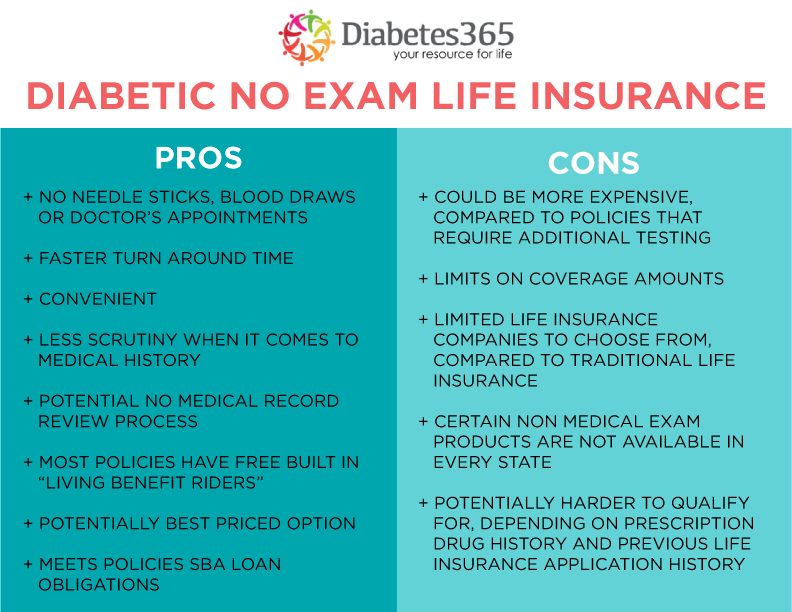

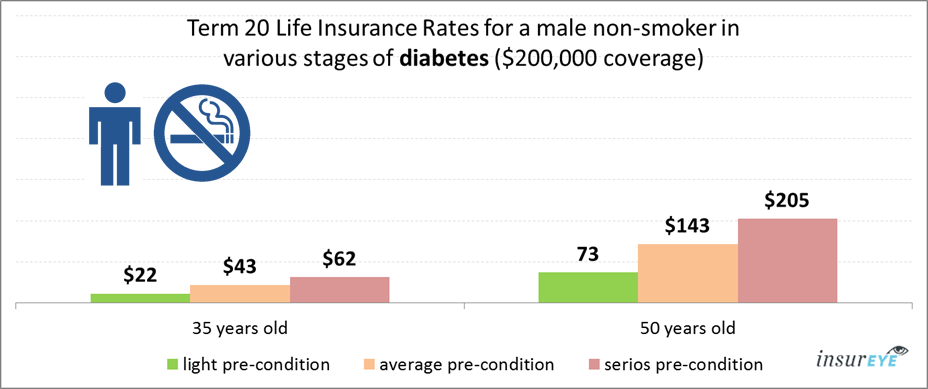

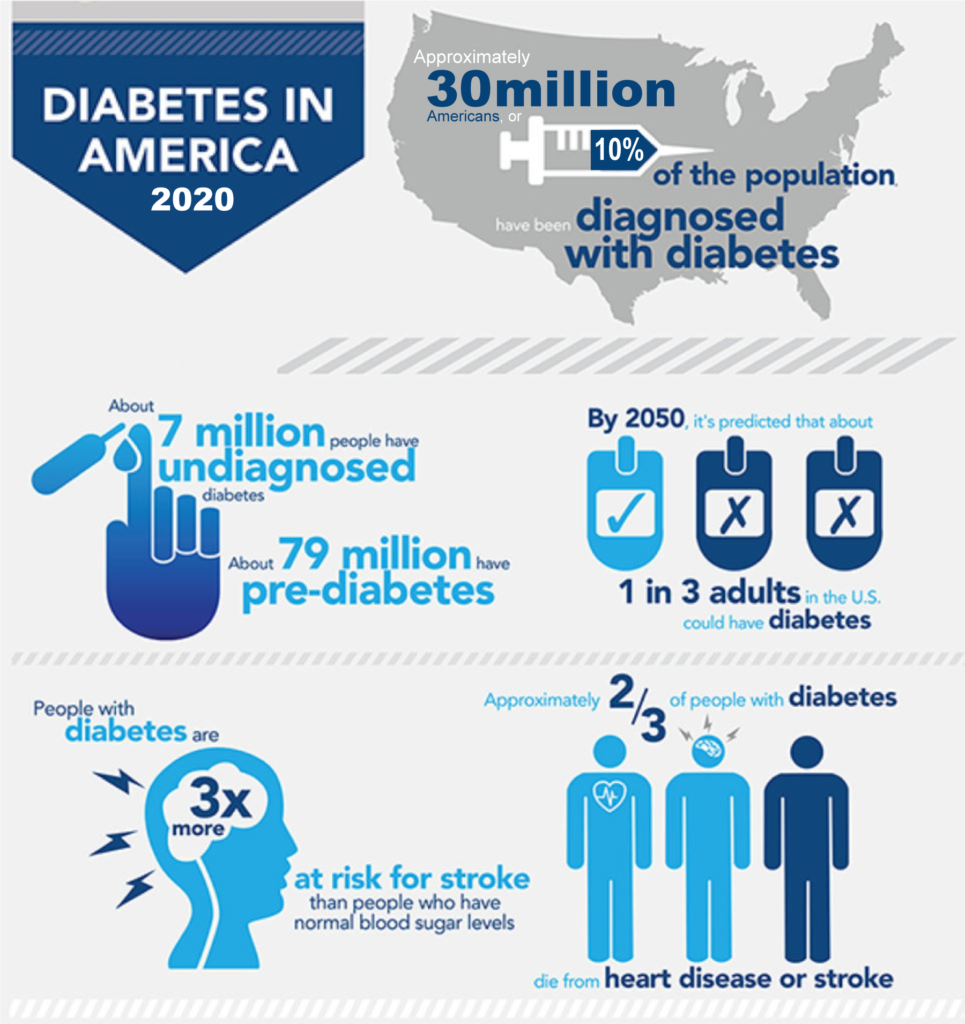

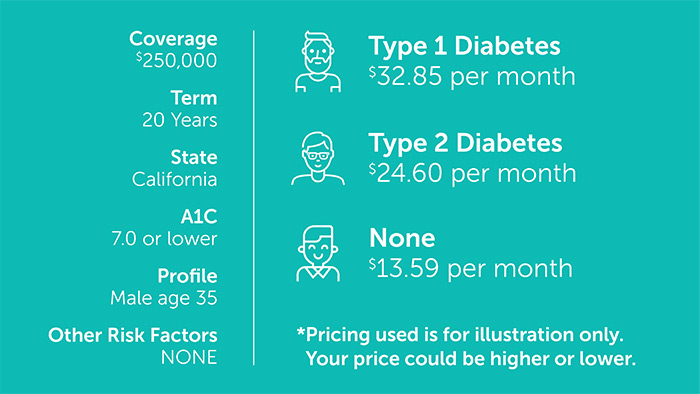

New life insurance providers are increasing the pressure on established insurers though. Also weight a1c levels blood pressure and other health conditions will impact your rates. Typically a no exam whole life insurance policy is used to pay for burial expenses.

Identical to a standard split dollar insurance plan except that a charity instead of an employer owns the life insurance policy.

