life expenses comparison

Life insurance coverage is the same no matter the provider you buy it from. How life insurance comparison works. The coverage or policy can help your heirs by providing them the burial expenses medical expenses etc.

However bear in mind that this is the minimum you can expect to pay as premiums are based on a range of factors.

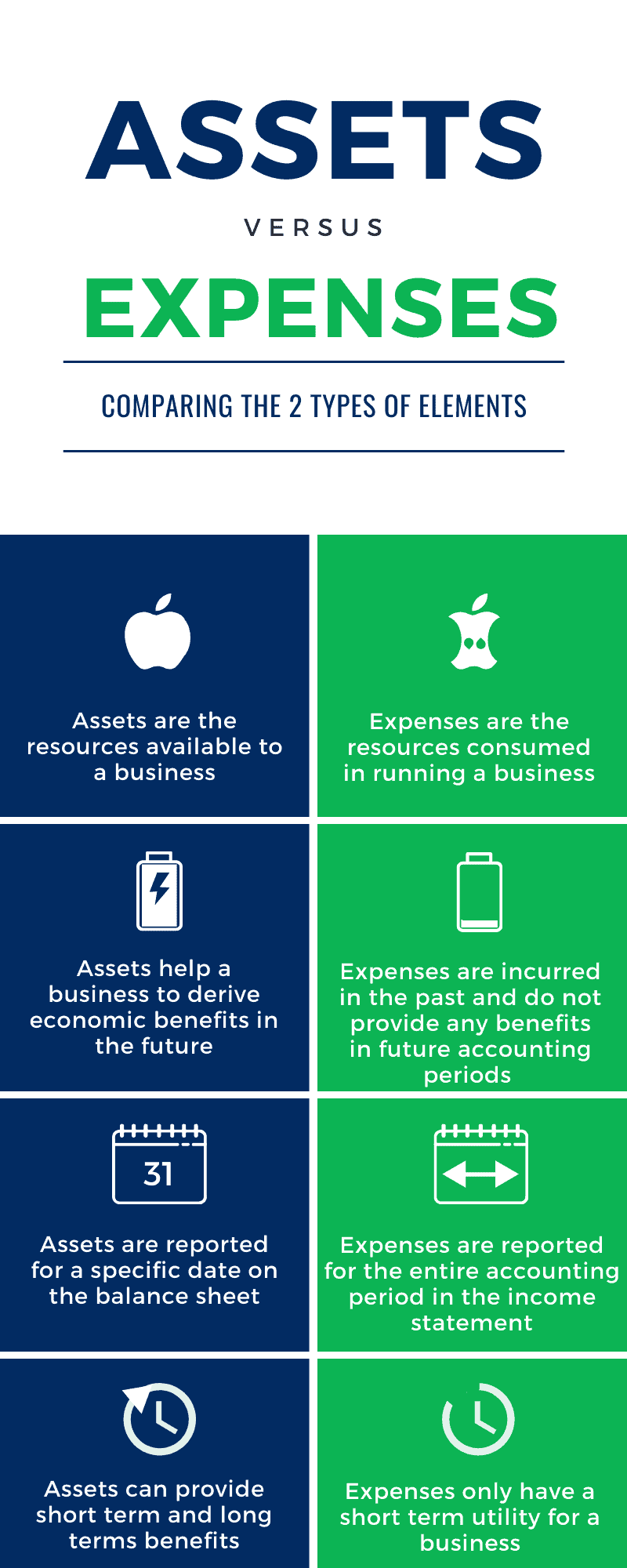

Life expenses comparison. The differences in rates simply means that for a given age a provider is pricing the policy lower to win the sale. The money is given to the people nominated as beneficiaries on your policy. There may also be underlying fund charges and expenses and additional charges for riders that customize a policy to fit your individual needs. That s because quotes are tailored to your specific.

Life insurance allows a family to help maintain its standard of living by providing income tax free money to help pay for funeral expenses pay off the mortgage set aside college tuition for the kids and help provide financial peace of mind after the loss of a loved one. Types of a life insurance policy. In our case we ve also eliminated a lot of unnecessary steps from the application process like requiring everyone to get a medical exam even. Compare life insurance brands in australia.

