final life insurance

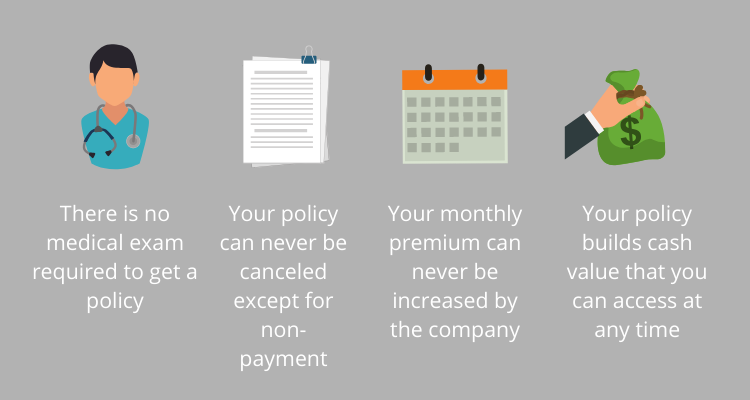

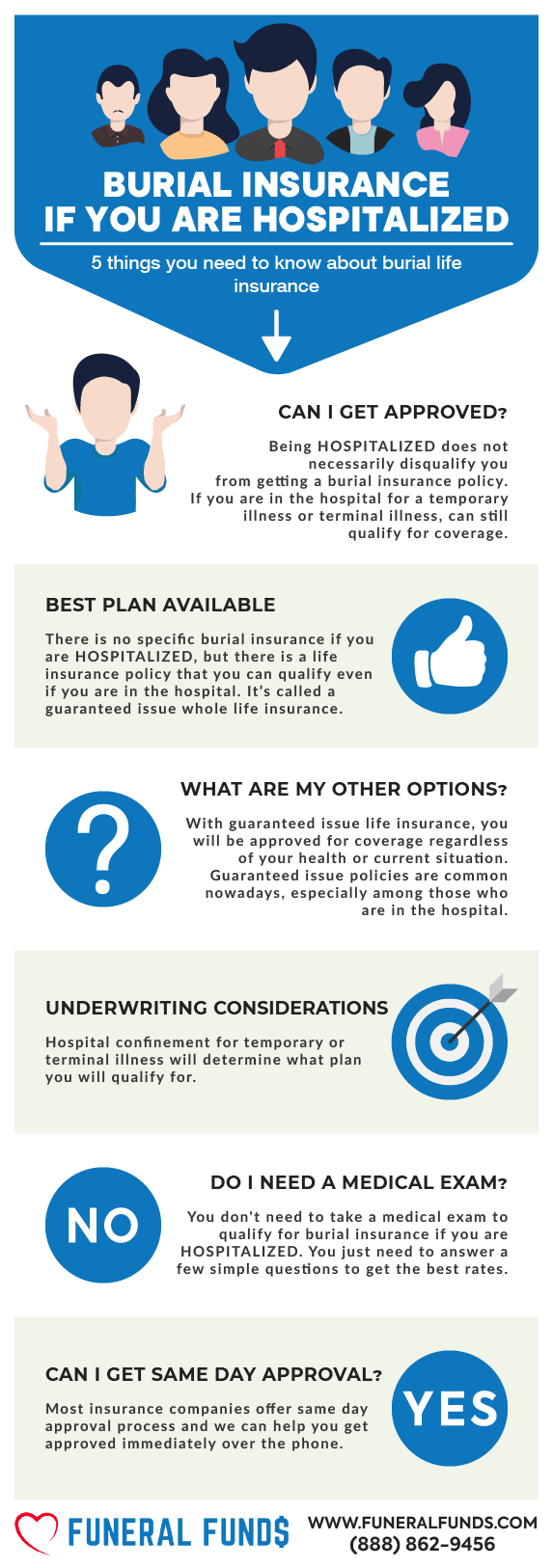

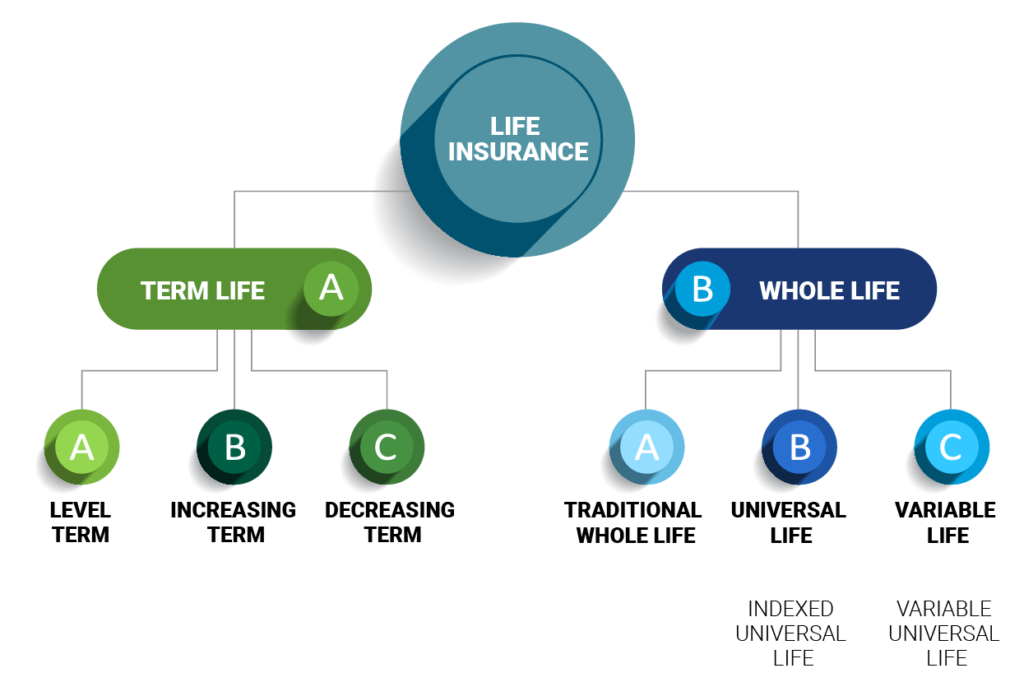

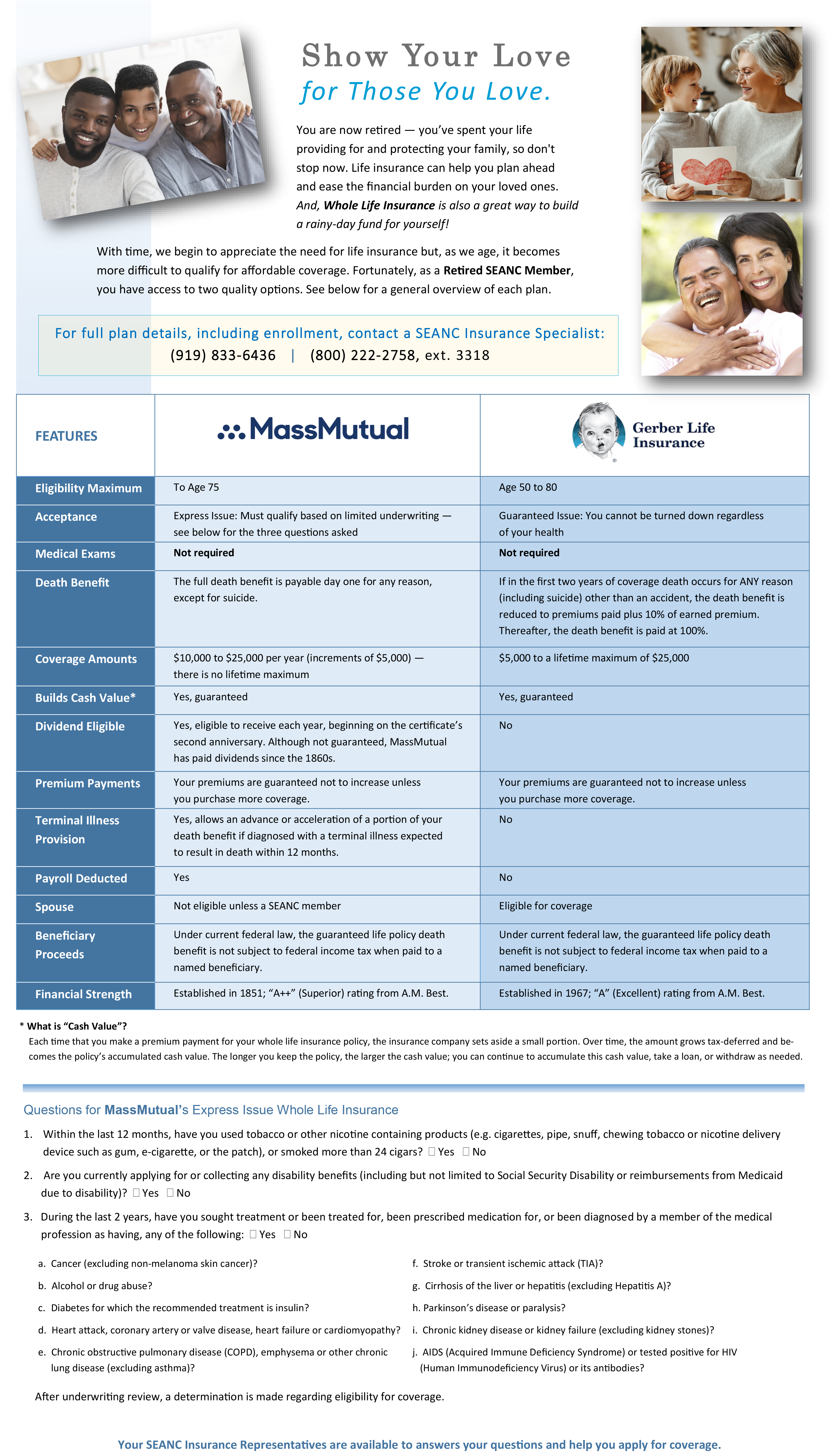

Burial insurance also known as final expense or funeral insurance is generally a small whole life insurance policy with affordable premiums designed to pay all final expenses. If you re looking for final expense insurance with limited underwriting perhaps because you have a health issue globe life offers a variety of. Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family.