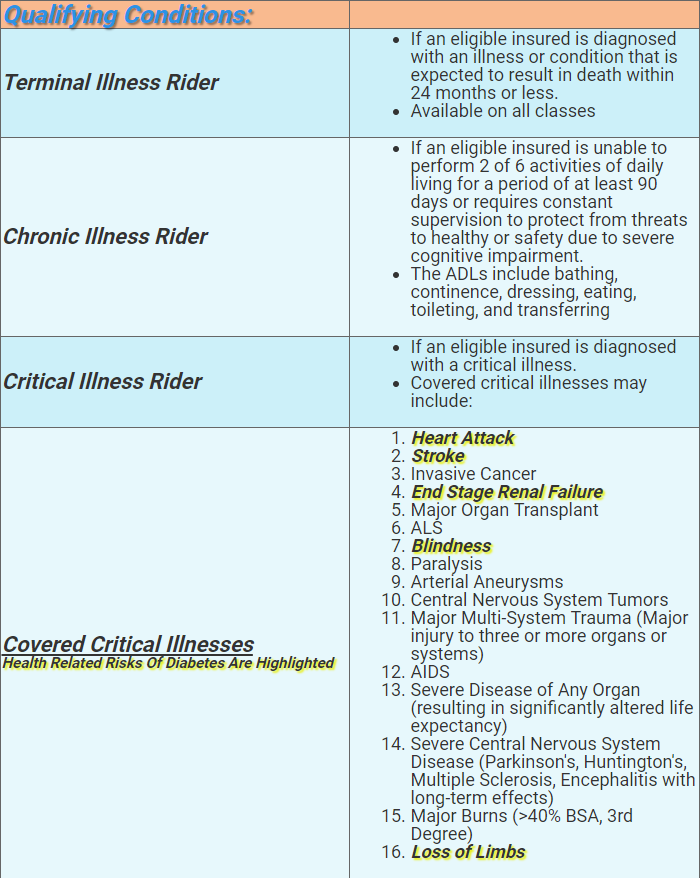

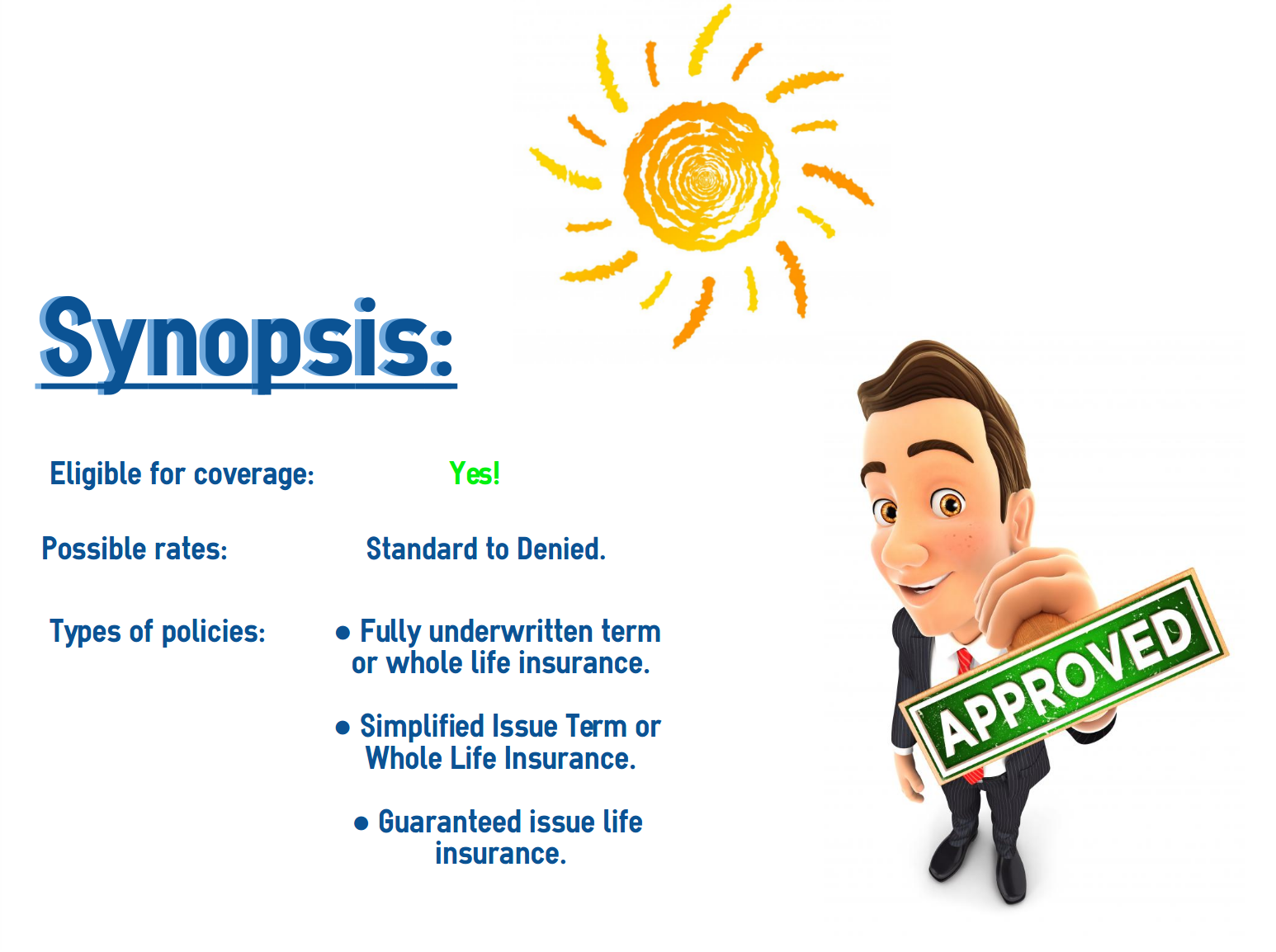

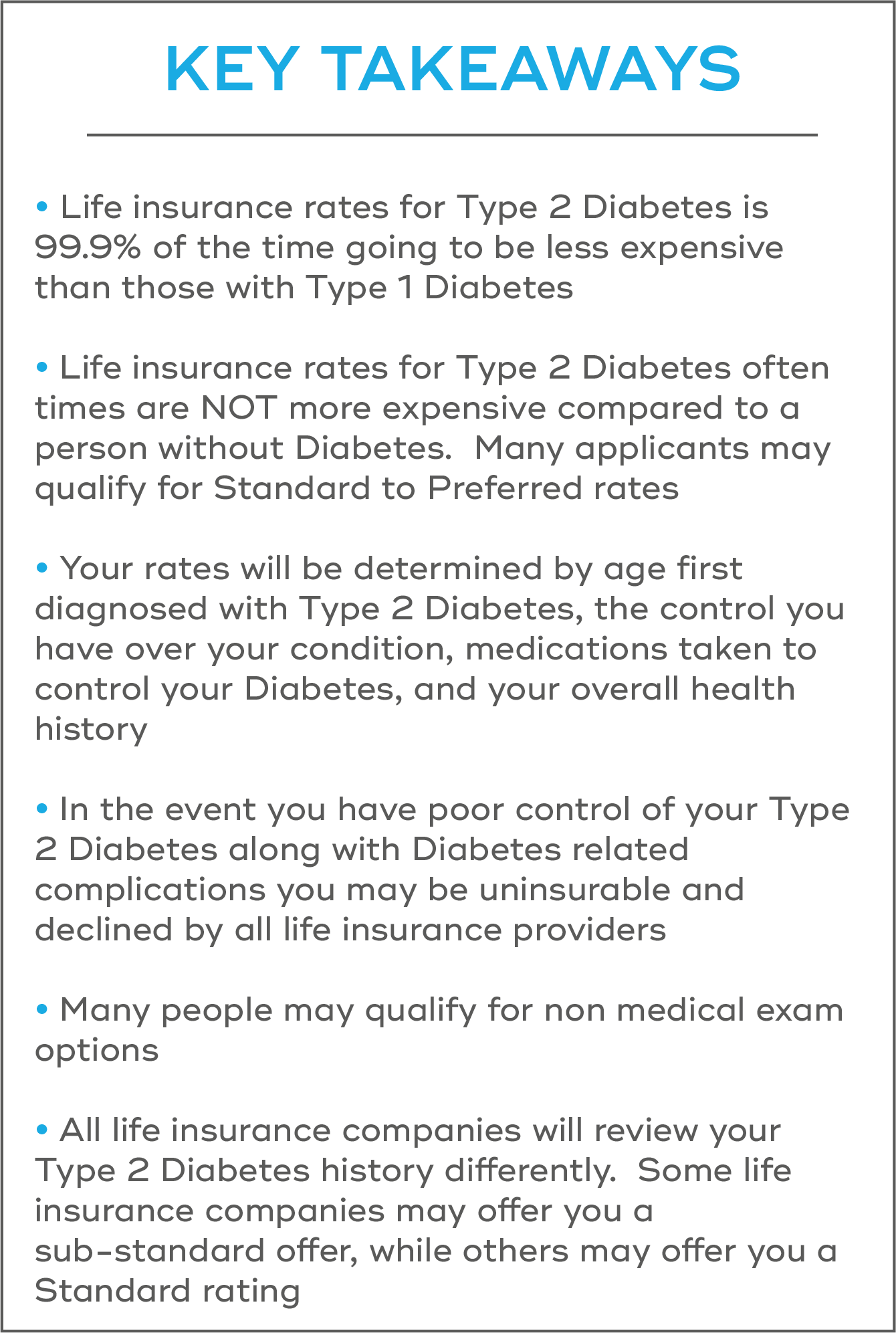

Life insurance for diabetics. With a wide range of affordable coverage options our portfolio is designed for a broad spectrum of individuals underwritten on a simplified issue basis no medical exams required or lengthy applications just a few yes no health questions to complete in order to. The good news is affordable life insurance for diabetics is still possible if you can prove consistent and effective treatment for 6 12 months or more have a less severe. Whole life insurance is often sold as a kind of cure all investment with built in tax advantages and flexibility to help you handle just about any need. Pre diabetics who are able to control their condition with diet will rate much better than those on insulin.

