lif withdrawals

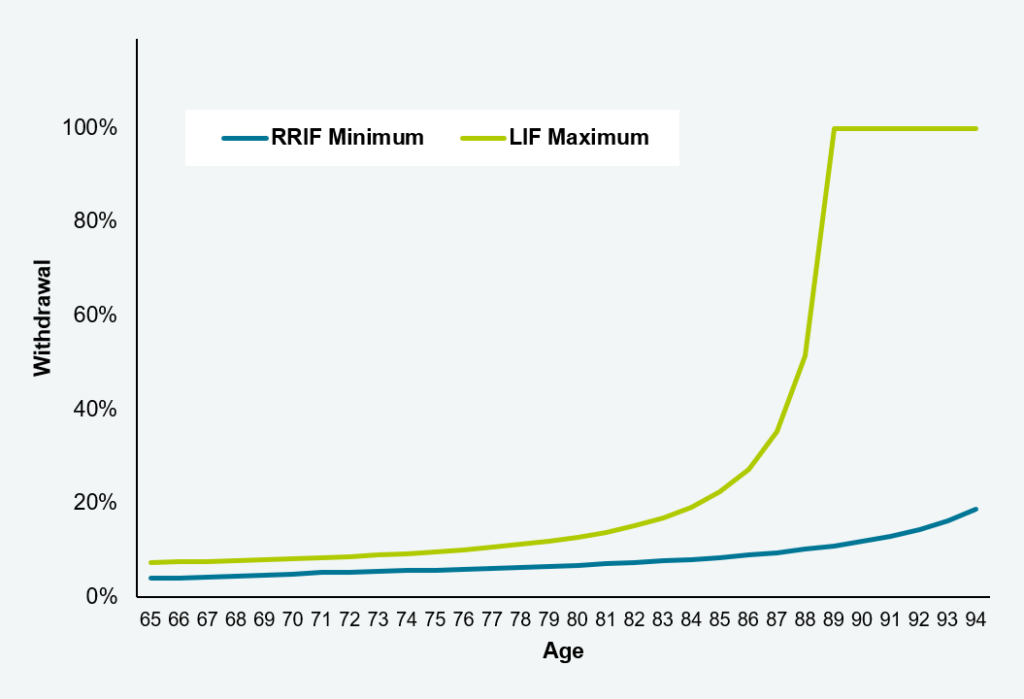

These are often referred to as a locked in rrif. Of course once you convert a lira to a lif you must begin withdrawals the subsequent year om. A lif follows rrif minimum withdrawal rules.

