life insurance for burial expenses

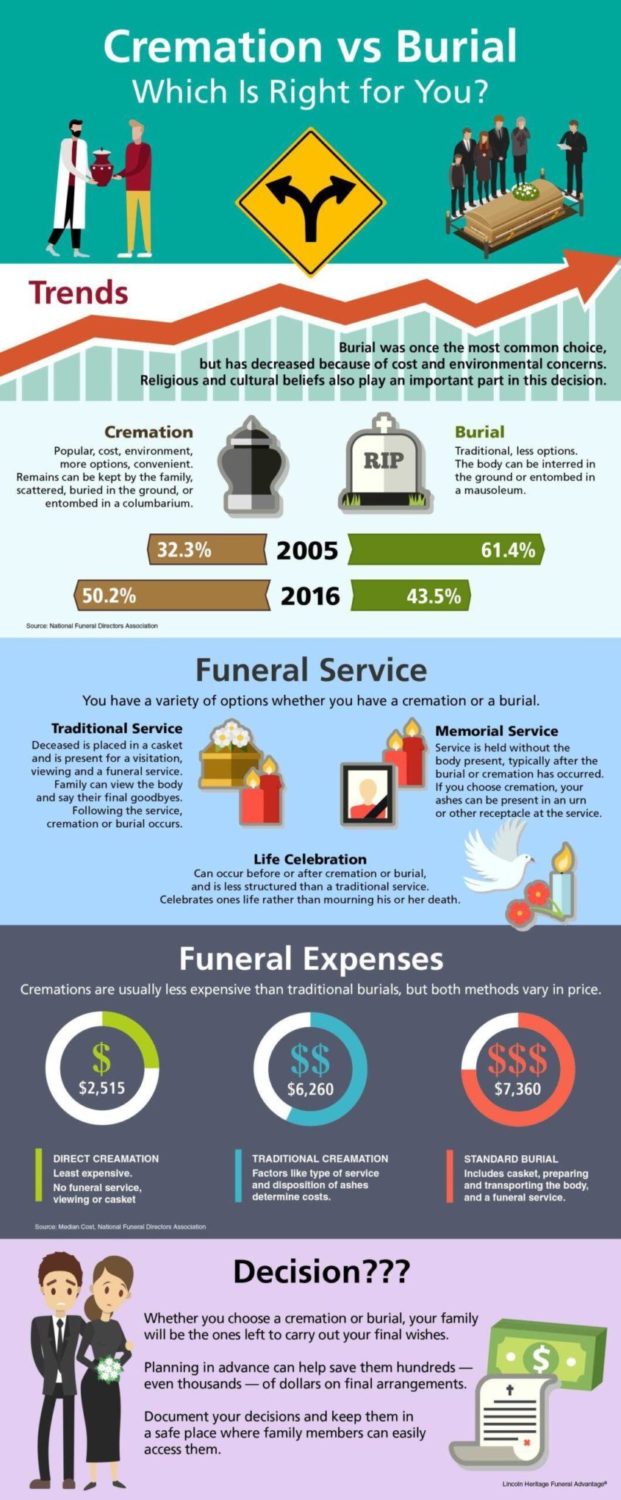

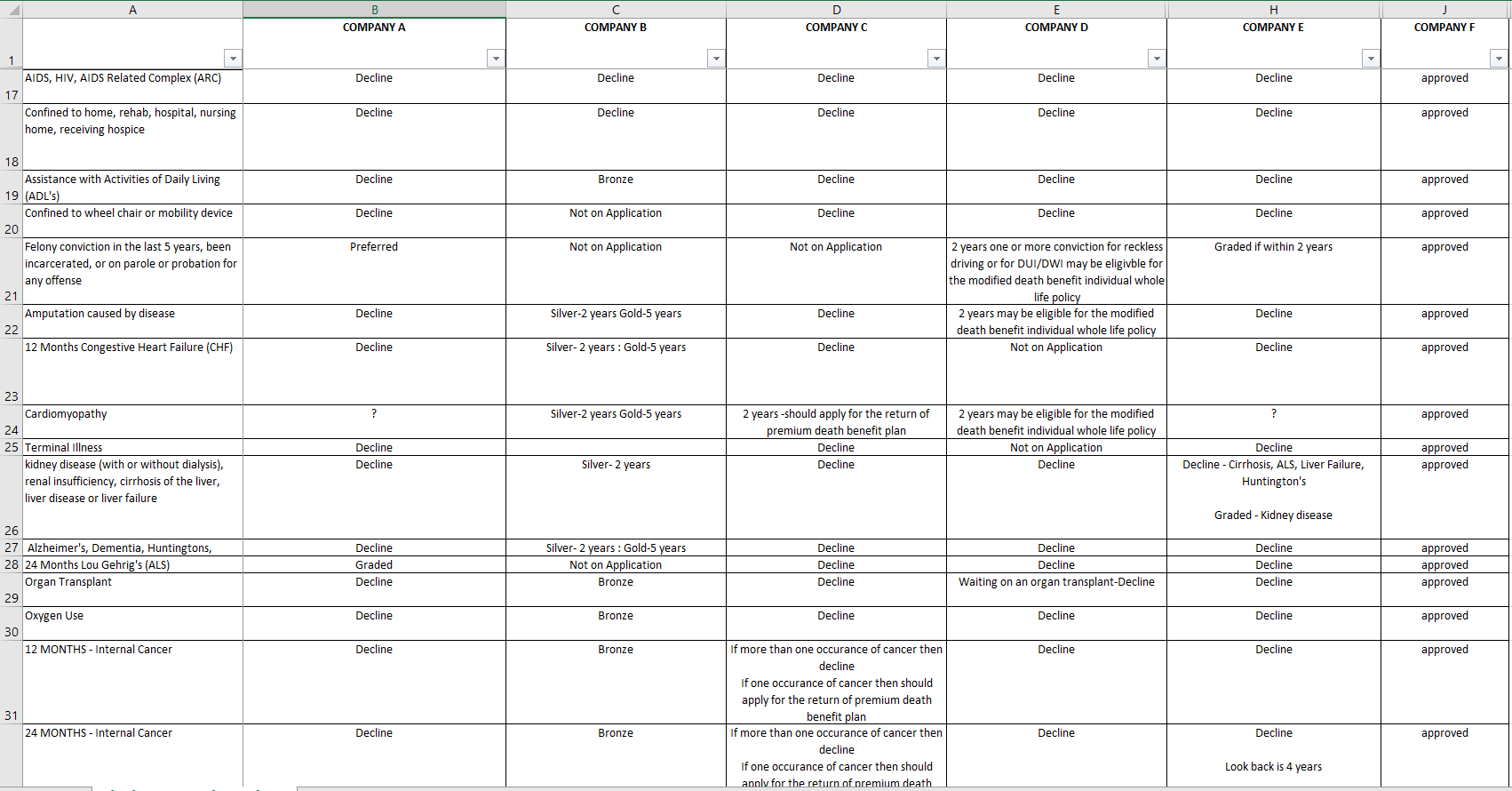

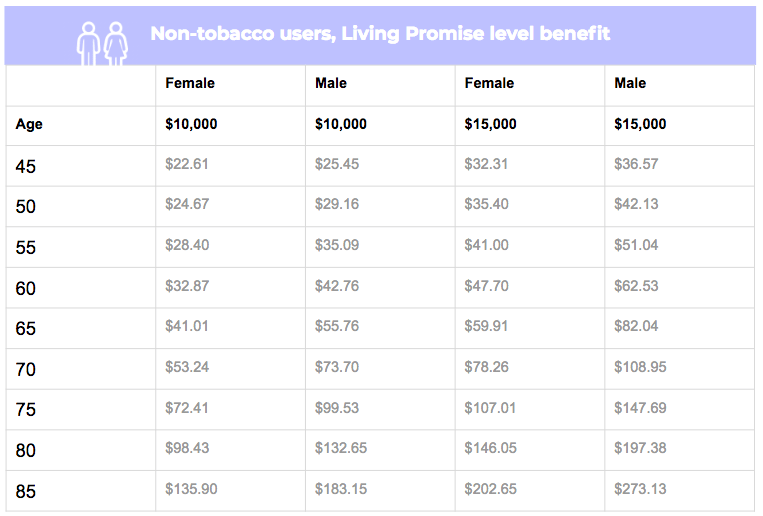

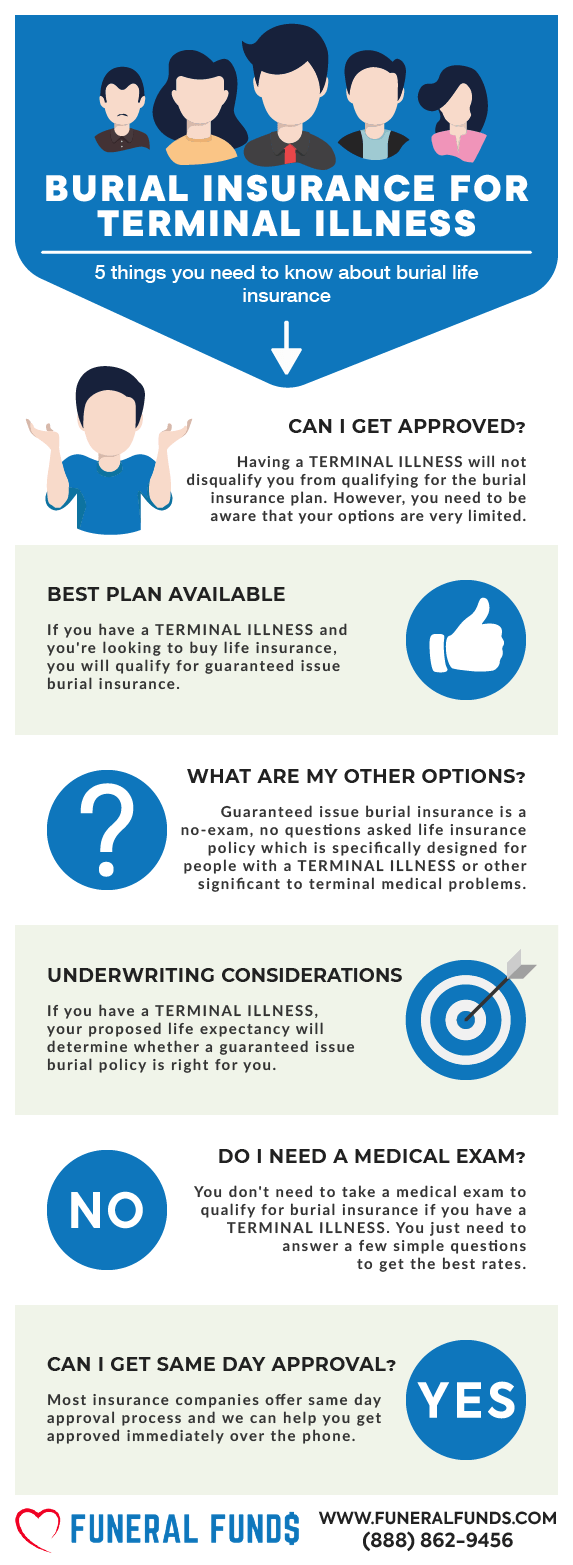

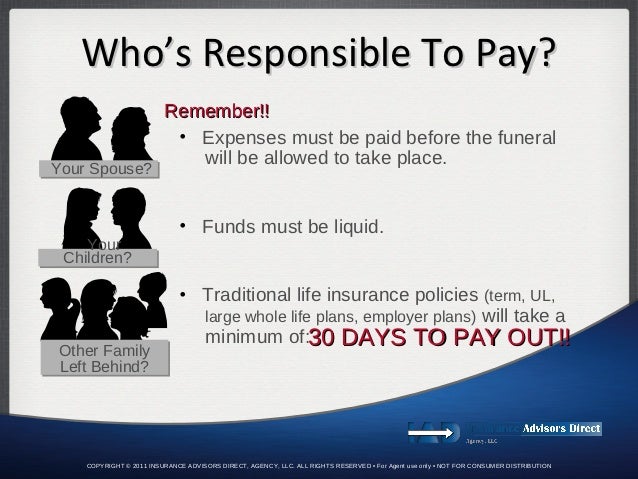

Many burial insurance policies don t require a medical exam to qualify and they typically have a smaller face value than. Here are a few solutions that may help avoid complications with life insurance at the time of death. Burial insurance also called funeral or final expense insurance is a helpful tool for loved ones paying for a departed family member or friend s funeral memorial service headstone urn and other final expenses it is essentially a life insurance policy but with a much smaller benefit amount than traditional life insurance.

A life insurance scheme is too much beneficial for every policy holder.