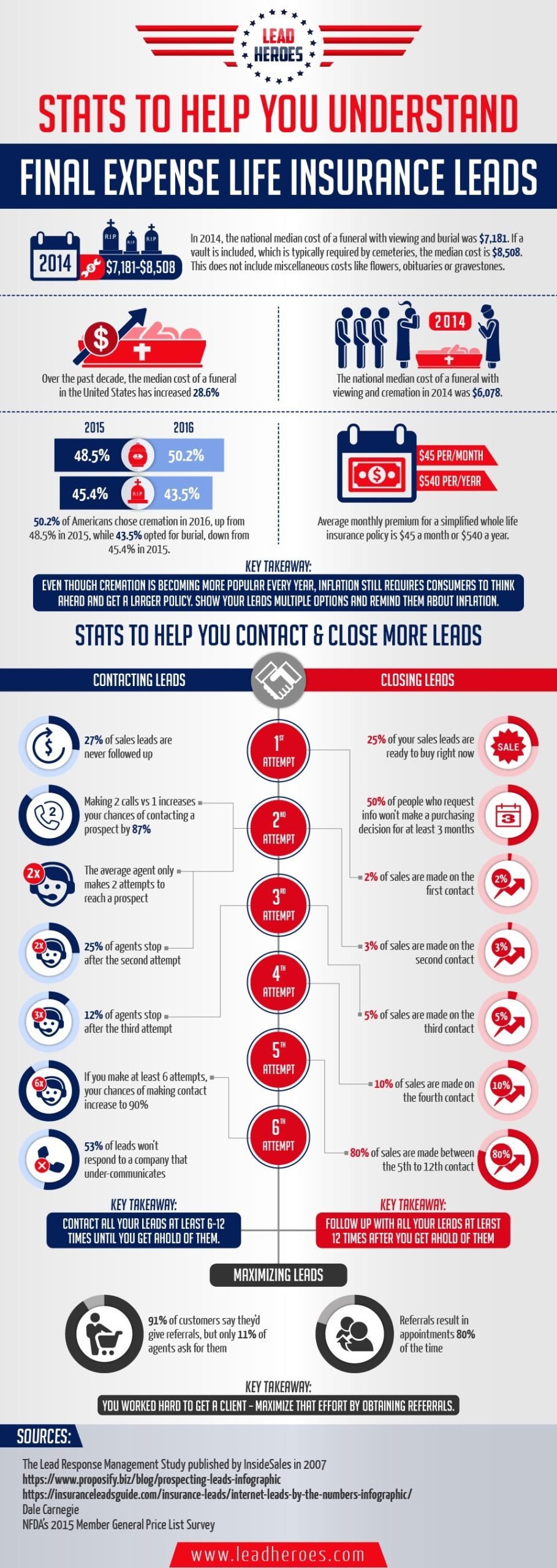

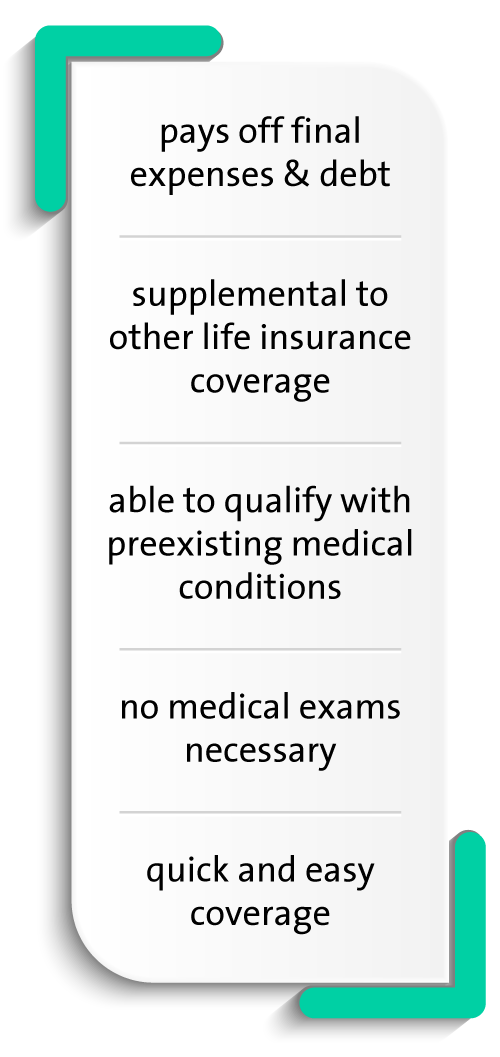

Final expense life insurance can help protect loved ones from having to pay these costs out of pocket.

Final life insurance. Read on to learn about each of these products and how globe life s quotes compare. Life insurance needs calculator. For a 50 year old man rates for term life insurance from colonial penn can range from 13 to 57 per month. The interest you earn in your annuity is not taxable as long as the funds remain within the annuity account.

Globe life offers whole life insurance term life insurance with no medical exam and accidental death insurance. The tax deferral makes a substantial difference on the return on your fund compared for example to a cd account in which the interest is taxable each year. Life insurance from state farm life insurance company not licensed in ma ny or wi or state farm life and accident assurance company licensed in ny and wi can be the foundation of a family s financial protection and one kind of whole life policy is final expense insurance. And final estate settlement costs.

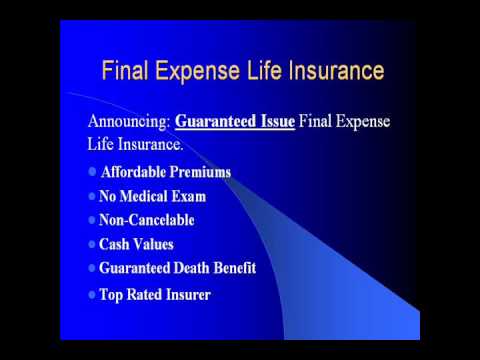

Guaranteed acceptance policies ran between 10 and 80 per month while whole life insurance was the most expensive at 30 to 133. No exams are required serious health issues will not prevent acceptance and coverage typically ranges from 2 000 40 000 with most companies. Final expense insurance is a form of life insurance that ensures your loved ones are taken care of after you re gone. Developed by new york life insurance company the aarp senior life insurance insurance plan will provide your beneficiaries an invaluable financial peace of mind should you pass away unexpectedly.

In 2017 the cost of the average funeral exceeded 8 700. Without life insurance hard earned assets and savings that were intended for other purposes may have to be used for paying off debt funding living costs or paying the high cost of one s final expenses which today can average more than 10 000 in some areas. When you need a good senior life insurance policy with the right benefits the aarp final expense insurance plan may be your answer. 2 in most cases a basic funeral service will include a memorial death certificates for the deceased and housing the remains.

imlr life insurance income protection insurance disability insurance long term care insurance final expense insurance