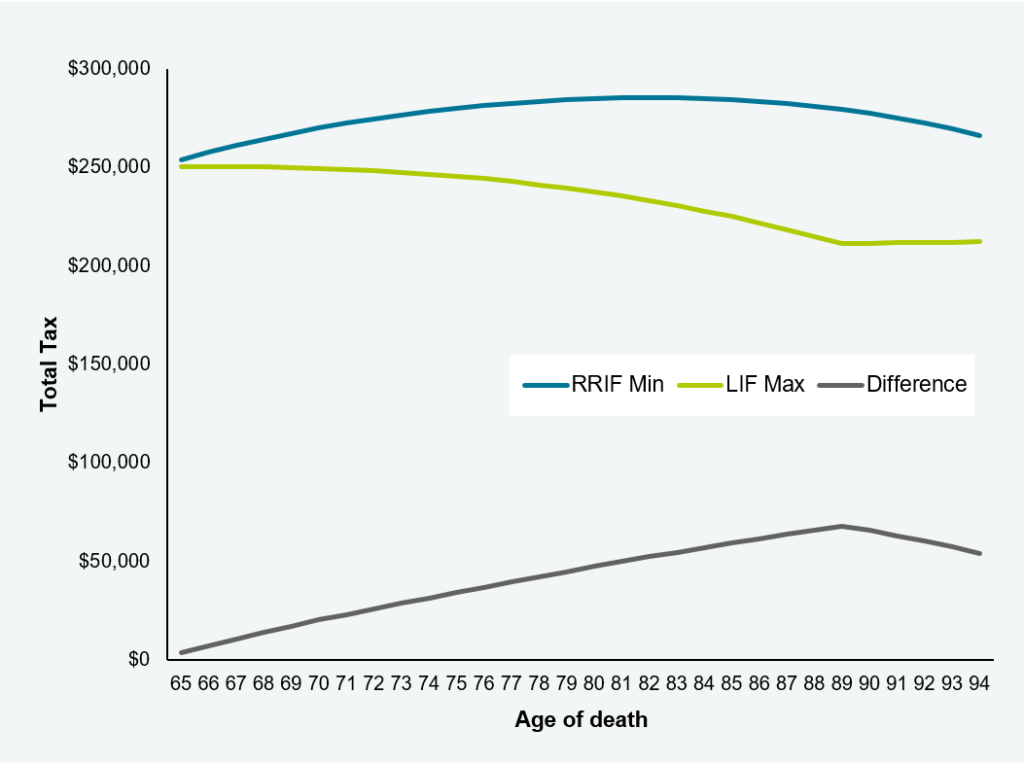

From minimum and maximum withdrawals to making sure your funds last for your lifetime estimating your retirement income from a rrif or other locked in plans can be complex.