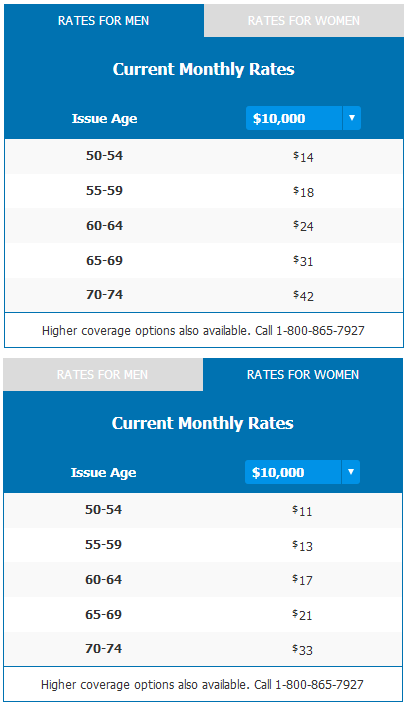

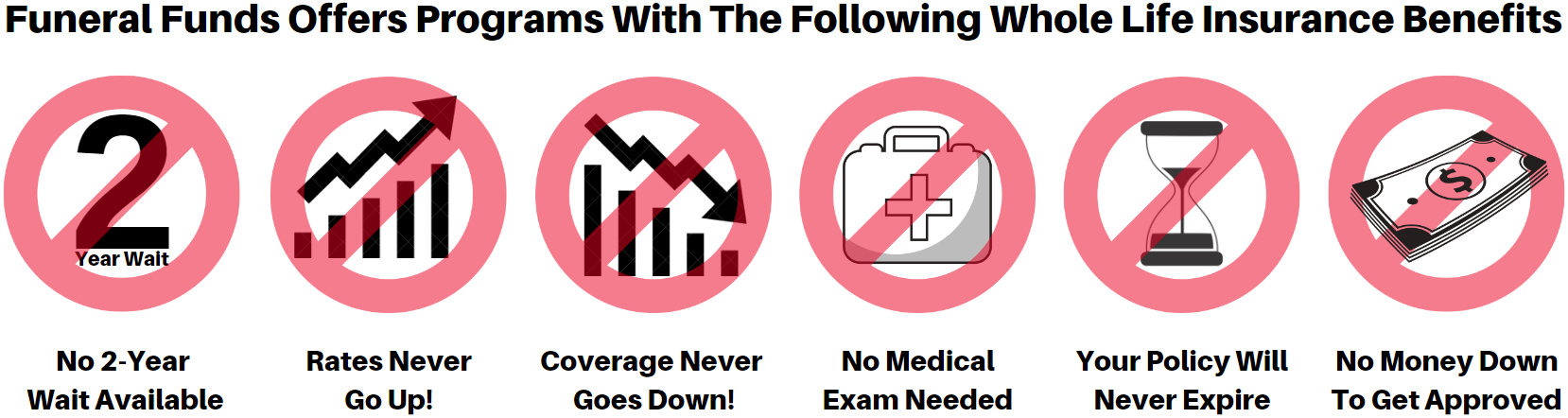

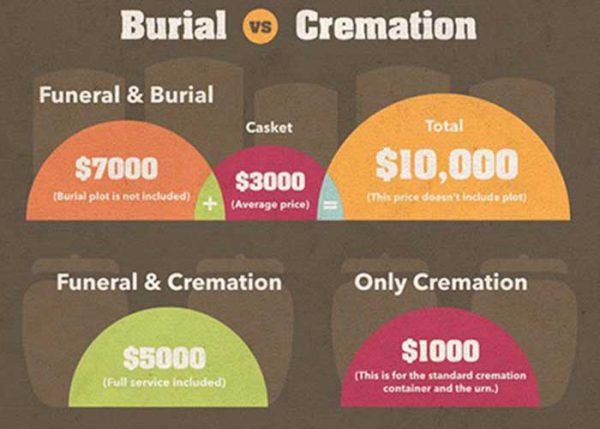

Life insurance for burial expenses. No exams are required serious health issues will not prevent acceptance and coverage typically ranges from 2 000 40 000 with most companies. The death benefit is usually used to pay for final medical bills and other end of life expenses like burial or cremation items like caskets and urns and more. Burial insurance is also known as funeral insurance and is an easy to qualify for low coverage whole life insurance policy designed to cover end of life expenses like medical bills funeral expenses and other debts that are left behind when you pass. It is the best tool for assuring the financial stability of your loved ones.

