life insurance for diabetics type 2

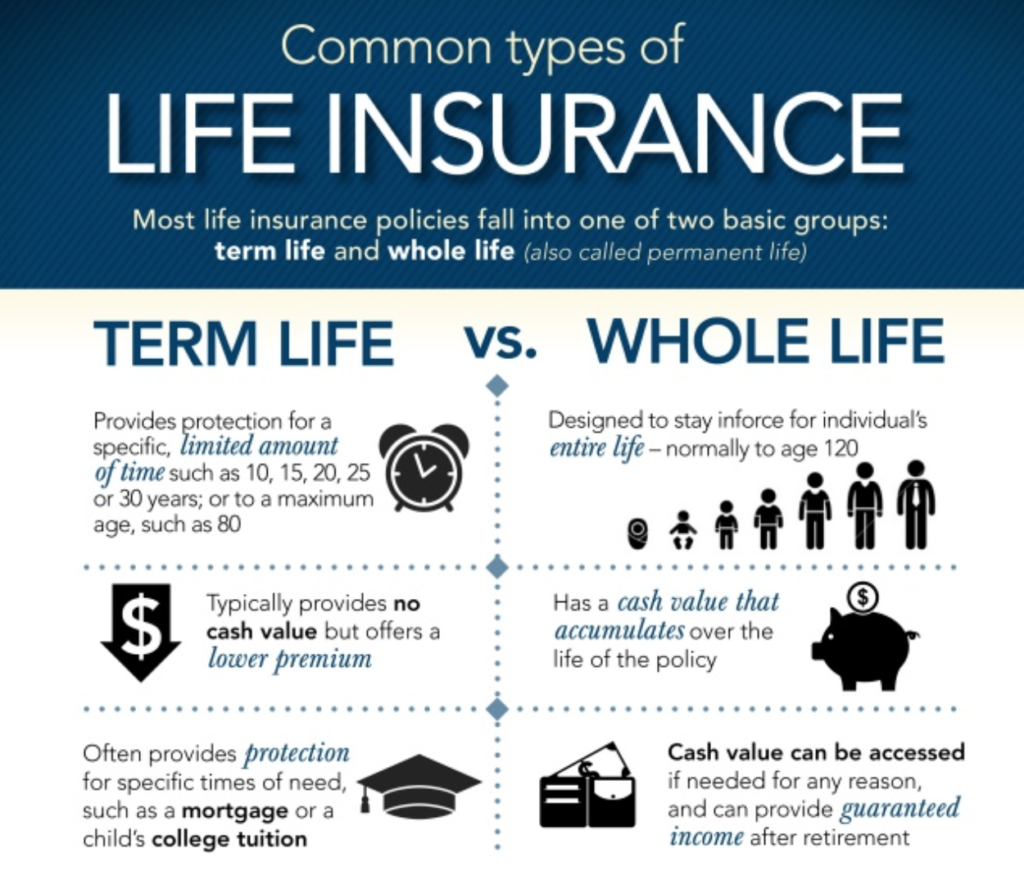

Whole life insurance is often sold as a kind of cure all investment with built in tax advantages and flexibility to help you handle just about any need. 1 2020 tricare began providing continuous glucose monitoring cgm for members with uncontrolled type 2 diabetes. It costs about 2 to 4 times less than whole life insurance.

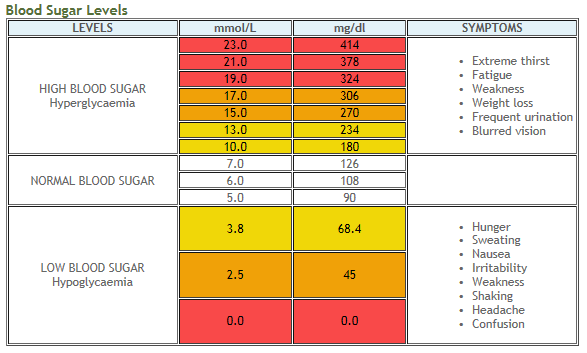

Maintaining a healthy diet and exercise routine can keep these.