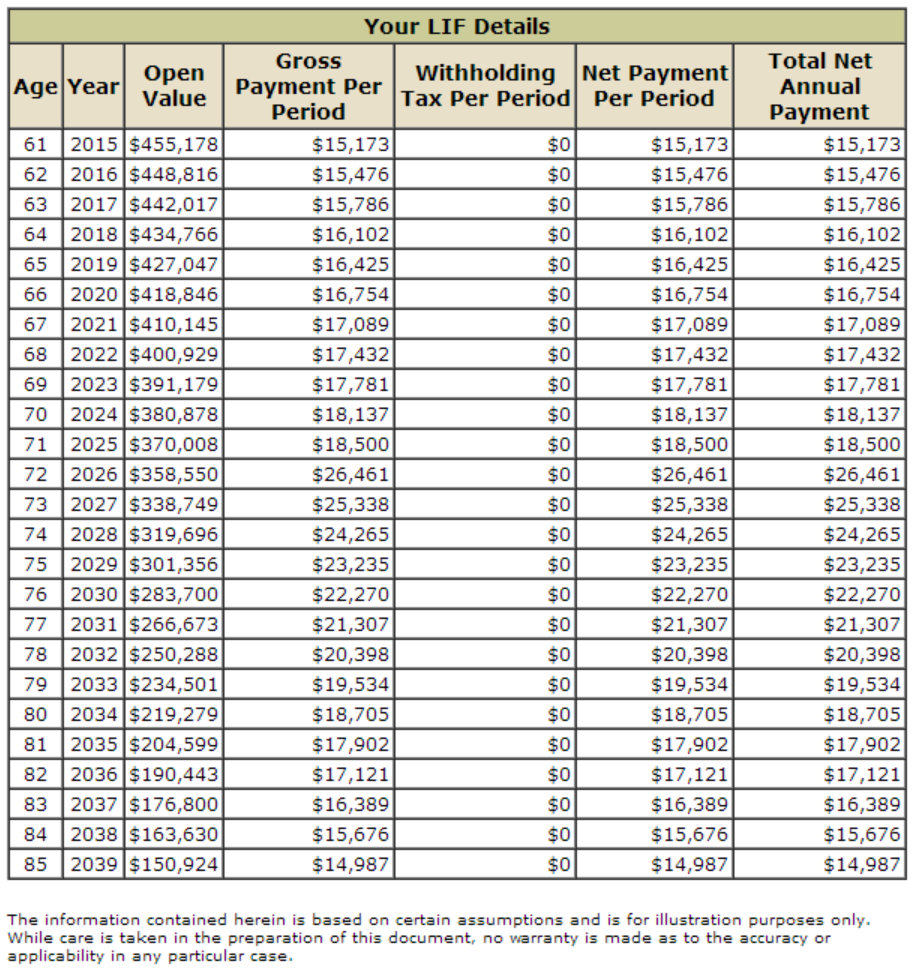

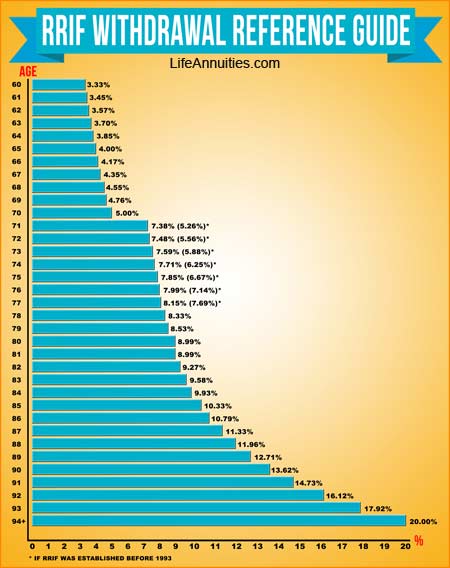

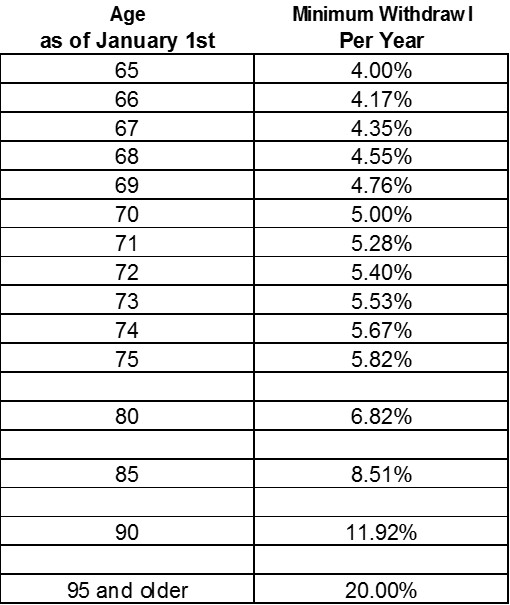

Lif withdrawals. The table below shows the prescribed factors for the minimum annual withdrawals and the. Lif withdrawals lif minimum. Financial planning pensions registered pension plans rpps lif and lrif minimum and maximum withdrawals lif and lrif minimum and maximum withdrawals minimum withdrawals. To determine the minimum annual amount you must withdraw from your lif find your age as of january 1 st and multiply the value of your lif on january 1 st by the percentage indicated under the lif minimum column.

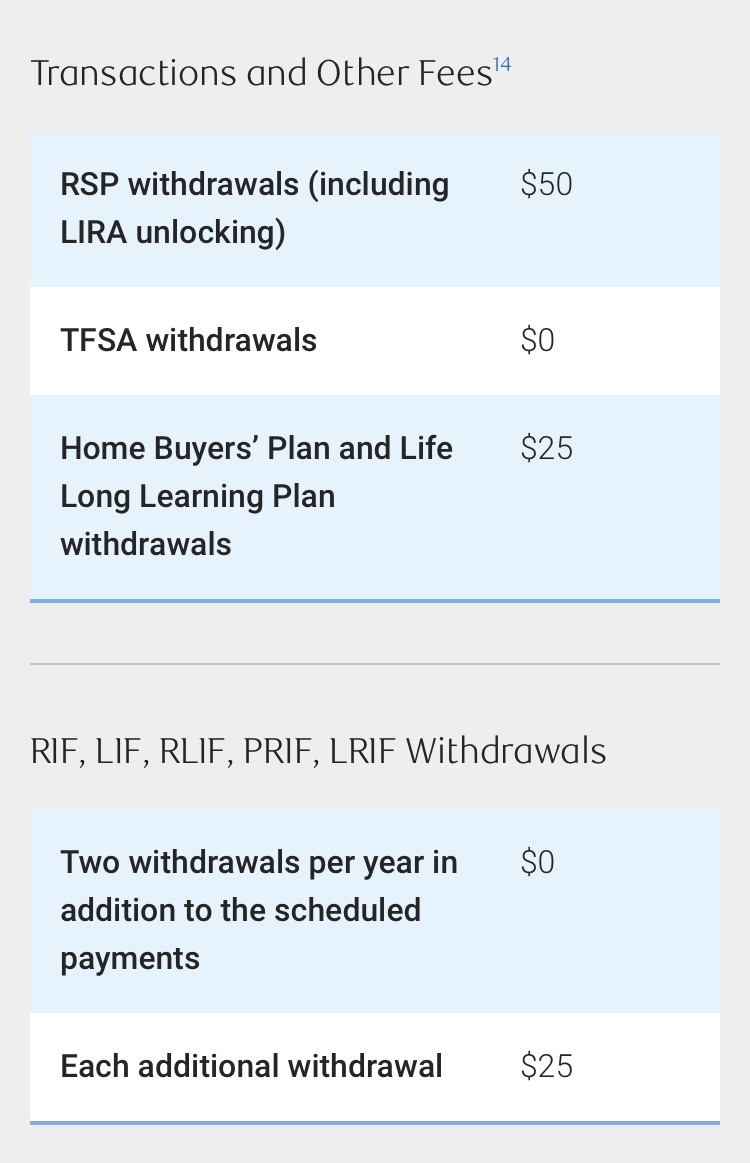

The rules for lifs lrifs and prifs may vary from the information on this page. 7308 3 4 see the rrif minimum annual withdrawals article for all the rules around minimum withdrawals. There is also a maximum amount you can withdraw each year. You will receive a t4 rif from the financial institution holding your lif account that will show the amount of the withdrawal.

