life expenses in canada

Many insurance companies offer coverage up to age 85. We can get you. Canada life has been paying claims for 150 years.

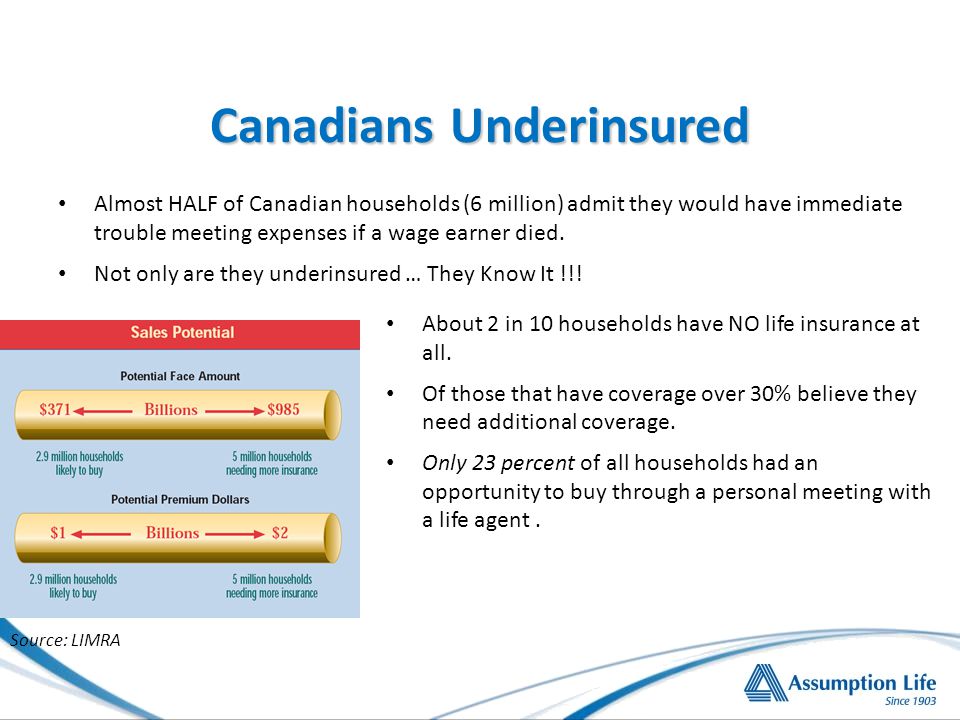

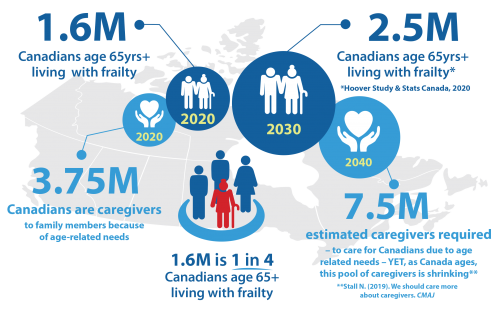

While seniors may have had difficulty getting insured in the past many developments can help you get insured.