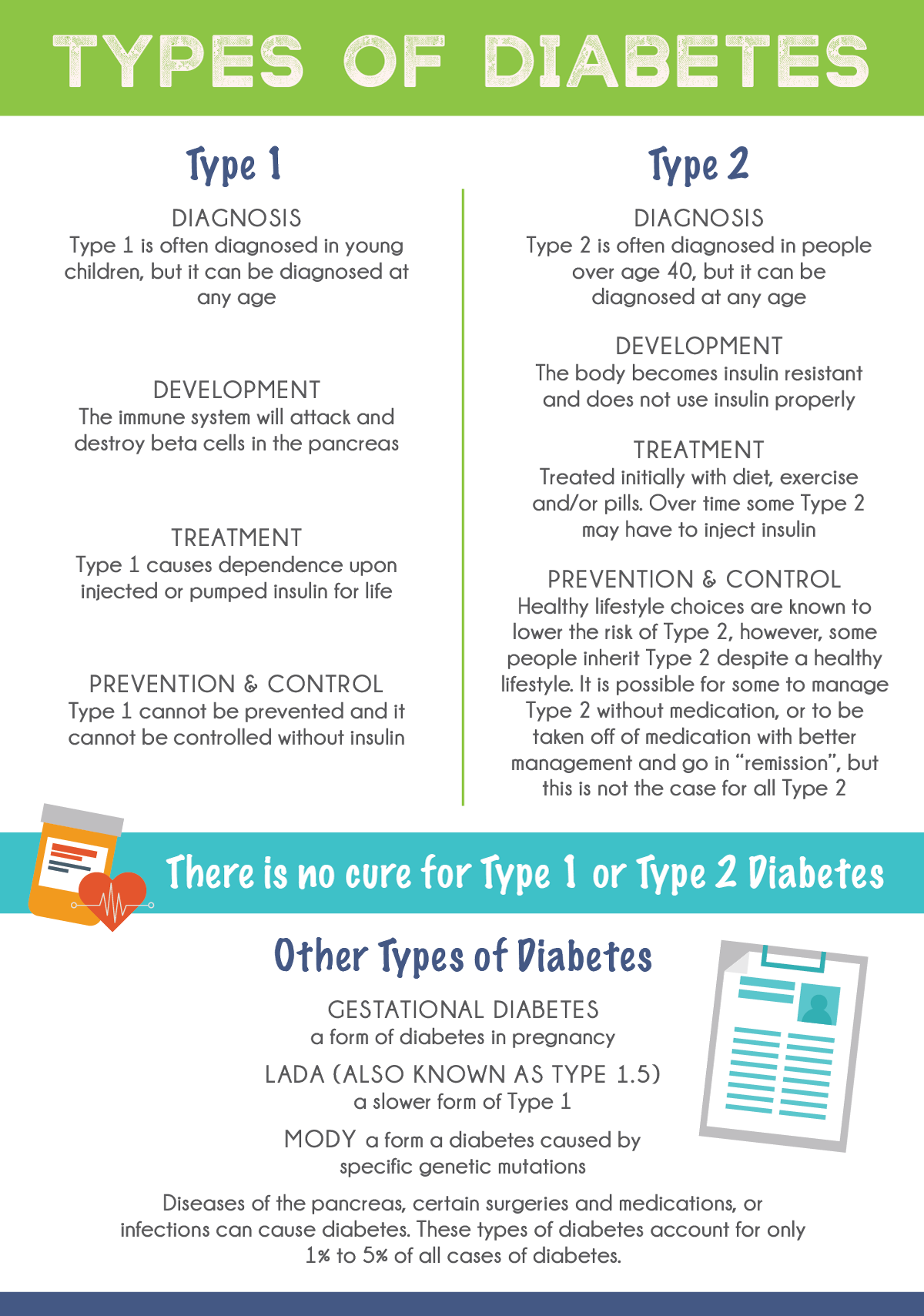

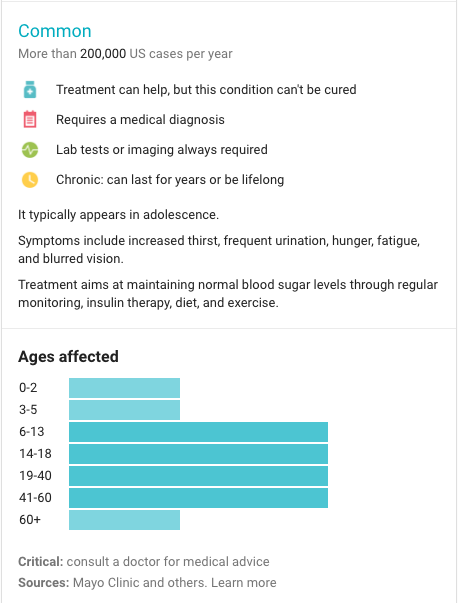

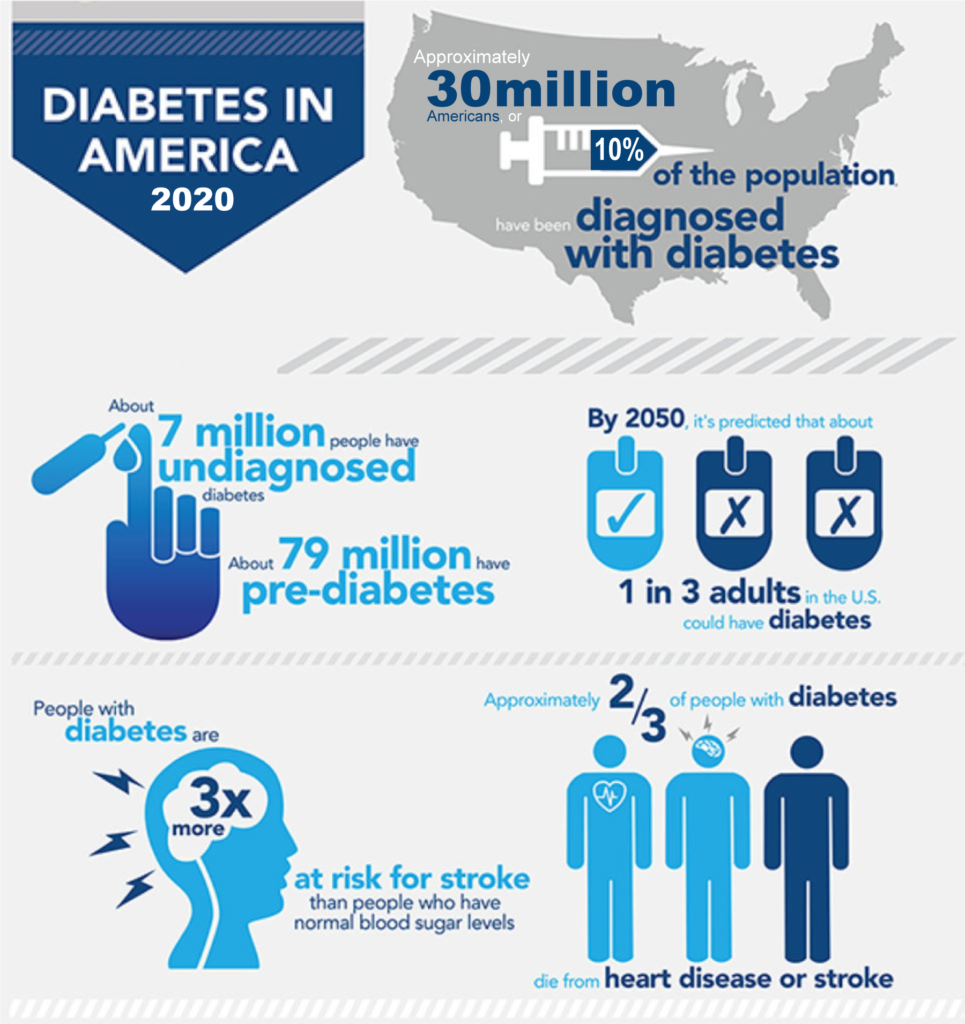

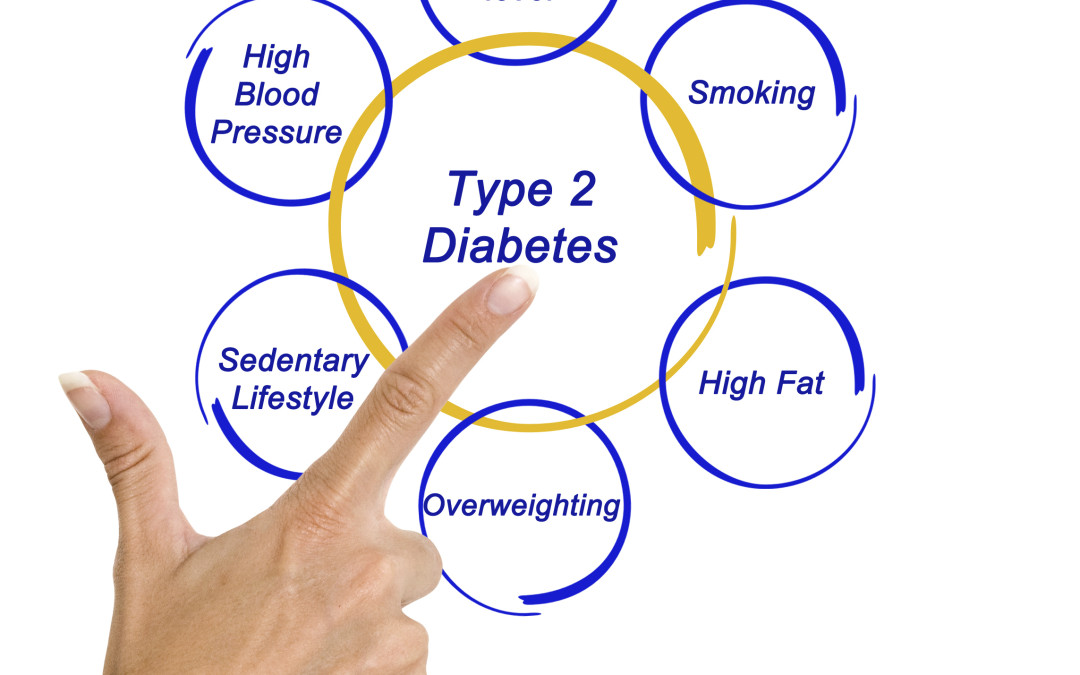

Life insurance for diabetics type 2. The same health risks including heart disease and stroke exist for type 2 diabetics and people with prediabetes which can lead to type 2 diabetes. They can do the same thing for whole life insurance which is a more traditional type of coverage that usually works best for people who want a lifelong policy or one they can use as an investment. Previously the devices were authorized only in limited. But the truth is that whole life insurance is a poor fit for just about everyone with significant weaknesses that are all too often hidden by the agents selling these policies read more.

