life critical illness cover

Critical illness insurance plans provides coverage against specific life threatening diseases. Please call us on 0345 745 6125 to find out more. Over half of our customers pay just 17 50 a month or less for our critical illness cover 1.

Some assume that you have to choose one or the other but you can get both life insurance and critical illness cover.

Life critical illness cover. Like life insurance policies the pay out can be used for anything. How much critical illness cover do you need. What is a critical illness insurance cover. Critical illness cover was originally sold with the intention of providing financial protection to individuals following the diagnosis or treatment of an illness deemed critical.

In addition to the hospitalisation cost there will be other costs like doctor visits medical expenses etc. Critical illness cover is a type of life insurance policy that offers protection in the event of a serious illness or injury. Treating such critical illnesses may require multiple visits to the hospital over a long period. Because our critical illness plan isn t combined with life insurance we re flexible.

If you have questions about life insurance or want to learn more then our videos and guides will help you get straight to the answers. Please note this critical illness cover document applies to new policies only. Critical illness may be purchased by individuals in conjunction with a life insurance or term assurance policy at the time of a residential purchase known as a bolt. If you already have a policy your existing terms may vary.

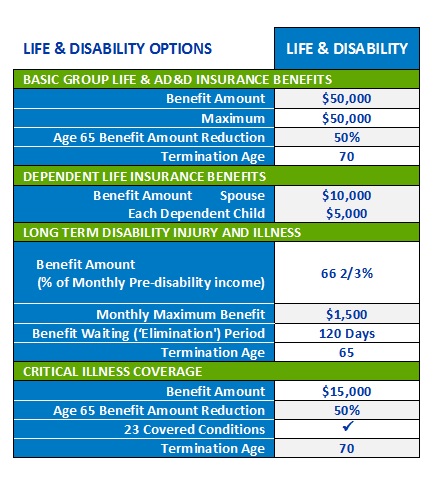

While the maximum age of adding critical illness cover is 65 years the maximum maturity age under max life critical illness and disability rider varies as per the critical illness coverage variant selected. For full details of cover download the critical illness cover policy document and summary of cover pdf 380kb. If you re diagnosed with an illness that your policy covers you ll usually receive a tax free one off payment. Your guide to life cover.

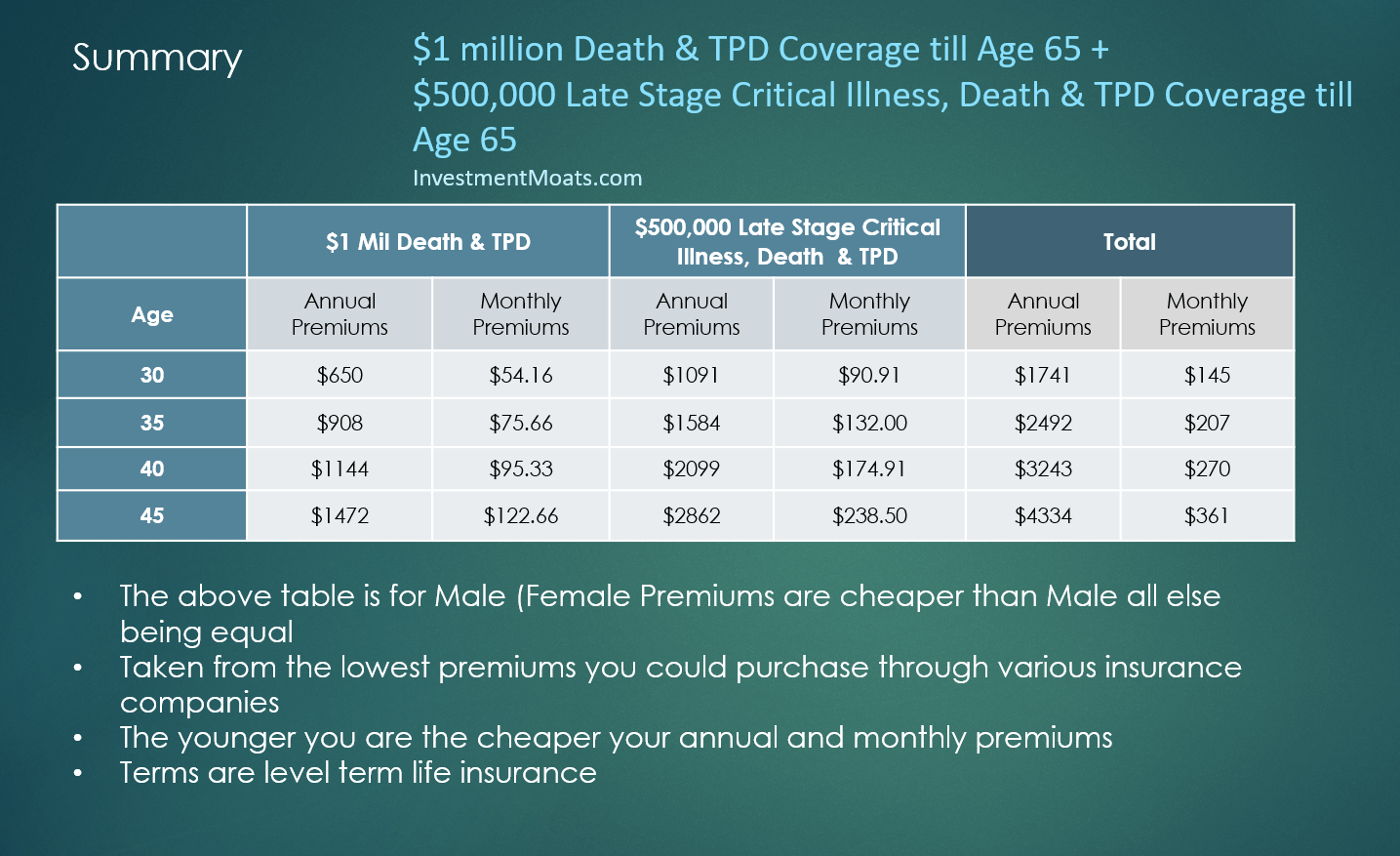

It depends on things like what you want to cover how much you re looking to pay each month and for how long. Terminal illness cover is different to critical illness cover and is usually included as standard in life insurance policies. Both male and female buyers can opt for the critical illness cover at the same premium rates while purchasing base life insurance plan. It means your insurer pays out if your doctor has confirmed you have a terminal condition and you re likely to pass away within 12 months.

Whereas critical illness cover will pay a set amount if you re diagnosed with a serious or life threatening illness.

/Aflac1-7a460fa8f4ed49d789e229fb2b82fc51.jpg)

/GettyImages-1046447804-7beb075e44a34852986cd92b2117afc4.jpg)