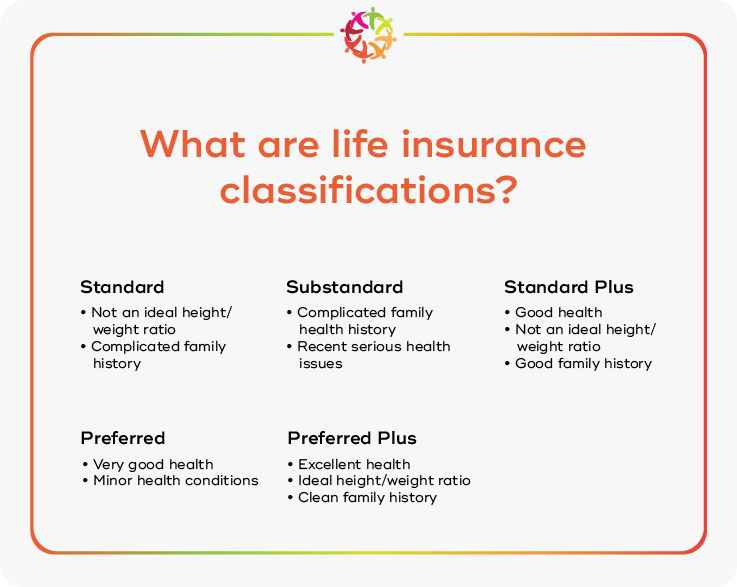

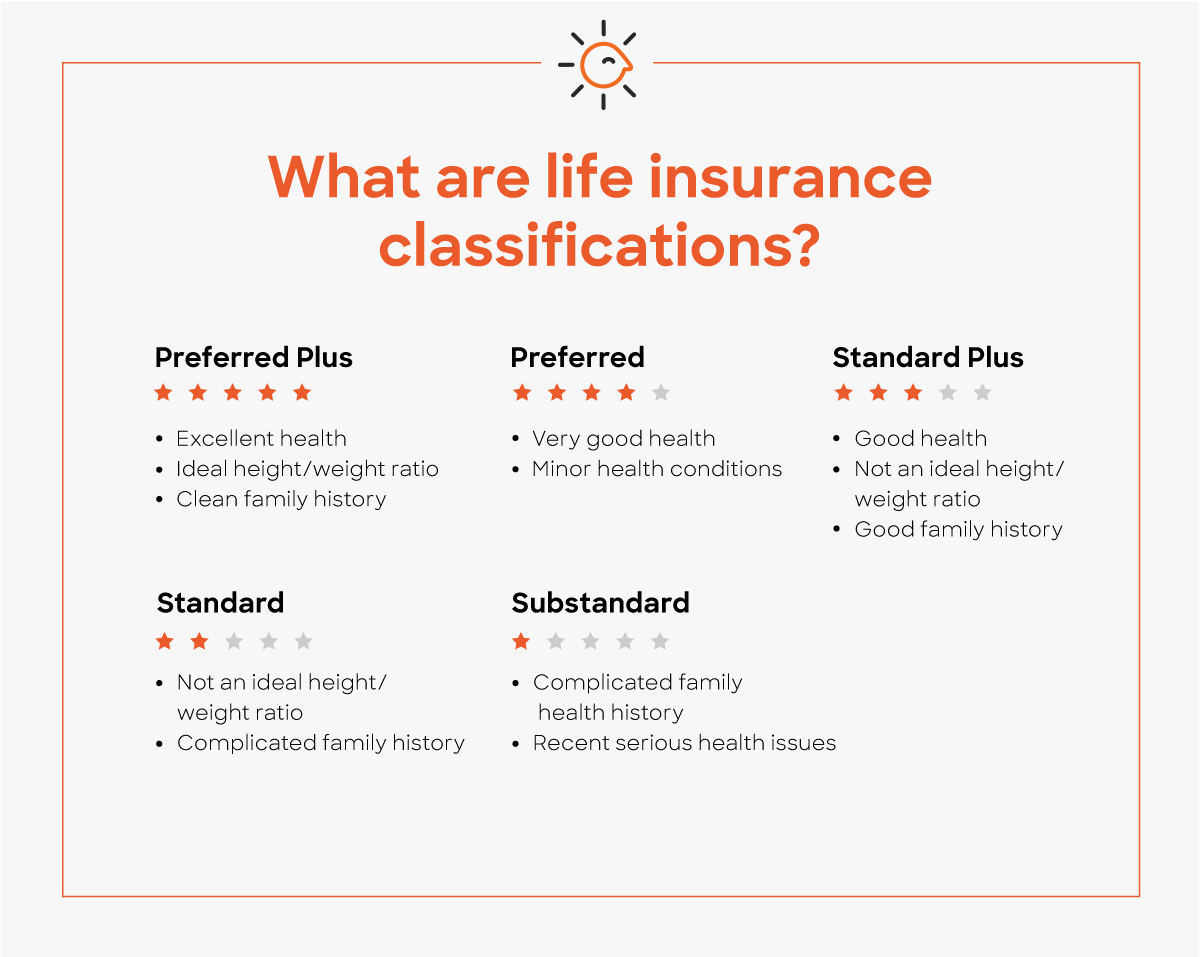

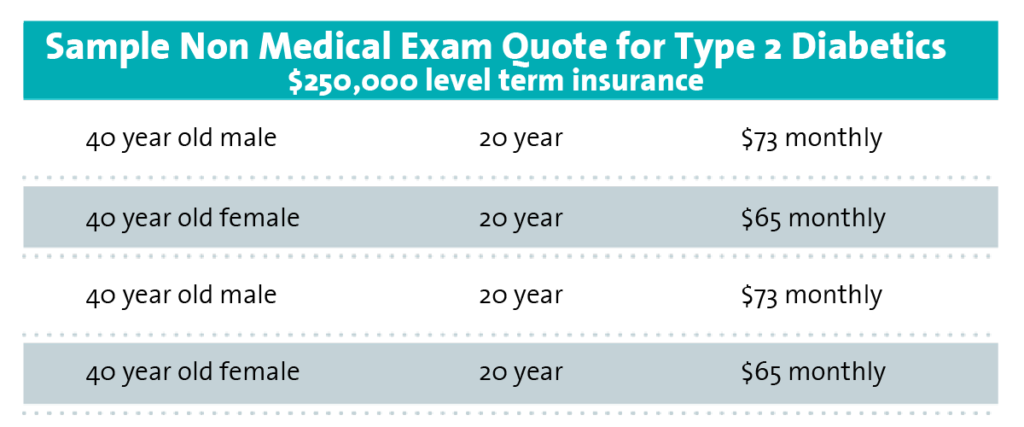

Charitable split dollar insurance plan. Older shoppers less healthy applicants and men also tend to pay more. Diabetics can still get life insurance though the process may be a bit different. We researched and reviewed the best life insurance for diabetics based on coverage cost ease of qualifying and.

Some offer as much as 2 million in coverage without a medical examination. Contact a policygenius agent for free to find out more. We ve made it our mission to offer life insurance products as simply as possible no health questions or invasive testing. In exchange for monthly premiums the insurance company agrees to pay a specific sum of money to named beneficiaries typically family members when the insured person dies.