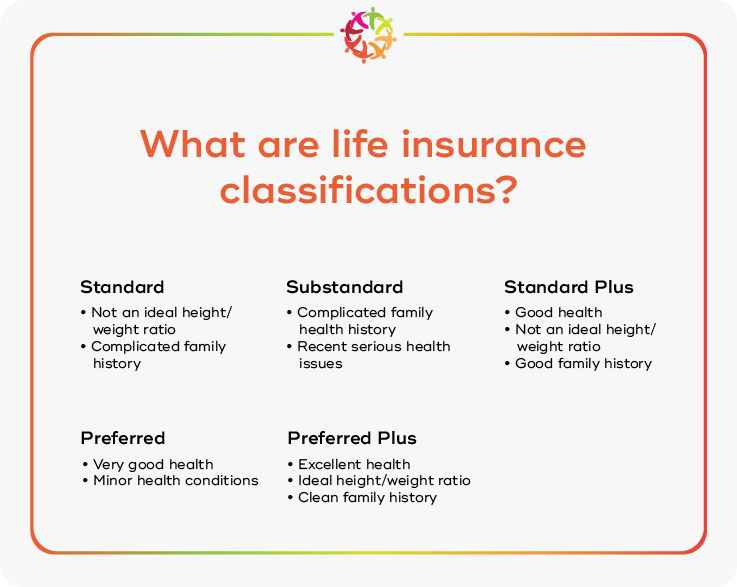

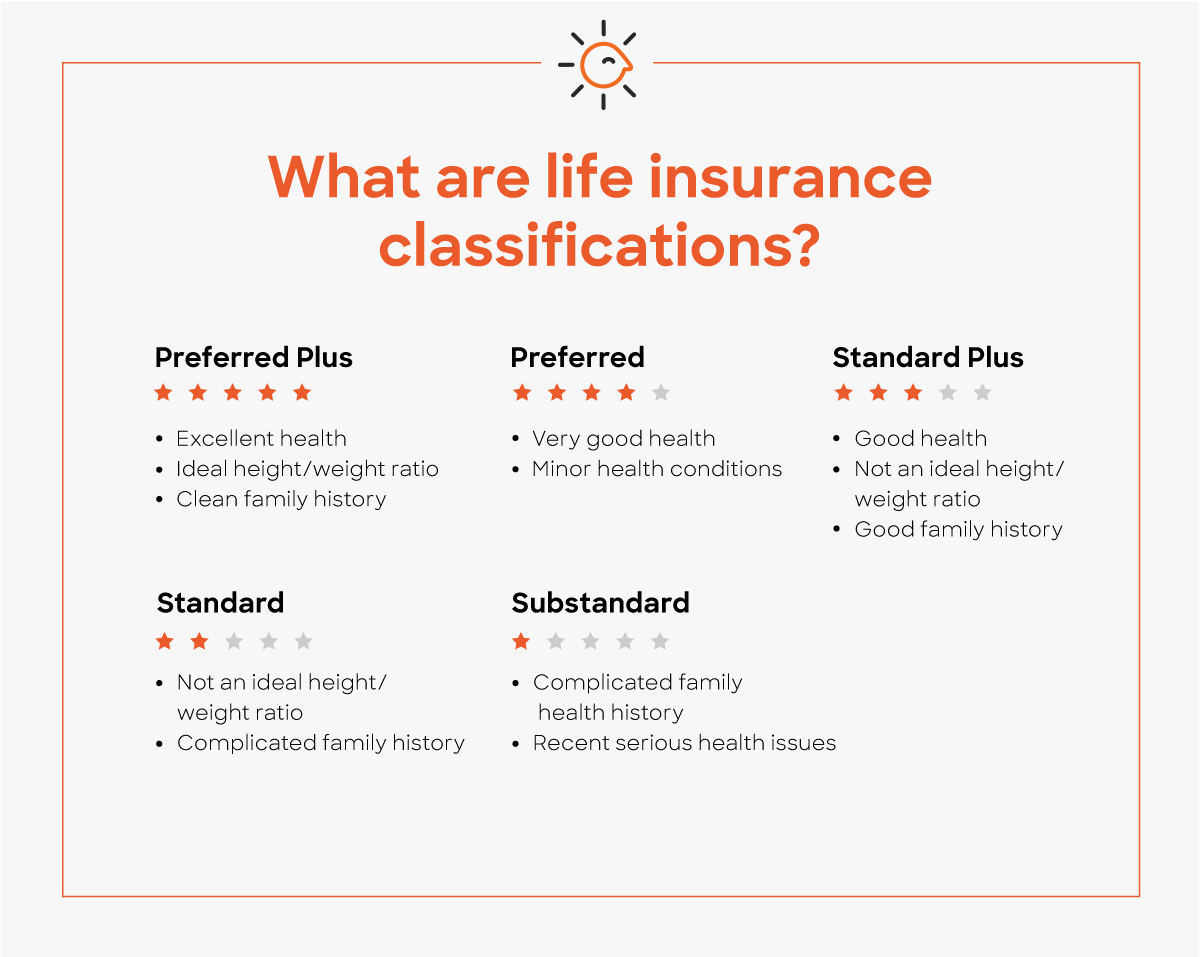

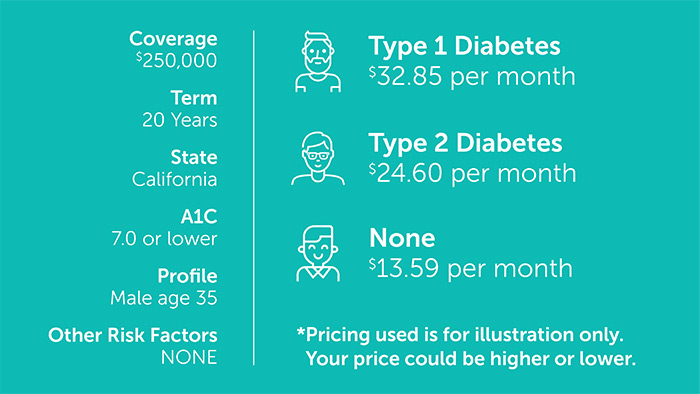

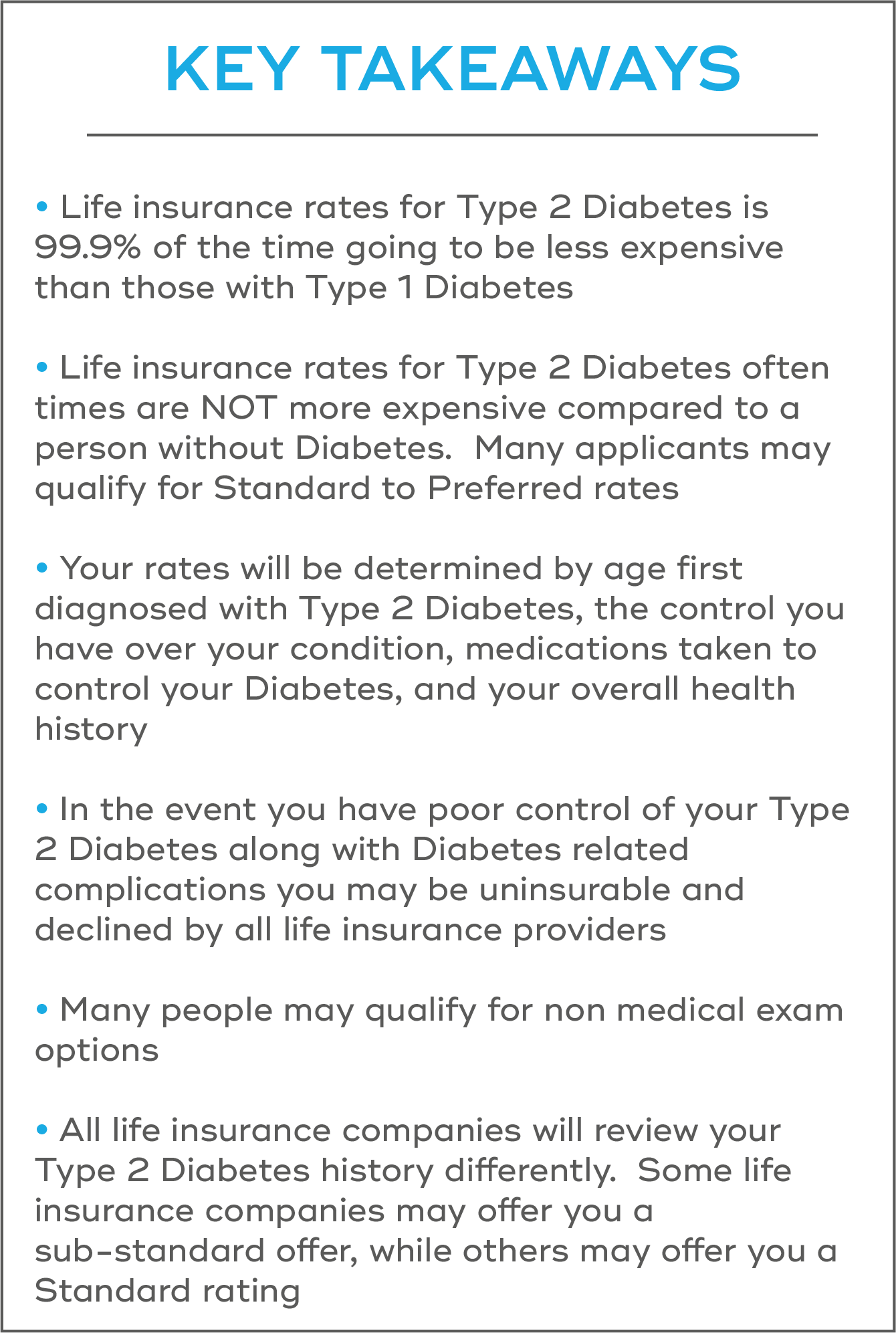

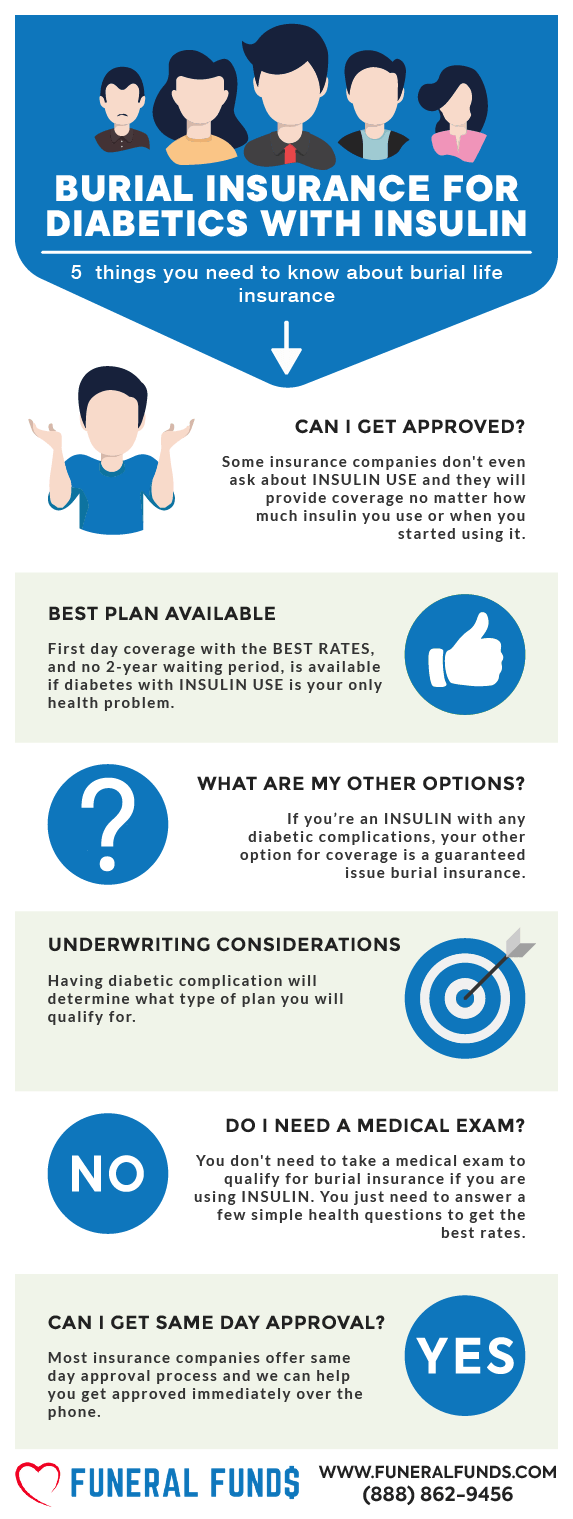

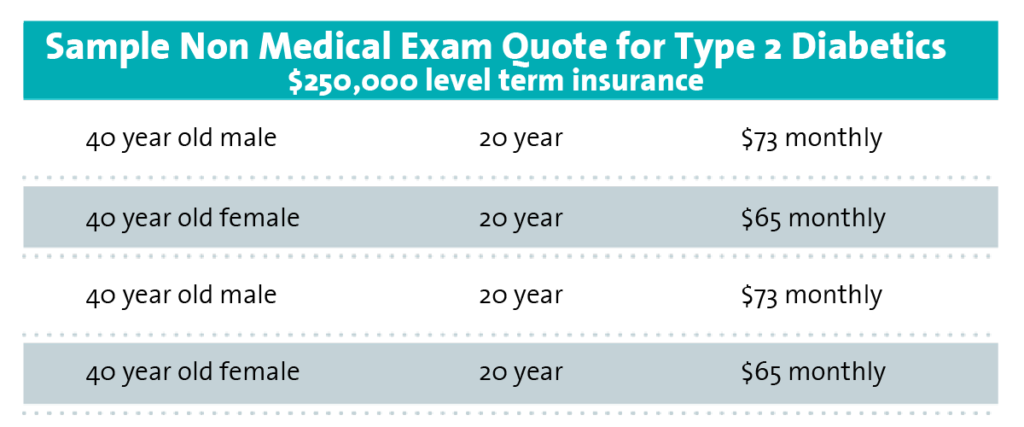

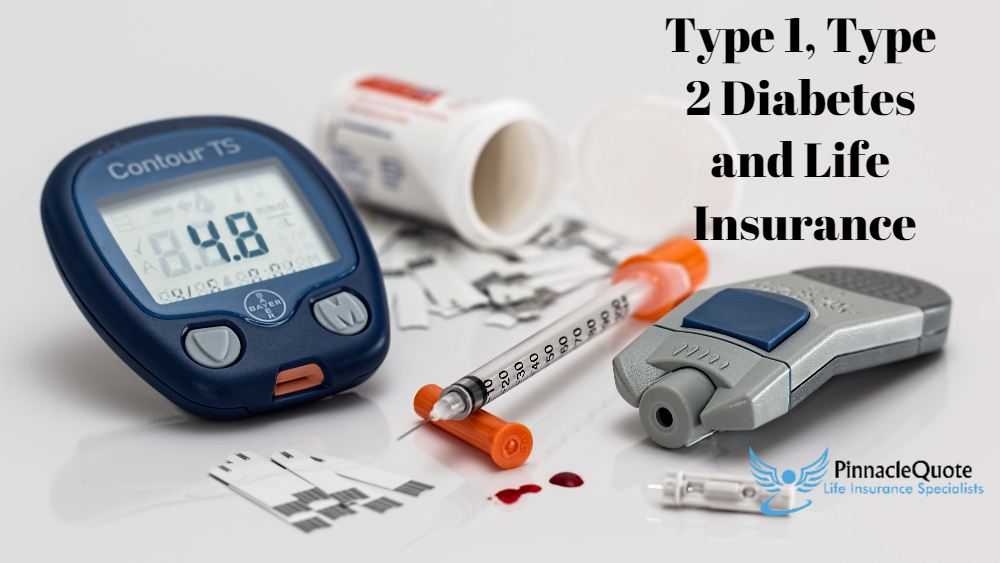

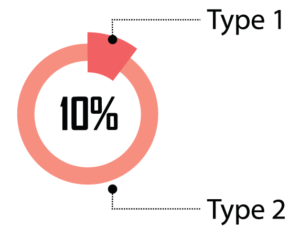

You can choose from many top rated providers. Term life insurance is the most flexible and cost efficient option fitting most people needs but you should ultimately choose what type of life insurance fits your circumstance. Type 