Faqs about life insurance. Trauma insurance will allow you to claim a lump sum payment to help clear any debts and medical expenses if you suffer from a medical trauma. We know price is important but we don t include costs in our direct life insurance comparison. With hippo co za you can compare life insurance quotes from a range of life insurance companies in south africa to help you find the right life cover policy to.

Your beneficiaries can choose to use the money to cover mortgage and credit card payments child care school fees and other living expenses. A life insurance policy generally pays a lump sum amount of money when you pass away. Guaranteed life insurance from gerber life can be a smart choice to help your family cover the cost of your final expenses. You can apply online or by phone in minutes for a lifetime of coverage and your acceptance is guaranteed.

It is the best tool for assuring the financial stability of your loved ones. Some policies provide you a form of saving your money and you can withdraw the money whenever you have urgency. Life insurance can help protect your family members when they suffer the loss of a breadwinner or stay at home parent. Life insurance costs vary but can start from as little as 3 84 per month.

The average cost of a policy is likely to be slightly higher. Investing involves risks including possible loss of principal. Gerber life s guaranteed life insurance policy is designed to be easy to understand and easy to buy.

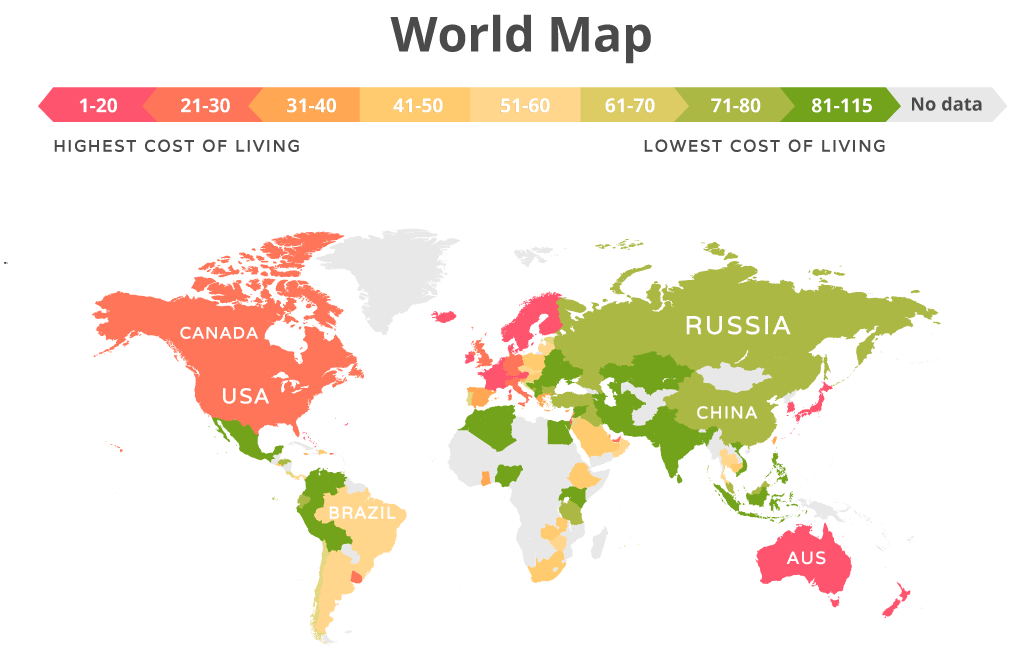

