life insurance differences

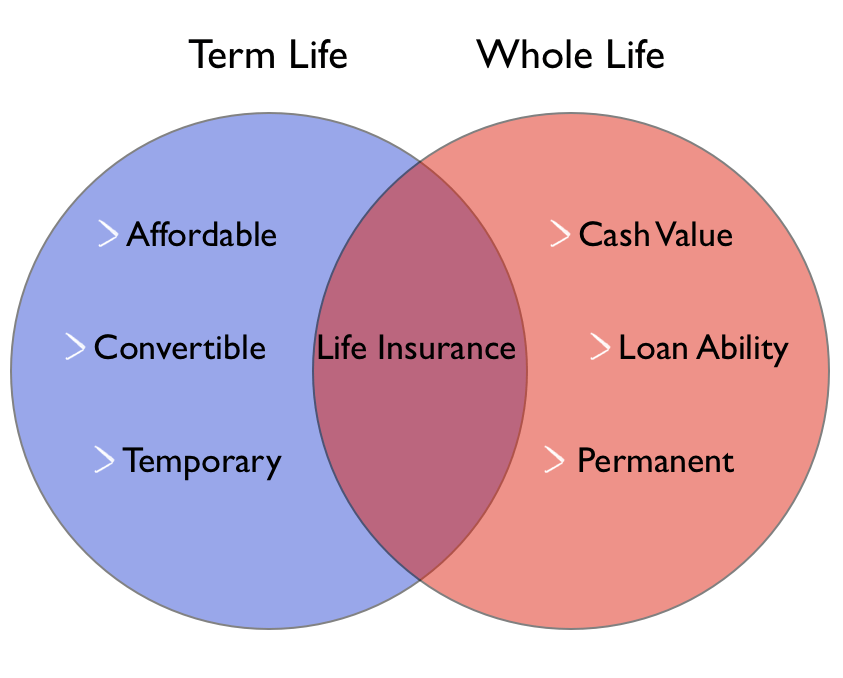

Most term policies have no. Life insurance and general insurance. Life insurance comes in various forms and two common types are term life and universal life.

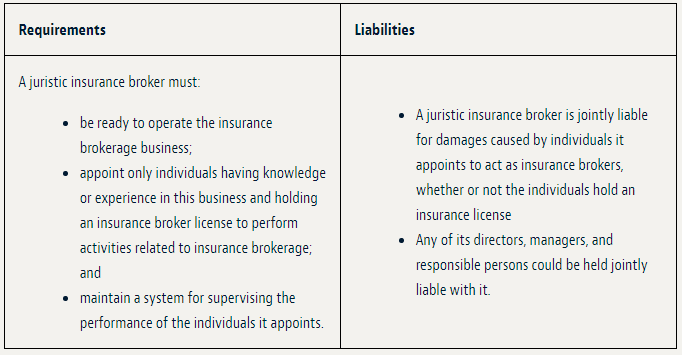

The information below focuses on life insurance sold to individuals.