2 diabetes is generally seen by insurance companies as milder than type 1. In fact most people significantly overestimate the cost of this type of coverage.

Protective life provides policies for people at the age of 85. Banner life insurance now known as legal general has been in business for over 150 years and they offer extremely competitive prices for term and universal life insurance plans for diabetics. With this plus a no exclusions policy and affordable premium prices they stood out as our top choice for type 2 diabetes life insurance. We researched and reviewed the best life insurance for diabetics based on coverage cost ease of qualifying and.

Permanent life insurance on the other hand can cover you for life providing both a death benefit and a potentially interest bearing cash value account. Most of the people we talk with want to know more about affordable life insurance or whether buying online life insurance is a good idea. Because no medical exam term life insurance has become so popular many insurers have improved their products in this category. How much is life insurance.

Individual life insurance quotes depend on many factors which assess your risk. Protective life offers a unique service that rewards healthy people with well controlled type 2 diabetes with lower life insurance costs. A healthy 35 year old male can expect to pay about 30 29 in monthly premiums for a 20 year 500 000 policy as of april 2021 while a 35 year old female may pay 25 43.

/Aspire_Logo-00338287b03b4dfba019fcabdfd901bf.jpg)

/Aspire_Logo-00338287b03b4dfba019fcabdfd901bf.jpg)

:max_bytes(150000):strip_icc()/Mutual_of_Omaha-854e01d49f3e43a6ba1e5567bf207b9d.jpg)