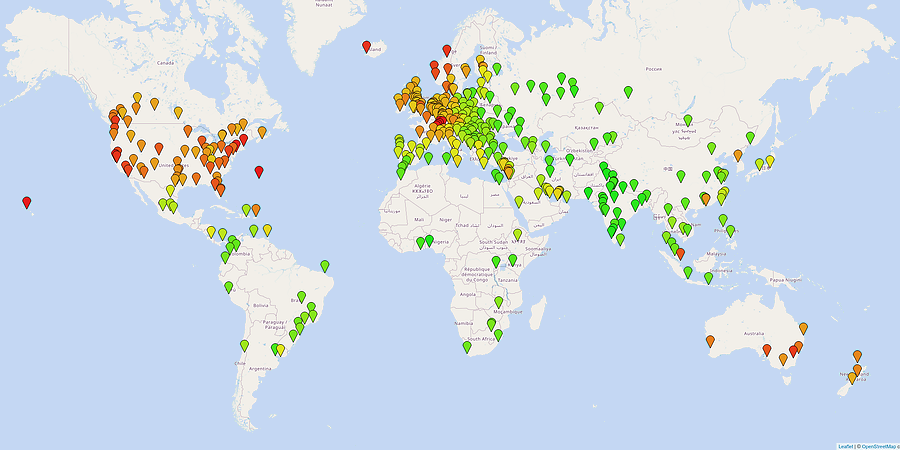

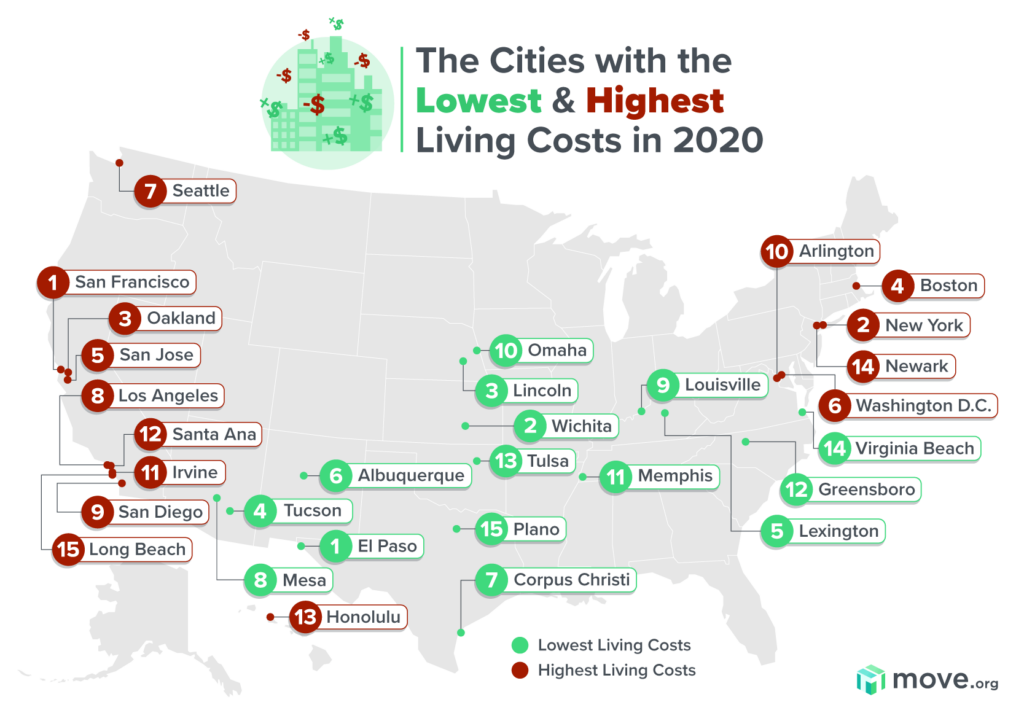

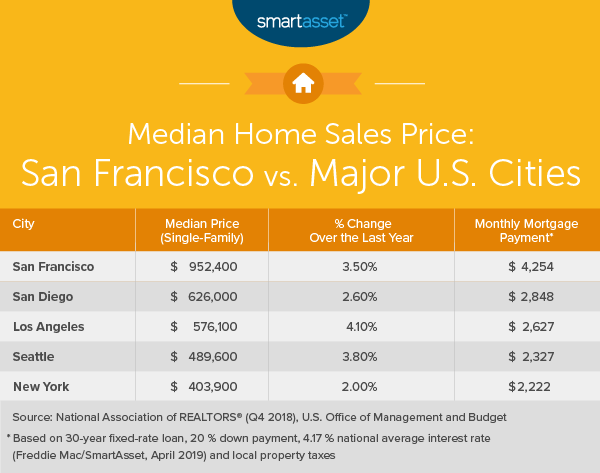

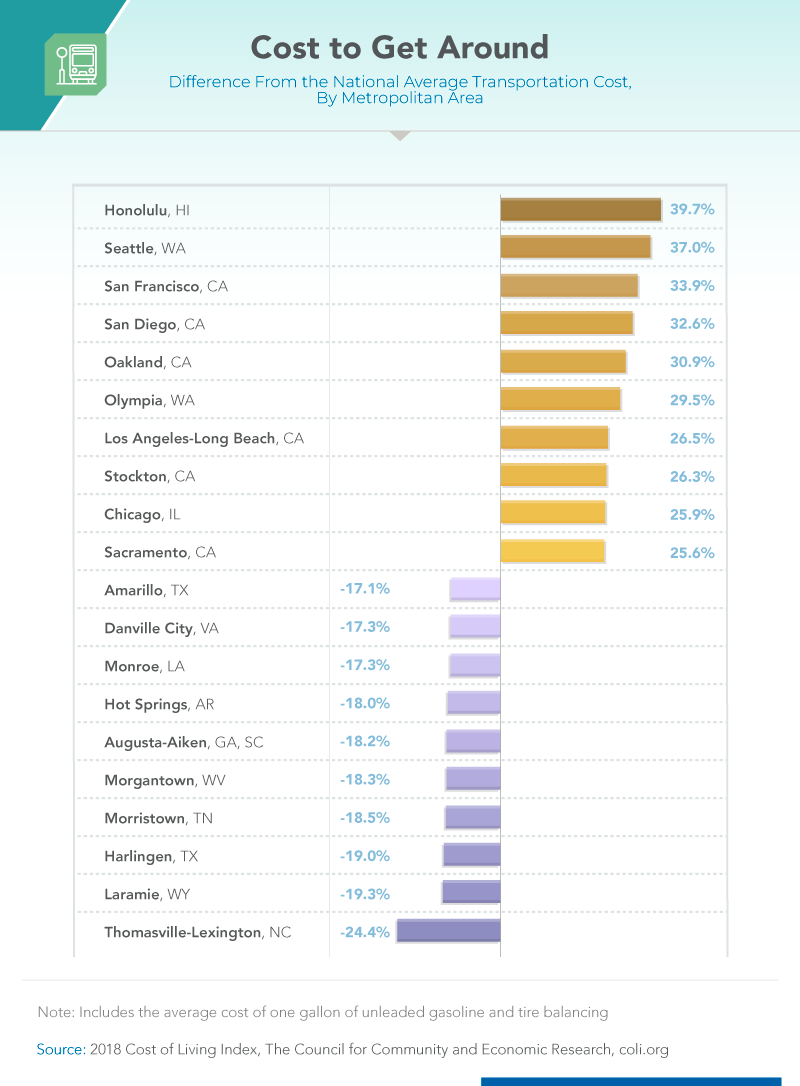

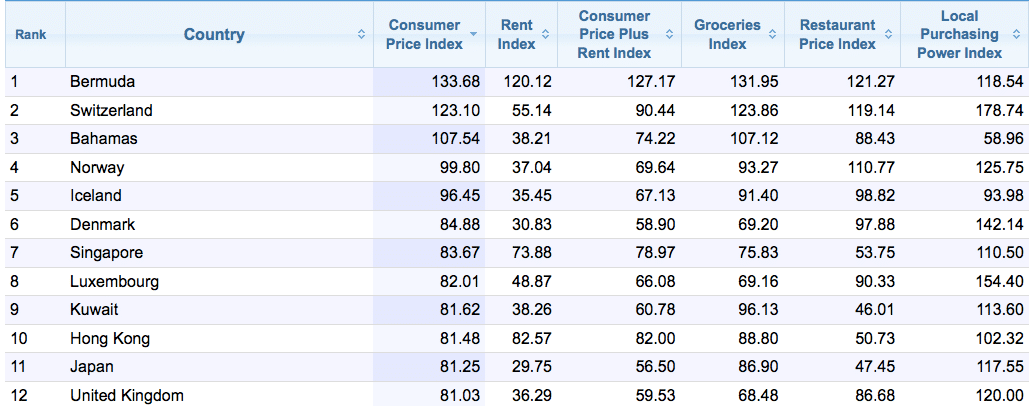

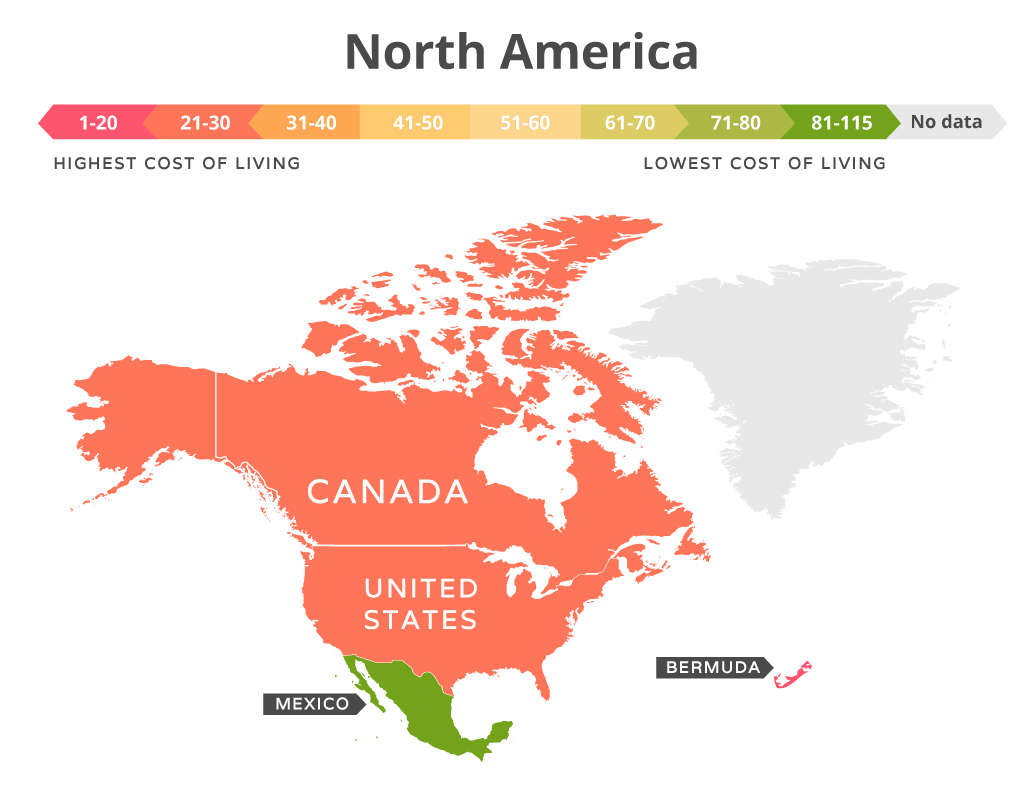

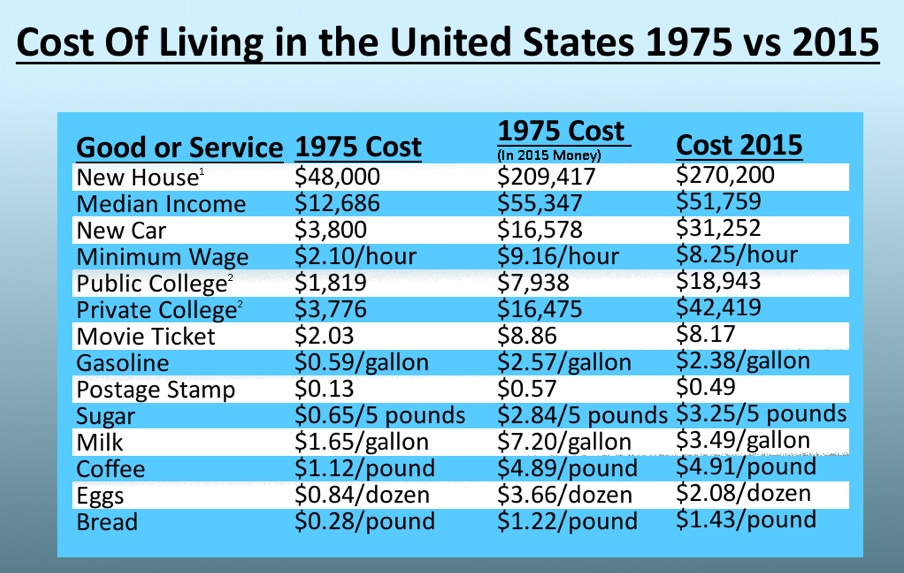

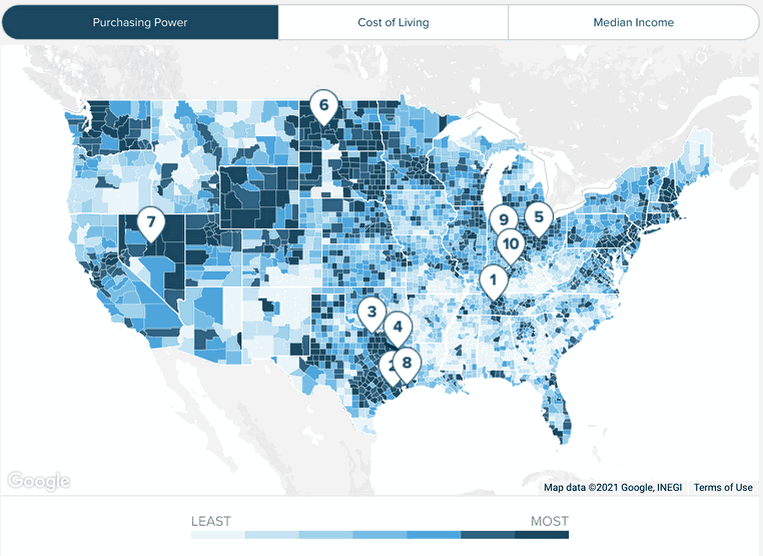

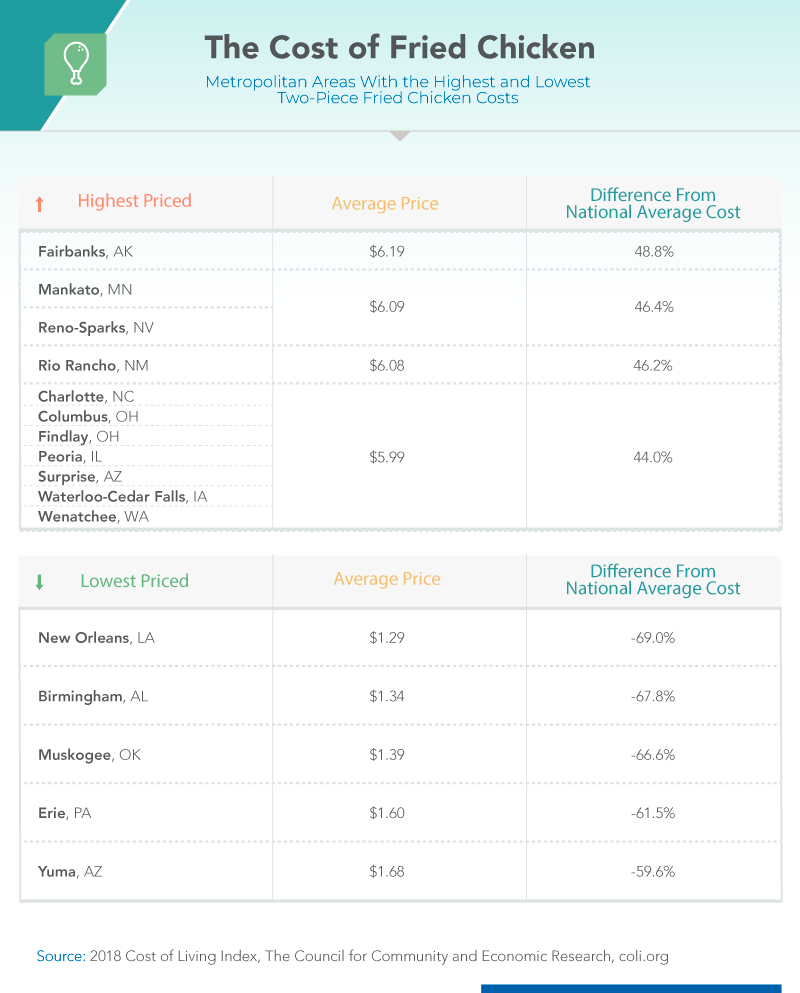

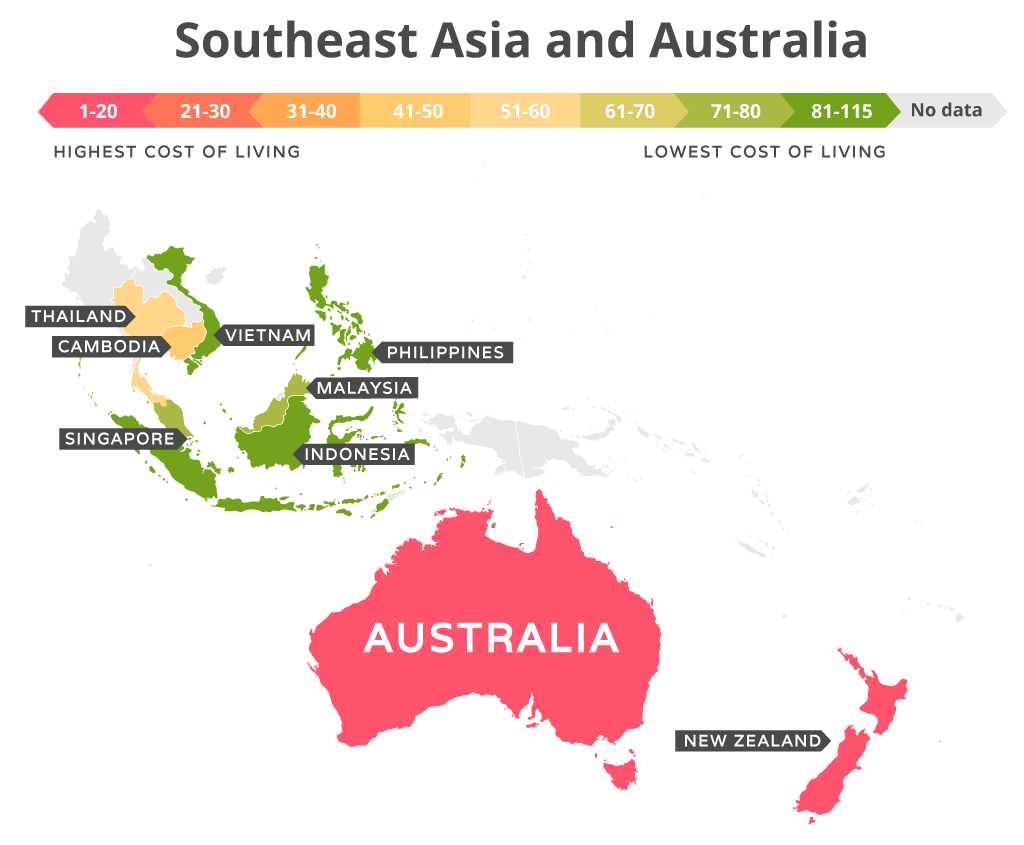