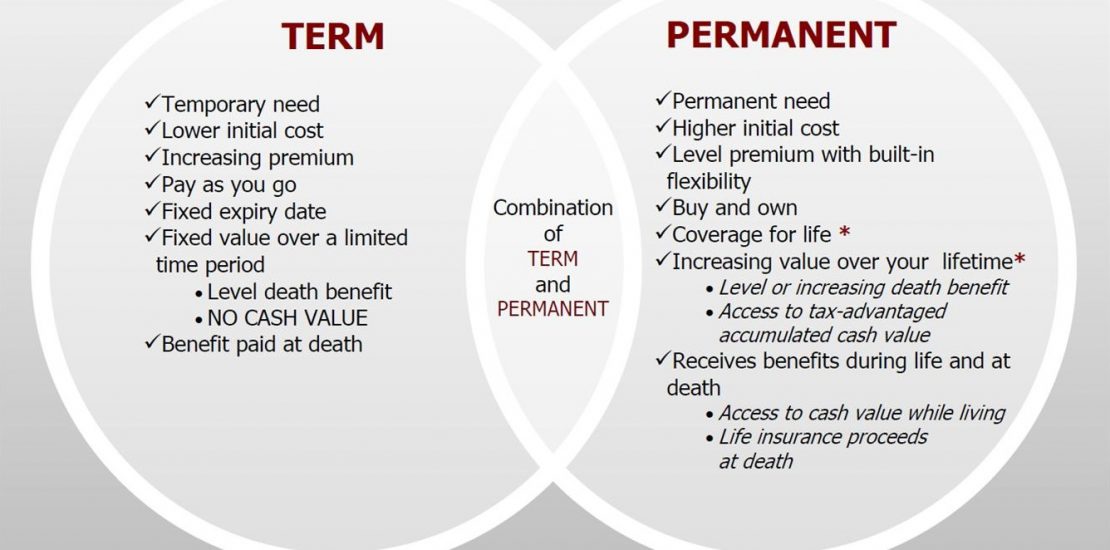

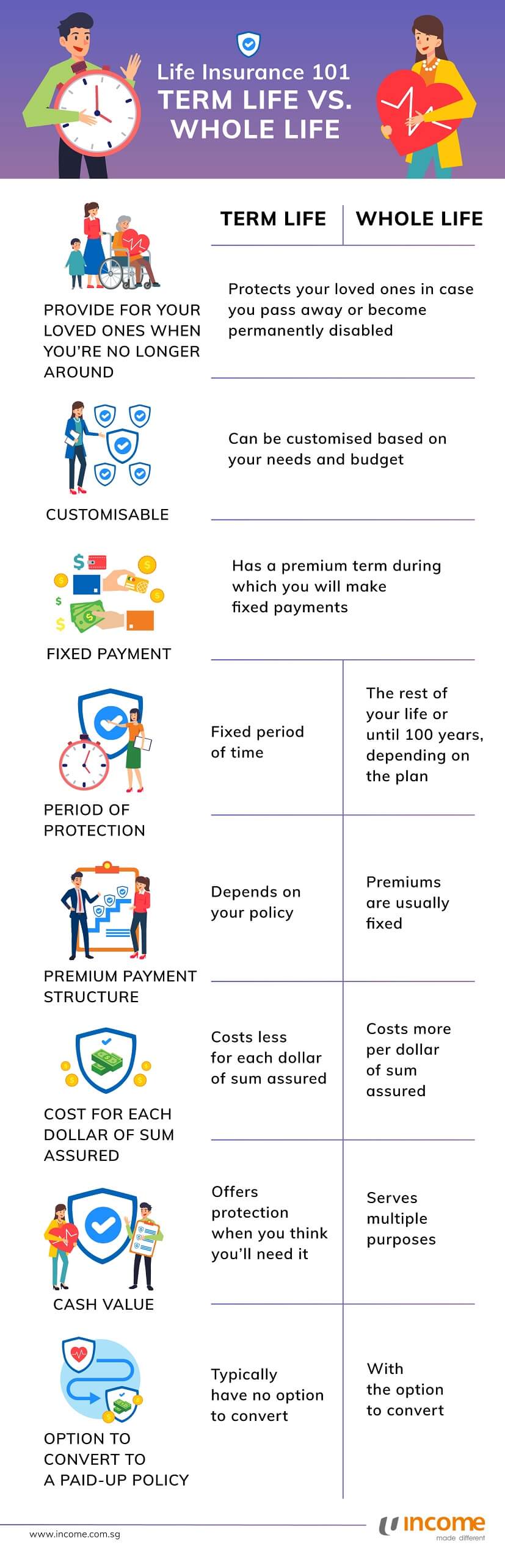

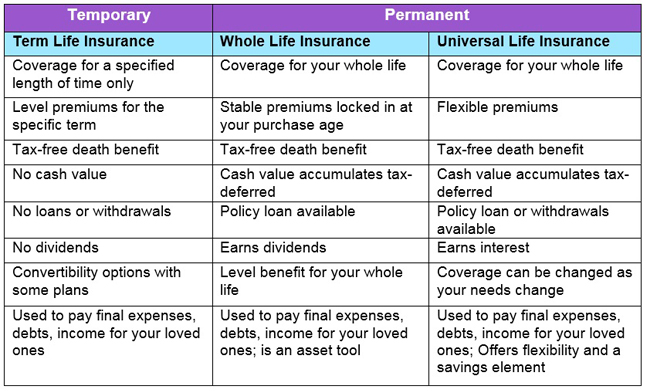

Life insurance differences. Deciding between the two. We make buying life insurance easy. Choosing the right life insurance policy starts with understanding your needs and knowing the differences between the types of policies available. It pays only if death occurs during the term of the policy which is usually from one to 30 years.

Term life universal life and variable life. In simpler terms the policy is not worth anything unless the policy owner dies during the course of the term. Check out this article excerpt in which we have covered all the important differences between life insurance and general insurance. Life insurance is also known as assurance whereby the sum assured is paid to the insured while the general insurance policies are called as insurance.

You ll find answers to many questions right here on our website including the most basic ones like what. In contrast indexed universal life insurance policies are more like retirement income vehicles. If you have questions about buying life insurance you re in the right place. If they die while the policy is in effect their beneficiary or beneficiaries receives a death benefit payout.