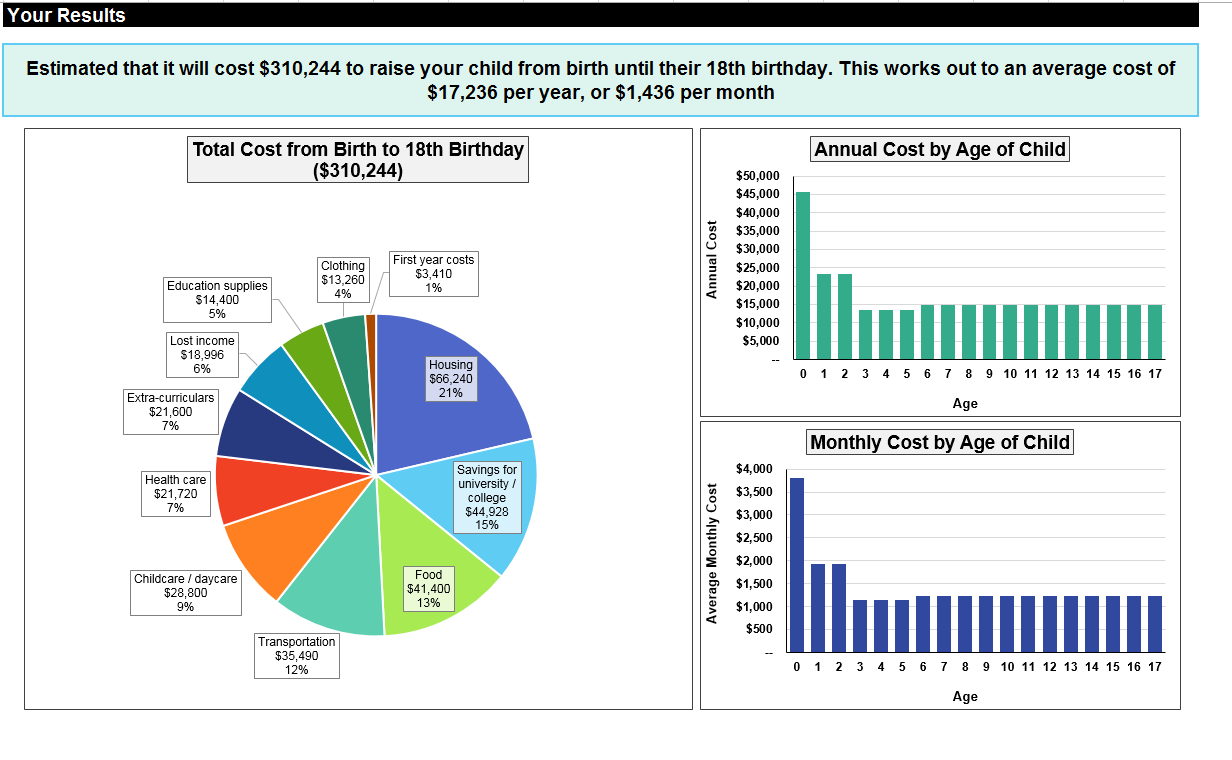

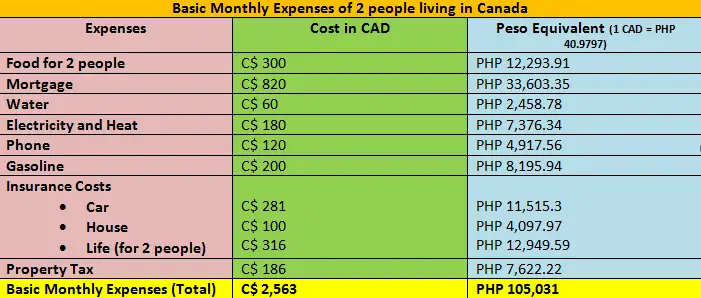

Life expenses in canada. Remember to include these increases in costs when making a budget for student life. We look at the prices for whole and term life insurance and the factors that go into determining how much life insurance costs in canada. The sum of expenses from these products can reach 467 per month or 6 5 of expenses. There are different types of life insurance and different ways to make it work for you.

Term life is affordable coverage for your big expenses so you re protected when it matters most. Find newcomer services a place to live work how to enrol in school get a driver s licence get health care or improve your language skills. Term life is affordable coverage for your big expenses so you re protected when it matters most. Go to main content.

Choice with a wide range of insurers available to you you can form a financial plan for any need. Key benefits of our services. Canada life international assurance ireland dac is authorised and regulated by the central bank of ireland and is a category a insurance permit holder with the jersey financial services commission. With term length options between five and 50 years a yearly renewable term structure and conversion options canada life my term is among the most adaptable in the industry.