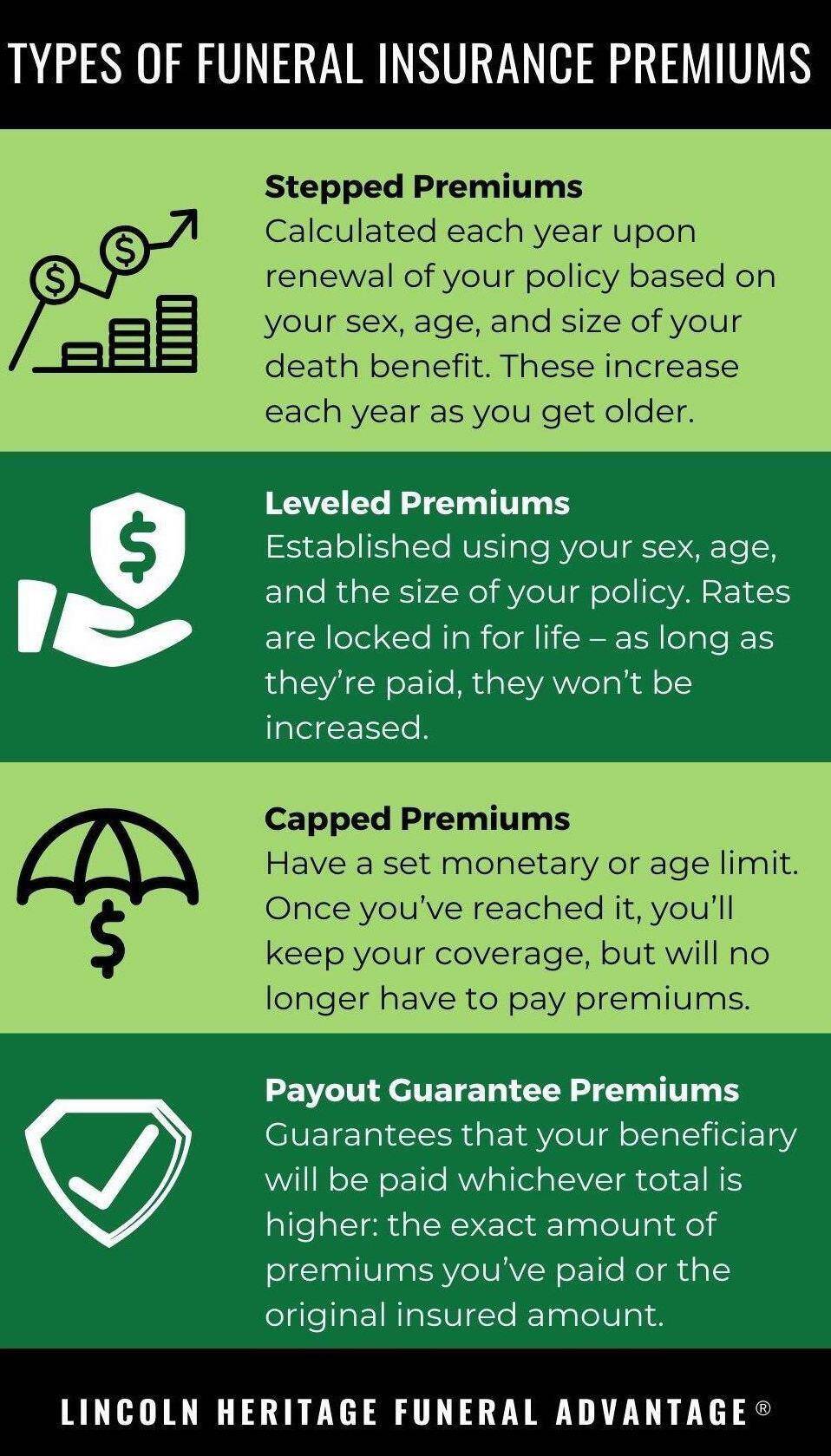

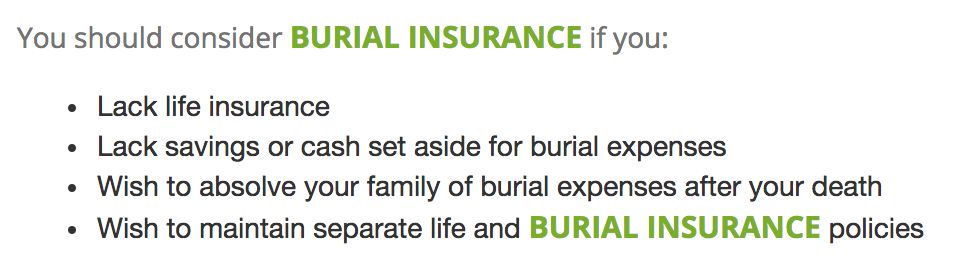

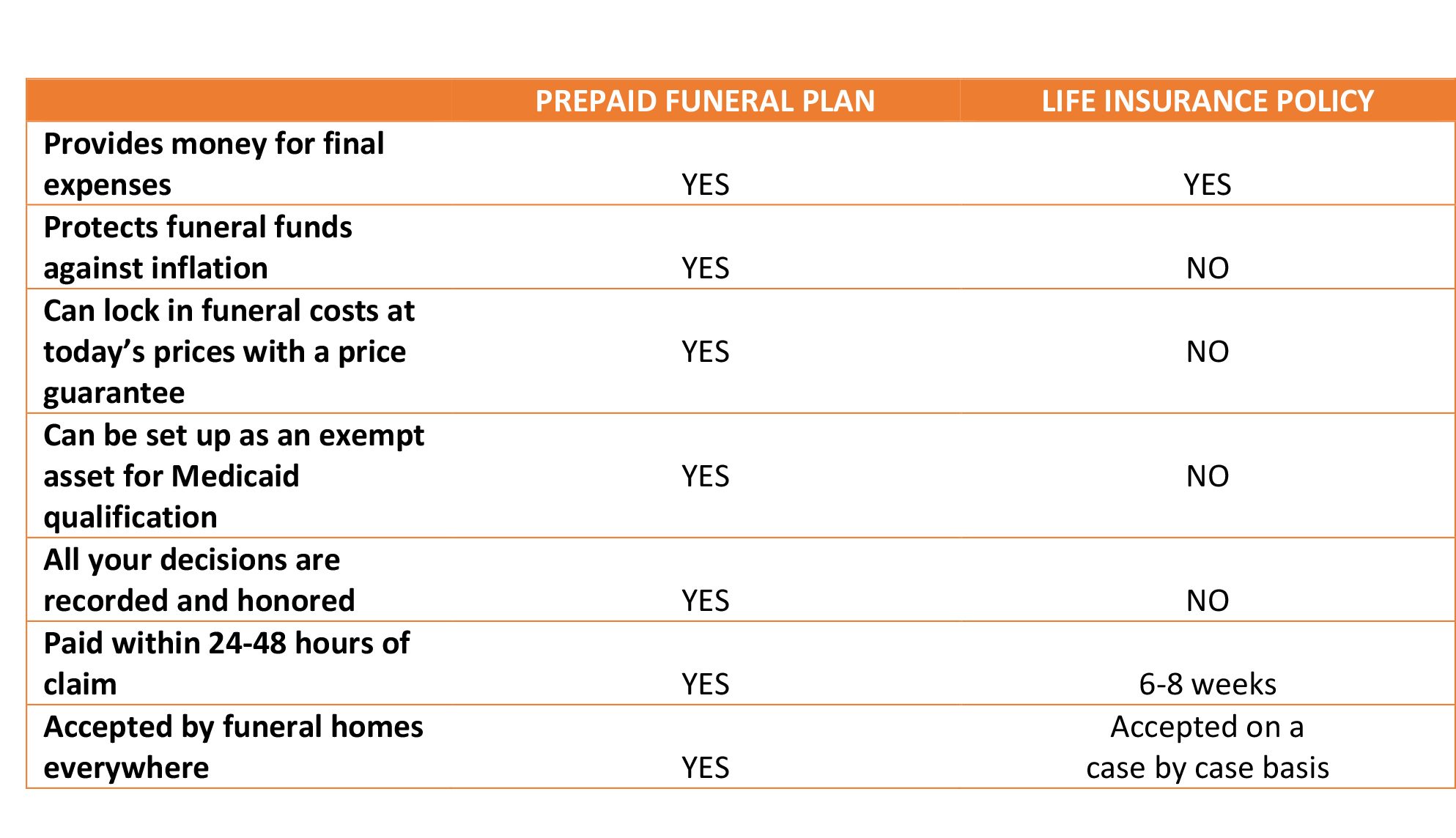

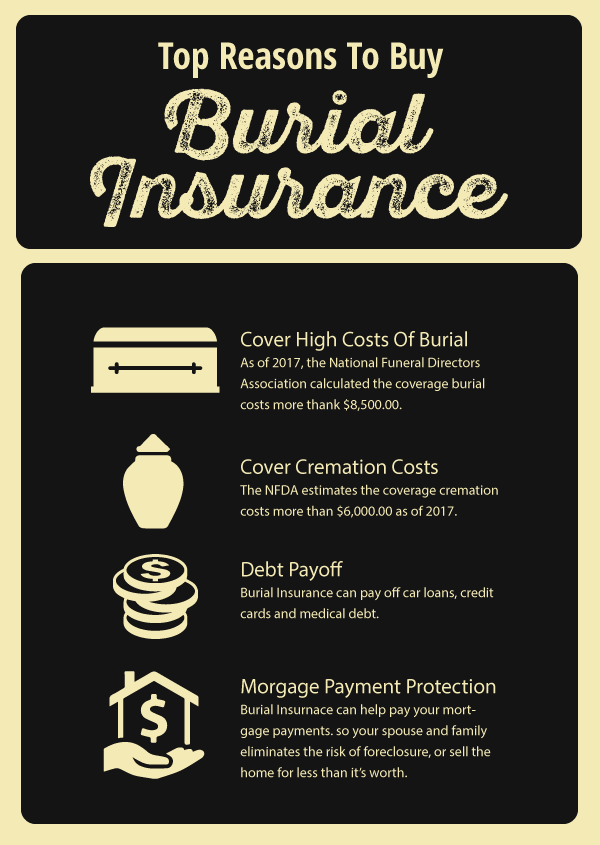

Burial insurance sometimes referred to as final expense insurance is a life insurance policy designed to cover funeral costs and other final expenses like medical bills and even lost wages due to time away from work. Final expense insurance is a type of permanent life insurance originally intended to cover funeral expenses. Like other permanent life insurance burial insurance never expires and remains active. If you have not considered these secondary expenses your family may have a hard time covering all the potential costs.