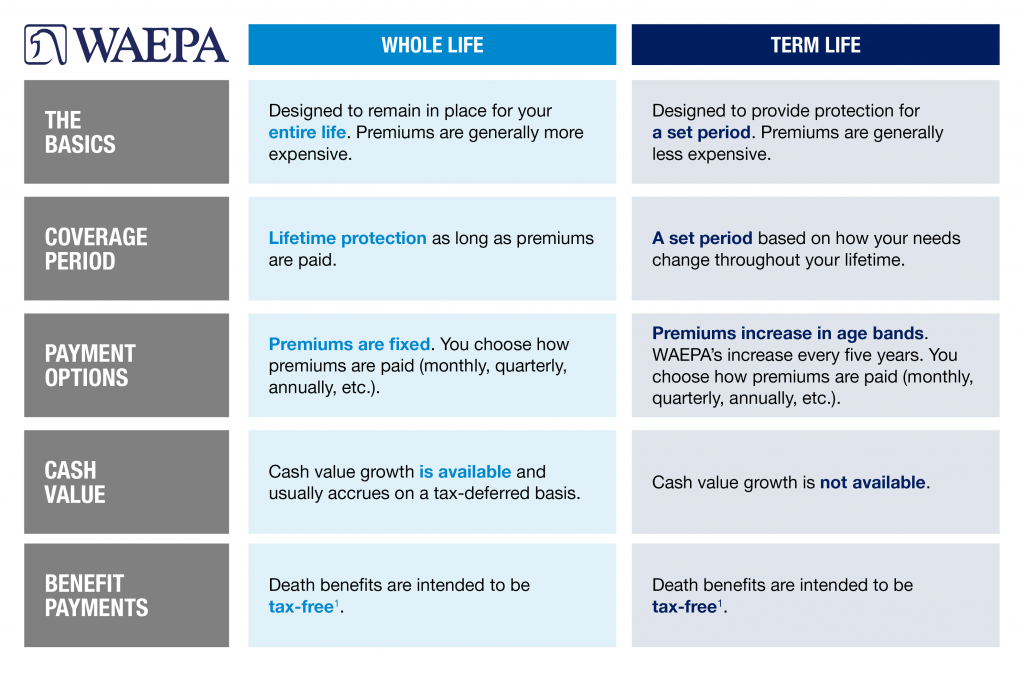

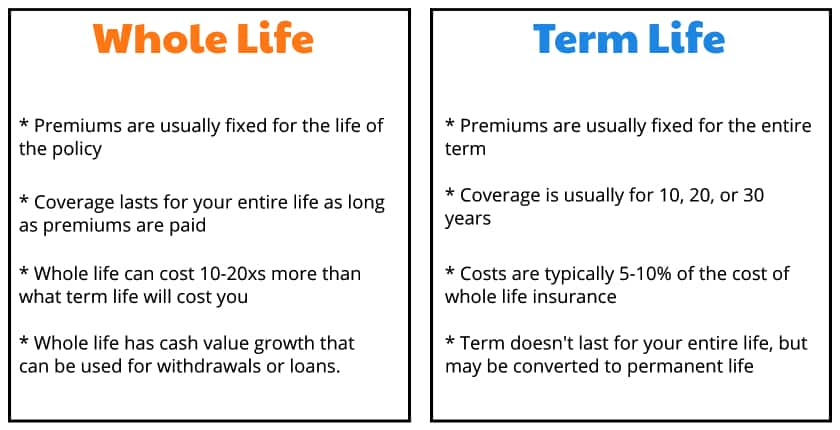

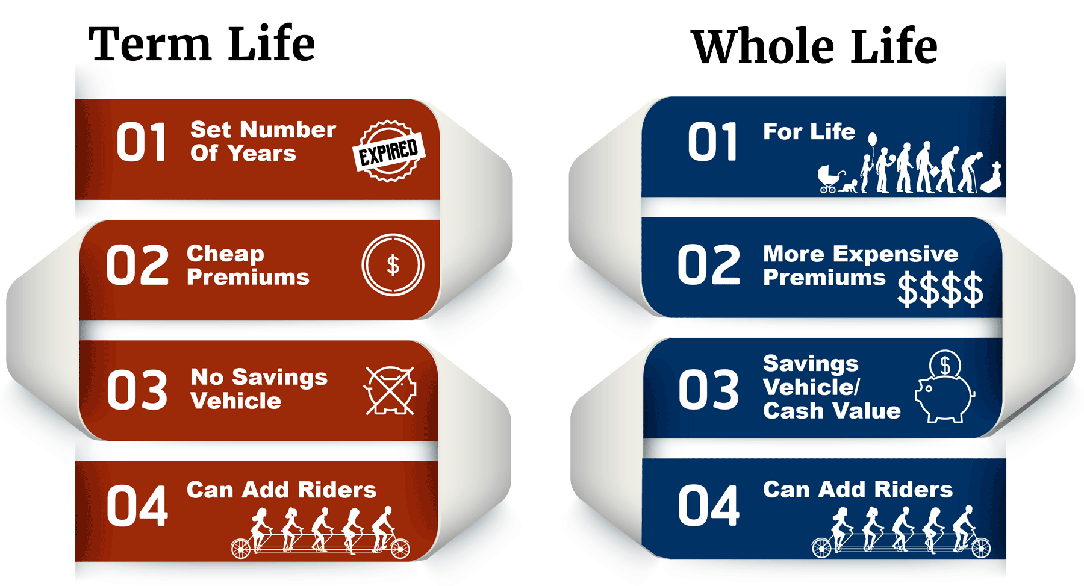

What is term life insurance. Term life insurance is pure life insurance. Guaranteed plans tend to cost slightly more than regular term policies but can prove invaluable if you get sick near the end date of your term and need to extend your coverage. This is because the term life policy has no cash value until you or your spouse dies.

Maybe you re wondering how much life insurance do i need or maybe you want to know the main differences between term vs. Whole life insurance is designed to be exactly that life insurance. It s straightforward and affordable which is the selling point for people who want a simple life. The policyholder pays premiums regularly for a set period of time usually between 10 30 years.

Guaranteed renewable term life insurance is a term life policy that gives you the right to extend your policy beyond the initial term without a new medical exam. Term insurance is the simplest form of life insurance. Term life insurance plans are much more affordable than whole life insurance. A life insurance policy is an agreement between an insurance company a policyholder that offers financial coverage under which the insurance company guarantees to pay a certain amount to the nominated beneficiary in the unfortunate event of the insured person s demise during the term of life insurance plans.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/coupleonbench-5e76dc9734b34b148e42fdc7ee500611.jpg)