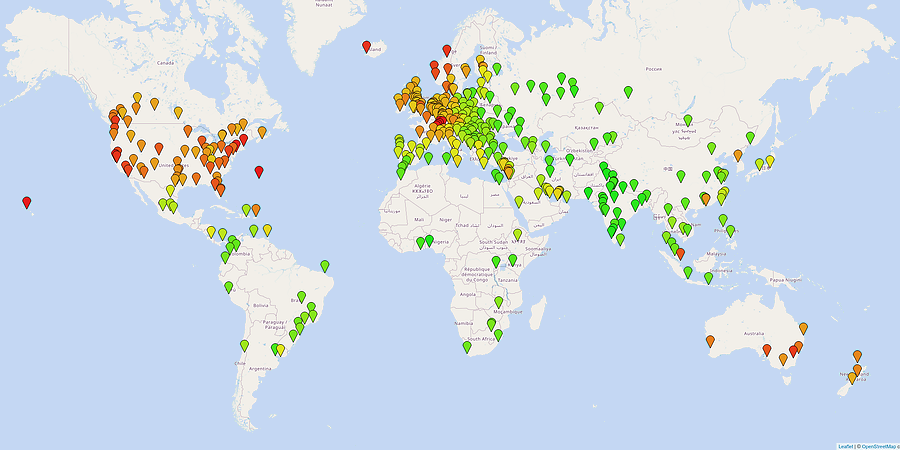

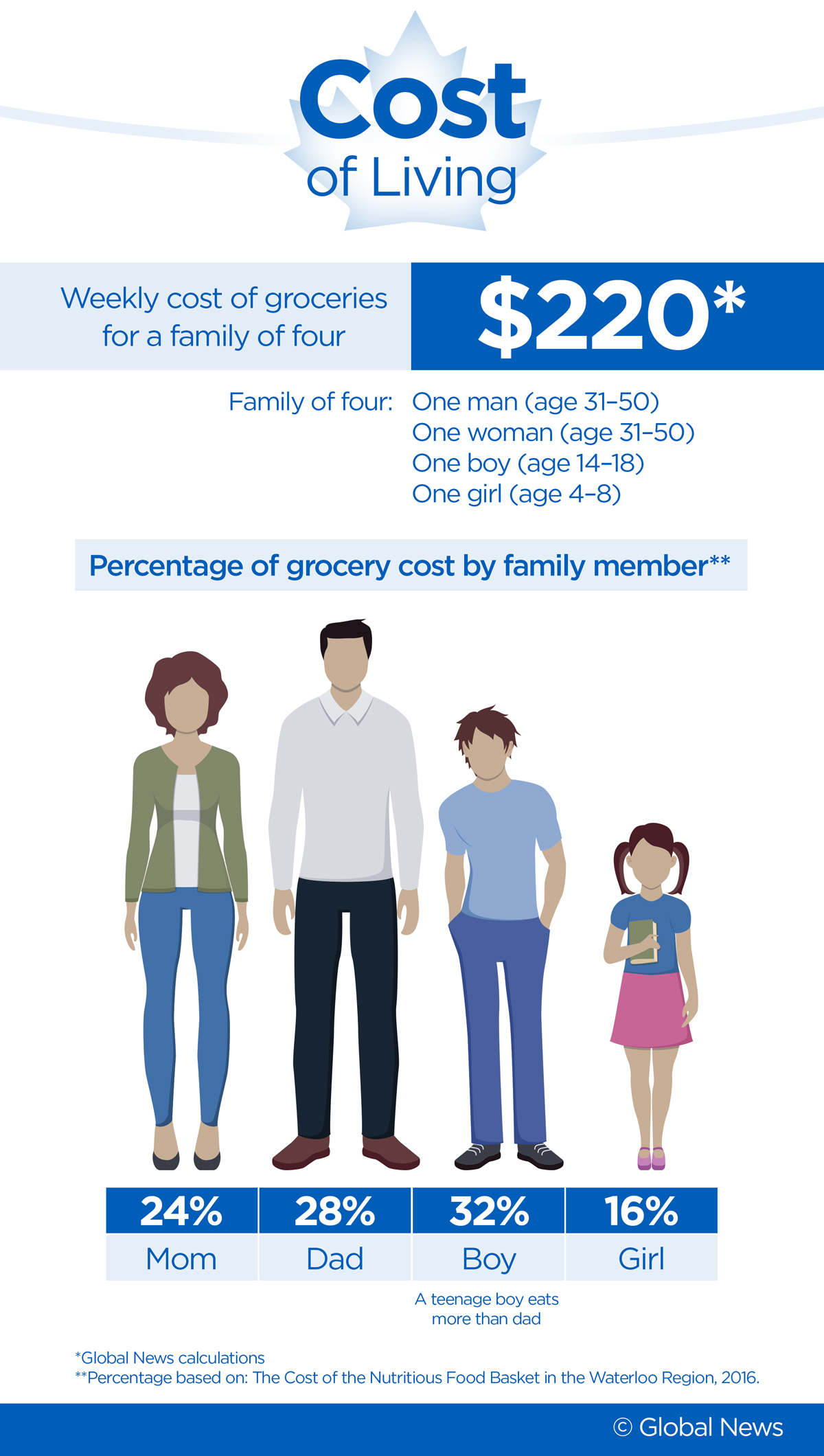

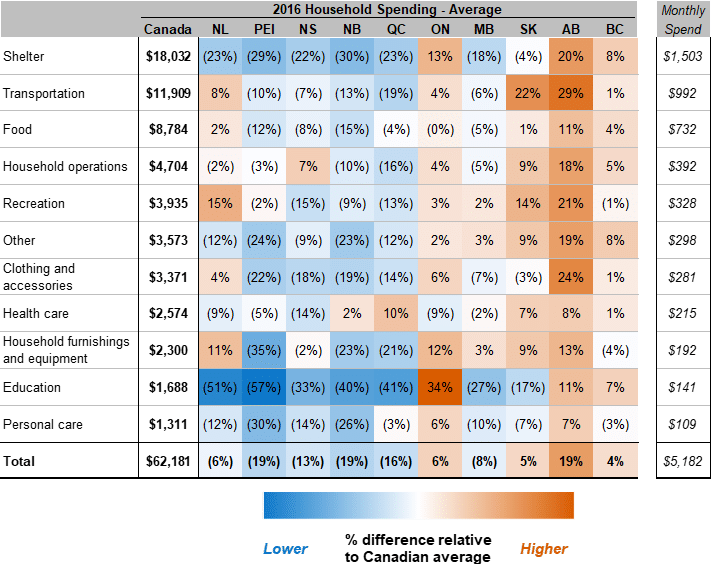

Start your life in canada learn about living in canada. Stonehaven uk limited and canada life platform limited trading as canada life are part of the canada life group u k limited. Whether you re looking to protect your home your business plan your funeral or help build your wealth. The money canadian households spend on these things are even higher compared to healthcare.