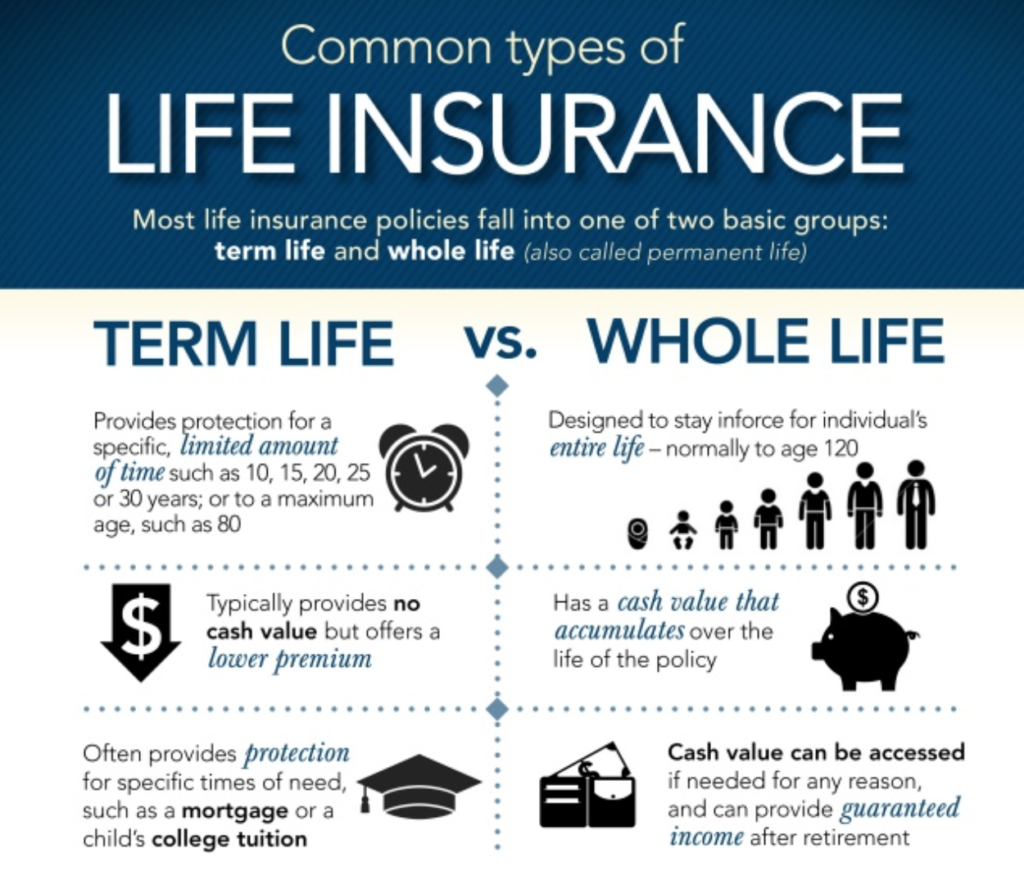

While life insurance premiums the amount you pay to keep your policy active vary from person to person in general whole life insurance is more expensive than term life by an average of 5 15x. Just answer a few yes no questions to determine eligibility. A life insurance policy for diabetics is an agreement between the insurance company and the person with diabetes. But the truth is that whole life insurance is a poor fit for just about everyone with significant weaknesses that are all too often hidden by the agents selling these policies read more.

Whole life insurance protecting your whole life has never been easier. Each company will have slightly different underwriting on how they categorize diabetics. With whole life insurance the maximum amount of coverage is far lower usually around 50 000. Life insurance for diabetics is usually affordable.

/Aspire_Logo-00338287b03b4dfba019fcabdfd901bf.jpg)

:max_bytes(150000):strip_icc()/Aspire_Logo-00338287b03b4dfba019fcabdfd901bf.jpg)

/images/2021/04/28/happy-woman-flower-shop.jpg)

:max_bytes(150000):strip_icc()/Principal_edit-7802b4f14a3e43a491831c59edc282f3.jpg)