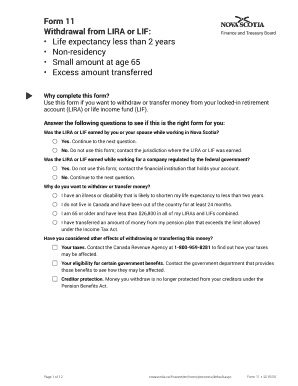

Unlocking withdrawals and transfers from new life income funds lifs this page provides frequently asked questions that relate to the unlocking withdrawal and transfer from new lifs. The owner of a new lif has a time limited option to withdraw in cash or transfer. Rrsps rrifs and tfsas rrif minimum annual withdrawals rrif minimum withdrawal factors prescribed factors for minimum annual withdrawal from a rrif income tax act s 146 3 1 regulations s. Shows the minimum and maximum lif withdrawal percentages for 2020.

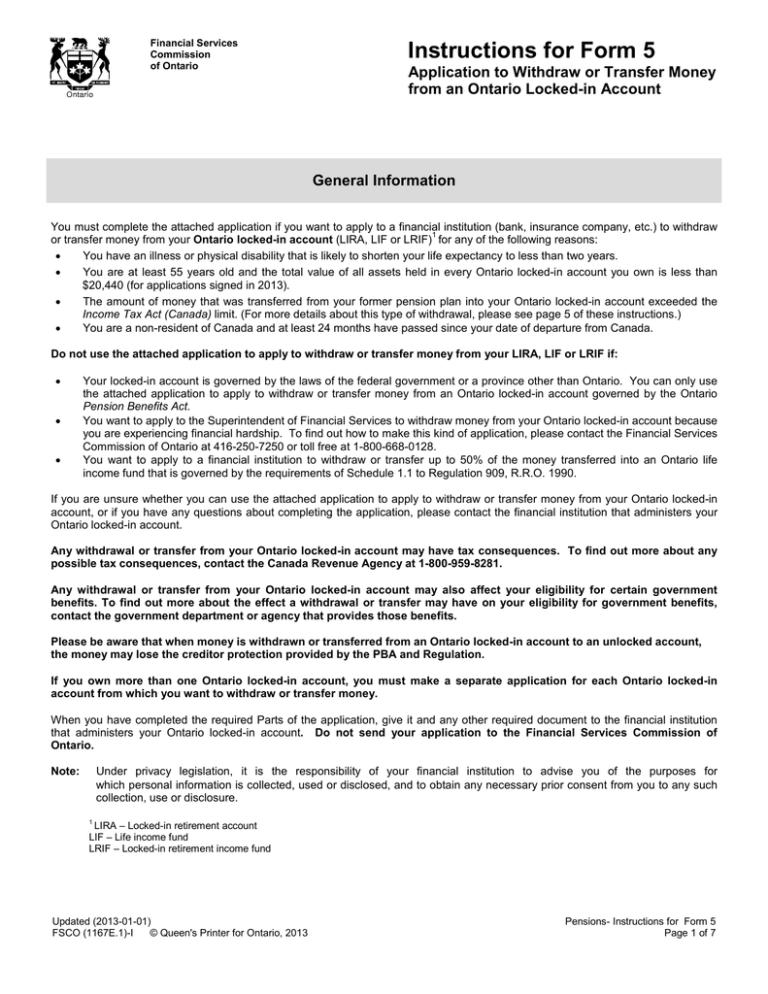

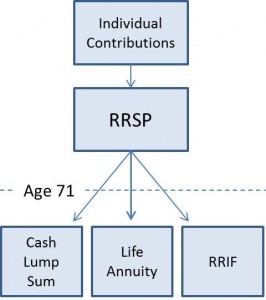

If you have a locked in retirement account lira or locked in rrsp you can convert to a life income fund lif locked in retirement income fund lrif or prescribed retirement income fund prif depending on the province you live in. You must make a minimum withdrawal each year after the year you open the lif. How does the unlocking withdrawal and transfer from the new lif work. The funds withdrawn from a lif are considered income and you will have to pay tax on them at your marginal tax rate.

Talk to a financial planner about securing your income in retirement. Life income funds lifs and locked in retirement income funds lrifs are subject to minimum withdrawals under the income tax act ita. The maximum annual income payment for the first year is based on the amount of money you have in the new lif at the start of the new lif s fiscal year regardless of any subsequent withdrawals. Email us or call 1 866 808 1426.

/abstract-view-of-a-skyscraper-643087328-3c3c9cc1c72a4eb595f285f5e80e6c49.jpg)