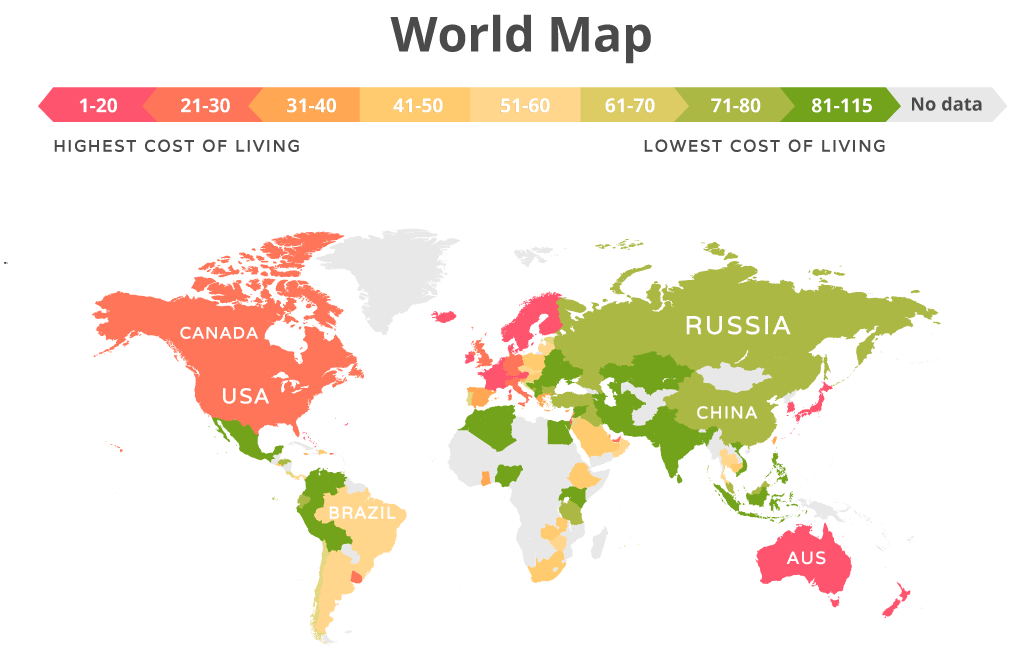

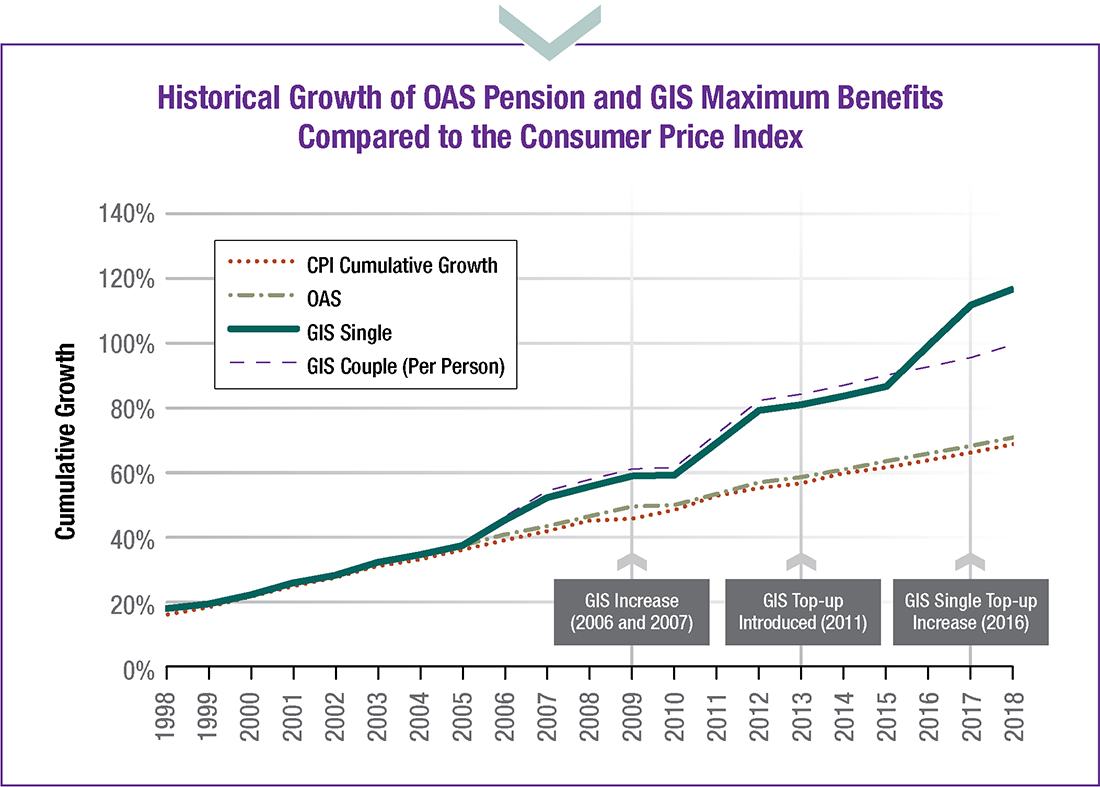

To help you meet these unique needs we re now offering canada life my term life insurance. Inflation is the rising cost of consumer goods and services. In recent years the average rate of inflation in canada has been 2 per year. These three items are followed by personal insurance and pensions expenditures at can 428 per month or 6 0 of monthly expenses.