Why to buy life insurance. Burial cost this may include uncovered medical costs funeral expenses and final estate settlement costs. Aarp permanent life insurance. Aarp burial insurance is a permanent life insurance policy available to aarp members between 50 and 80 years of age.

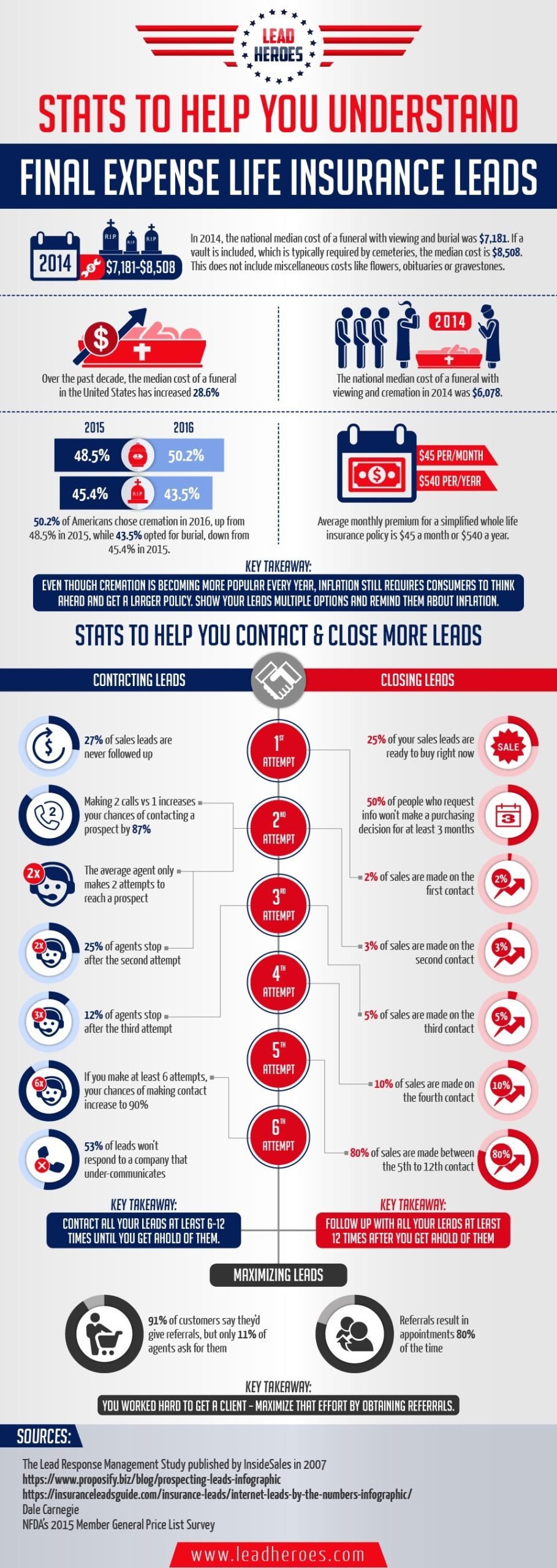

What is final expense life insurance. If your estate is over 1 500 000 your final expenses may be much higher due to federal and state estate or inheritance taxes. Burial insurance aka final expense insurance is a life insurance policy that provides a cash benefit that can be used to help pay for funeral and burial expenses credit card debt and other final expenses. If you plan to use life insurance benefits to cover your.

Welcome to burial insurance. What is burial or funeral insurance how does it work. Most burial insurance plans are affordable have fixed premiums and can be issued. Burial insurance also known as final expense or funeral insurance is generally a small whole life insurance policy with affordable premiums designed to pay all final expenses.

The coverage or policy can help your heirs by providing them the burial expenses medical expenses etc.

:max_bytes(150000):strip_icc()/Mutual_of_Omaha-854e01d49f3e43a6ba1e5567bf207b9d.jpg)

/cemetery-0e32932285ca4be39d2e01acfd394b04.jpg)

/AARP_Life_Insurance-d43ba8197d214b3ba6014ea7e7d9d9dd.jpg)

/GettyImages-104304892-8f8b3b9b437347a7849956c970edc060.jpg)