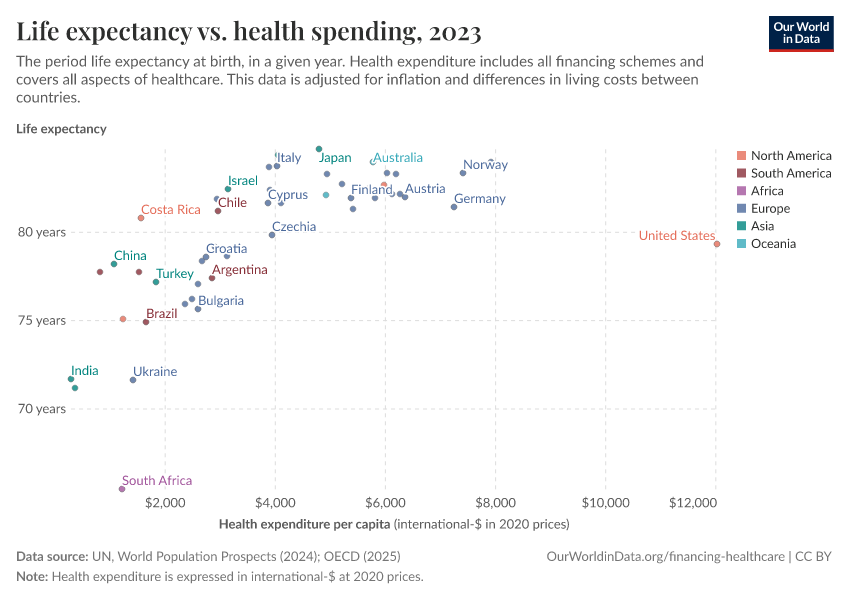

cost of living where you can compare cheap or expensive living expenses of cities where you live with cities around the world gigazine

:max_bytes(150000):strip_icc()/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)

/dotdash_Final_How_is_a_Cost_of_Living_Index_Calculated_Oct_2020-01-f5552b1a61f44bc38cf63bee4f1b67b0.jpg)