Expenses go up and or long term. Life insurance provides whomever you choose with a one time tax free payment when you die as long as you continue to pay your premiums. Low price we work directly with the largest insurance providers in canada giving you the freedom to find the best plan for your budget. Work with one of our trusted advisors to help build a plan for you.

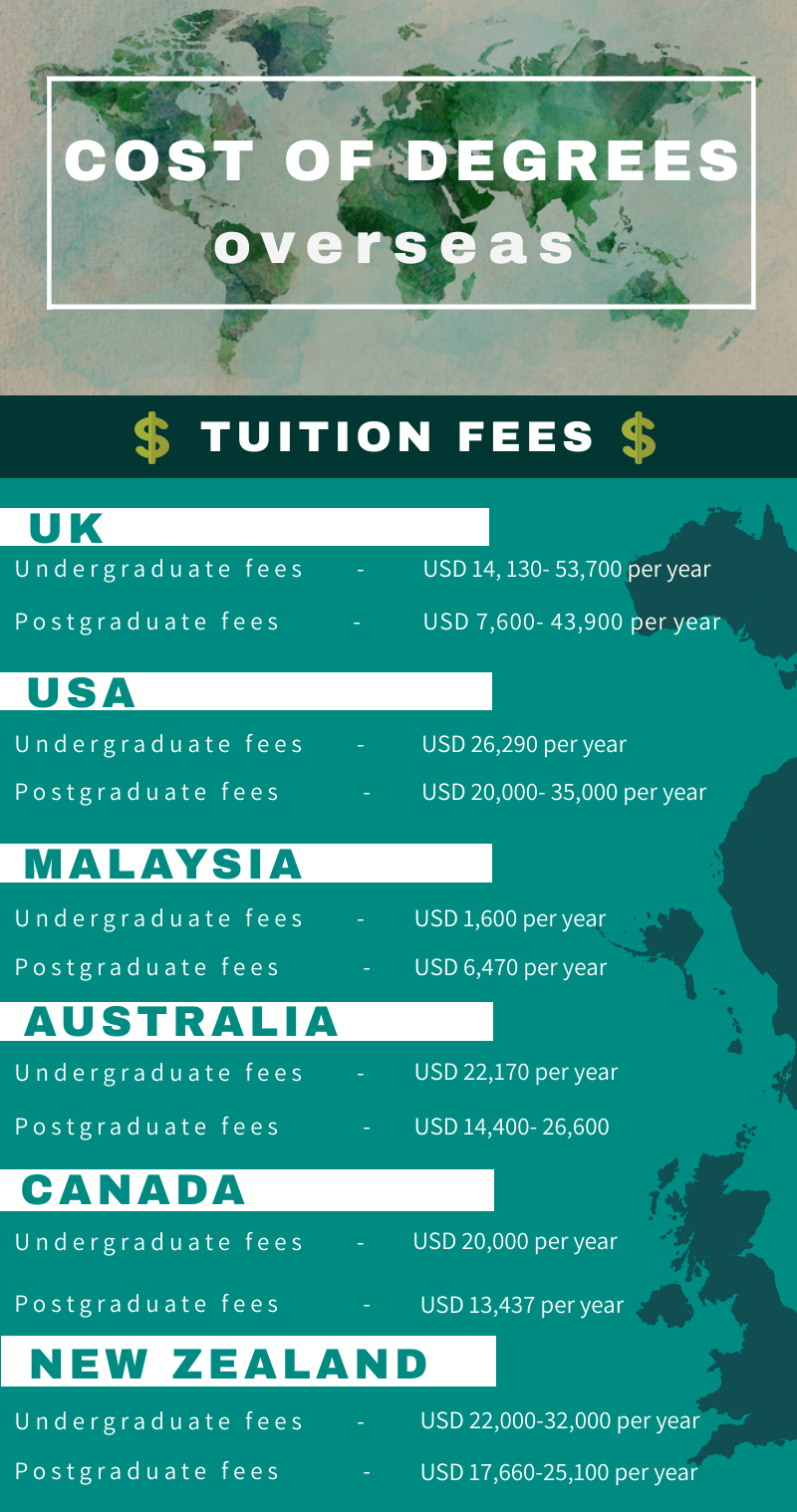

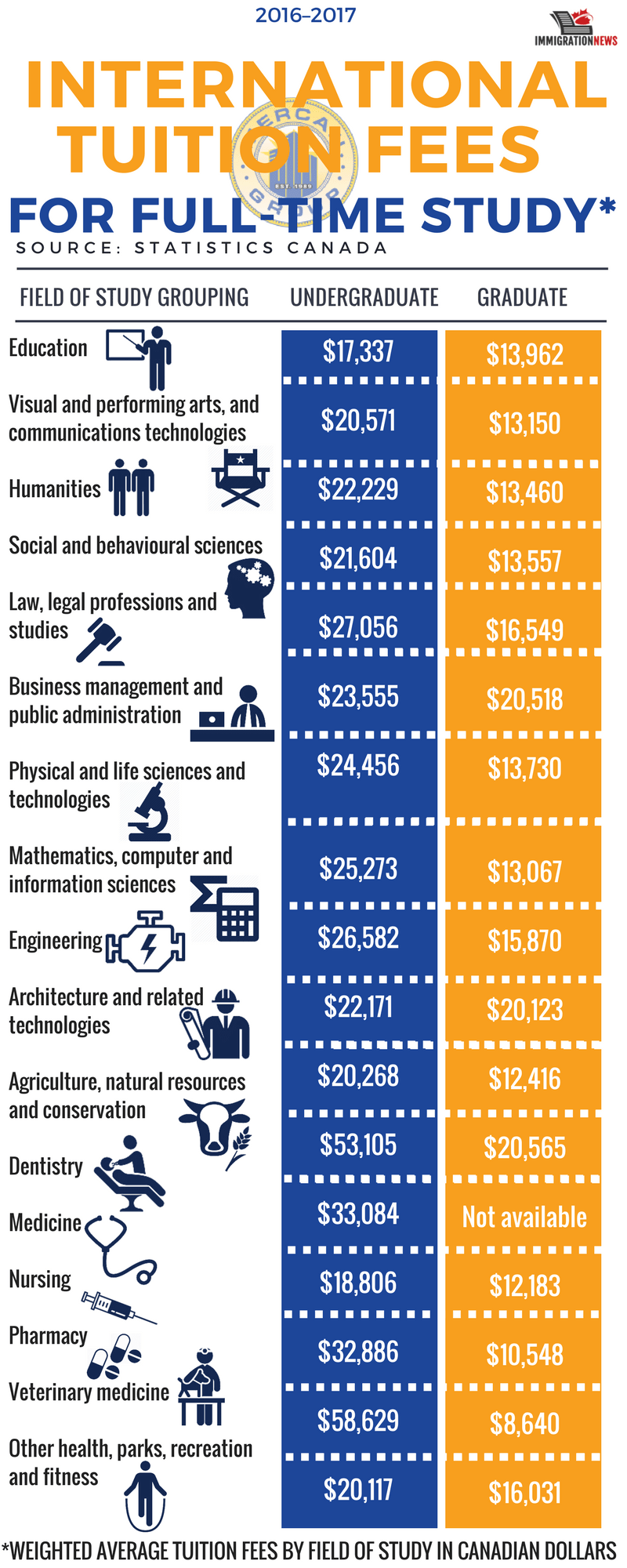

The cost of your books and living expenses may increase due to inflation.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/B6PJ35ZHONETFCJUXY2MFO3OTQ)